Rogers 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

been a leader in the deployment of next generation technology, first

with digital cellular, then with HSPA+ and more recently with LTE,

which we will continue to expand during 2013.

LTE is the most significant broadband wireless technology in

deployment around the world today. In most cases, the previous two

main generations of technology paths in the wireless industry – GSM/

HSPA+ and Code Division Multiple Access/Evolution Data Optimized

(“CDMA/EVDO”) – are now converging.

LTE is the worldwide GSM community’s new fourth generation (“4G”)

broadband wireless technology. An all-IP-based wireless data

technology using a new modulation scheme (orthogonal frequency-

division multiplexing), LTE is specifically designed to improve

efficiency, lower costs and enhance the range of voice and data

services available via mobile broadband wireless networks. It also

makes use of new spectrum allocations and better integrates with

other open technology standards. As a 4G technology, LTE is designed

to build on and be fully backwards compatible with UMTS/HSPA+,

which is the earlier world standard for 3G mobile broadband wireless

and the prior standard upon which Wireless also operates.

WiFi (the IEEE 802.11) is a wireless standard that allows suitably

equipped devices, such as laptop computers, tablets and smartphones,

to connect to a local area wireless access point. These access points

utilize unlicenced spectrum, and the wireless connection is effective

only within a local area radius of approximately 50–100 metres of the

access point. The access points provide speeds similar to a wired local

area network (“LAN”) environment. As WiFi technology is primarily

an unmanaged service designed for in-building wireless access, many

access points must be deployed to cover the selected local geographic

area and must also be interconnected with a broadband network to

supply the connectivity to the Internet. Future enhancements to the

range of WiFi service and the networking of WiFi access points may

provide complementary opportunities for wireless operators or

municipal WiFi network operators in the future, each providing

capacity and coverage under the appropriate circumstances.

Wireless Operating and Financial Results

Rogers Wireless is leading the way in driving mobile

commerce capabilities and adoption in Canada.

Despite increased competitive intensity as a result of new wireless

market entrants and network and device parity by incumbent

providers, Wireless generated a modest increase in year-over-year

revenue at an accelerating rate over the year. Operating expenses,

including cost of equipment sales, also increased year-over-year;

however, due to successful cost management initiatives, we also

generated an increase in year-over-year adjusted operating profit.

Data revenues continue to grow at double-digit rates as our

smartphone customers’ demands for data availability increase.

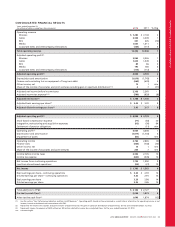

Summarized Wireless Financial Results

Years ended December 31,

(In millions of dollars, except margin) 2012 2011 % Chg

Operating revenue

Network revenue $ 6,719 $ 6,601 2

Equipment sales 561 537 4

Total operating revenue 7,280 7,138 2

Operating expenses

Cost of equipment(1) (1,585) (1,425) 11

Other operating expenses (2,632) (2,677) (2)

(4,217) (4,102) 3

Adjusted operating profit(2) $ 3,063 $ 3,036 1

Adjusted operating profit margin as

% of network revenue(2) 45.6% 46.0%

Additions to PP&E $ 1,123 $ 1,192 (6)

Data revenue included in network

revenue $ 2,722 $ 2,325 17

Data revenue as % of network

revenue 41% 35%

(1) Cost of equipment includes the cost of equipment sales and direct channel

subsidies.

(2) As defined. See the section “Key Performance Indicators and Non-GAAP

Measures”.

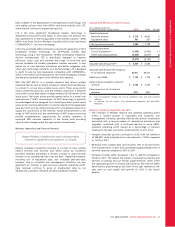

Wireless Operating Highlights for 2012

• The increases in Wireless revenue and adjusted operating profit

reflect a modest growth in subscribers and successful cost

management initiatives, partially offset by the upfront investments

associated with a record number of smartphone activations and

upgrades, combined with a continued decline in voice ARPU.

Adjusted operating profit margin as a percentage of network

revenue for the year was 45.6%, essentially flat to 2011 levels.

• Postpaid subscriber growth continued in 2012, with net additions

of 268,000, while postpaid churn was reduced to 1.29% compared

to 1.32% in 2011.

• Revenues from wireless data services grew 17% to $2,722 million

from $2,325 million in 2011 and represented approximately 41% of

network revenue compared to 35% in 2011.

• Postpaid monthly ARPU decreased 1.4% to $69.30 compared to

$70.26 in 2011. This reflects the impact of competitive intensity and

declines in roaming and out-of-plan usage revenues, which offset

the significant growth in wireless data revenue. The trend of ARPU

deterioration experienced at the start of the year reversed as the

year went on and ended with growth of 1.6% in the fourth

quarter.

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 35