Rogers 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGEMENT’S DISCUSSION AND ANALYSIS

acquisition. In July 2012, the CRTC approved the transfer of the five

television licences held by MLSE in which Rogers subsequently

completed a 37.5% investment.

In the first quarter of 2012, Rogers Media announced an agreement

to purchase the Saskatchewan Communications Network, an over-the-

air broadcast station. In June 2012, the CRTC approved the

acquisition.

In August 2012, Rogers announced that it had entered into an

agreement to purchase 100% of the outstanding shares of Score

Media Inc. for $167 million. As part of this transaction, Rogers also

received a 10% interest in Score Media’s digital media assets, which

has been spun out as a separate entity called Score Digital. Score

Media Inc. includes theScore Television Network, a national specialty

TV service providing sports news, information, highlights and live

event programming across Canada. This transaction is subject to

regulatory approval, anticipated in the first half of 2013, following

which Rogers will wholly own and control theScore Television

Network and its related television assets.

Further in regard to theScore Media Inc. transaction in October of

2012, the $167 million purchase price was paid and the shares of

Score Media were transferred to an interim CRTC-approved trust that

is responsible for the independent management of the business in the

normal course of operations until CRTC approval is obtained. The

ultimate control over theScore Media business will not transfer to

Rogers until such approval is obtained. In addition, Rogers holds

approximately 11.8% of the outstanding shares of Score Digital,

which includes 10% that will be issued in connection with this

transaction and approximately 1.8% of the shares of Score Digital

received by Rogers as partial payment for our shareholdings in Score

Media prior to the acquisition.

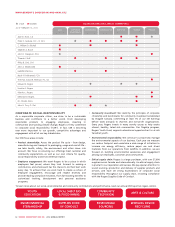

COMPETITION IN OUR BUSINESSES

We currently face significant competition in each of our Wireless,

Cable, RBS and Media businesses from entities that provide similar

services. Each of our segments also faces competition from entities

that use alternative communications and transmission technologies

and may face competition from other technologies being developed

or to be developed in the future. This section contains a discussion of

the specific competition facing each of our Wireless, Cable, RBS and

Media businesses.

Wireless Competition

With approximately 27 million subscribers, Canada’s wireless industry

is highly competitive. Competition for wireless subscribers is based on

price, quality of service, scope of services, network coverage,

sophistication of wireless technology, breadth of distribution,

selection of devices, branding and marketing. Wireless also competes

with its rivals for dealers and retail distribution outlets.

In the wireless voice and data market, Wireless competes nationally

with Bell and TELUS, as well as newer entrants, various regional

players, resellers, and other emerging providers that use alternative

wireless technologies, such as WiFi “hotspots”.

As previously noted, parity of Wireless networks and handset devices

has dramatically transformed the competitive landscape. This

competition is expected to continue and even intensify. Consolidation

among new entrants or with incumbent carriers could provide greater

competition to Wireless on a regional or national basis. As previously

discussed, in 2013 and 2014, auctions of 700 MHz and 2500-2690 MHz

spectrum respectively, are expected to be held. Rogers will not be

allowed to participate in the auction of the 2,500-2,690 MHz

spectrum, because the company already holds more than the

maximum 40 MHz of spectrum limit to bid in this auction. The

outcomes of both of these auctions may serve to increase competition

at Wireless.

Rogers was the first carrier to launch LTE in Canada in 2011. In 2011

Bell Canada launched LTE, and in 2012 both TELUS and MTS launched

LTE networks. The Bell Canada, TELUS, and MTS launches of LTE

enable these companies to provide a wider selection of wireless

devices and to compete for customers who desire the increased

capacity and speed that LTE provides, and this is expected to grow

over time as LTE expands around the world.

Cable Competition

Canadian cable television systems face competition from several

alternative Canadian multi-channel BDUs including Bell TV (previously

Bell ExpressVu), Shaw Direct (previously Star Choice) satellite TV

services and telephone company IPTV services, as well as from the

direct reception by antenna of over-the-air local and regional

broadcast television signals. There is also competition from the illegal

reception of U.S. direct broadcast satellite services. In addition, the

availability of television shows and movies streaming over the

Internet through providers such as Netflix has become a direct

competitor to Canadian cable television systems.

Cable’s Internet access services compete with a number of other ISPs

offering residential and commercial dial-up and high-speed Internet

access services. Rogers Hi-Speed Internet services, where available,

compete directly with Bell’s DSL Internet service in the Internet

market in Ontario, with the DSL Internet services of Bell Aliant in New

Brunswick and Newfoundland and various resellers using wholesale

telco DSL and cable Third Party Internet Access services in local

markets.

Cable’s Home Phone services compete with Bell’s wireline phone

service in Ontario and with Bell Aliant’s wireline phone service in New

Brunswick and Newfoundland and Labrador. In addition, Home

Phone service competes with ILEC local loop resellers (such as Primus)

as well as VoIP service providers (such as Vonage and Primus) riding

over the services of ISPs.

Internet delivery is becoming a direct threat to voice and video service

delivery. Younger generations increasingly use the Internet as a

substitute for traditional wireline telephone and television services.

The use of mobile phones among younger generations has resulted in

some abandonment of wireline telephone service. The number of

wireless-only households is increasing, although the large majority of

homes today continue to use wireline telephone service. In addition,

wireless Internet service is increasing in popularity, although is

generally more expensive and not as fast as wired broadband.

RBS Competition

The Canadian market for enterprise network and communications

services features a wide variety of players, with competitors often

focusing on individual geographic markets where their respective

network assets are most extensive. Although each market presents its

own challenges, with competitors investing in maintaining market

share in these target areas, there are relatively few national

providers.

In the wireline voice and data market, RBS competes with facilities

and non-facilities-based telecommunications service providers. In

markets where Rogers owns fibre and cable infrastructure, direct

competition is with incumbent fibre-based providers. In Ontario, RBS

products and services compete with Bell, Cogeco Data Services and

Allstream. In Quebec, competition is predominantly with Bell and

Videotron, and with Bell Alliant and Eastlink in Atlantic Canada.

Media Competition

Rogers’ radio stations compete with the other stations in their

respective markets as well as with other media, such as newspapers,

magazines, television, outdoor advertising and digital properties.

60 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT