Rogers 2012 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

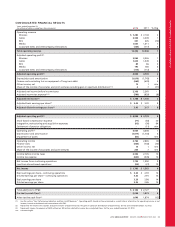

Postpaid Prepaid

1,652 1,761 1,591

7,325 7,574 7,846

2010 2011 2012

(In thousands)

WIRELESS POSTPAID

AND PREPAID SUBSCRIBERS

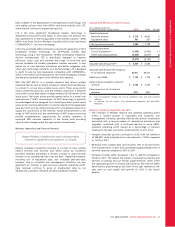

(%)

SMARTPHONES AS A PERCENT

OF POSTPAID SUBSCRIBERS

41.0% 56.0% 69.0%

2010 2011 2012

Wireless Subscribers and Network Revenue

The increase in the number of gross postpaid subscriber additions

during 2012 is primarily the result of demand for smartphones as

Wireless activated and upgraded approximately 2.9 million

smartphones, compared to approximately 2.5 million in 2011. These

smartphones were predominately iPhone, Android and BlackBerry

devices, of which approximately 33% were for new Wireless

subscribers. This is the largest number of annual smartphone

activations and new smartphone customer additions that Wireless has

ever reported. At year-end, subscribers with smartphones represented

69% of the overall postpaid subscriber base, versus 56% at the end of

2011. These subscribers generally commit to multi-year term contracts

and typically generate significantly higher ARPU.

Overall, net additions of postpaid subscribers were relatively

consistent with 2011 levels, which primarily reflects heightened

competitive intensity, offset by a continued reduction in postpaid

churn. The year-over-year decrease in overall prepaid subscriber net

additions primarily reflects an increase in the level of churn associated

with heightened competitive intensity, particularly at the lower end

of the wireless market where the prepaid product is most penetrated.

Network revenue includes revenue derived from voice and data

services from postpaid monthly fees, airtime, data usage, long

distance charges, optional service charges, inbound and outbound

roaming charges and certain fees, as well as prepaid usage for

airtime, data and other ancillary charges such as long distance and

roaming.

The increase in network revenue compared to 2011 reflects the

continued growth of Wireless’ subscriber base and the escalating

adoption and usage of wireless data services, partially offset by a

decrease in voice ARPU due in large part to heightened competitive

intensity.

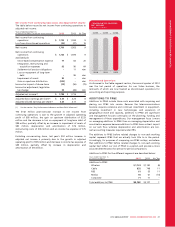

Wireless data revenue increased by 17% from 2011, to $2,722 million.

This growth reflects the continuing proliferation of smartphones,

tablets and wireless laptop devices, all of which are expanding

consumption of apps, mobile video, text messaging and other

wireless data services. In 2012, data revenue represented

approximately 41% of total network revenue, compared to 35%

in 2011.

(In millions of dollars)

WIRELESS DATA

REVENUE

$1,832 $2,325 $2,722

2010 2011 2012

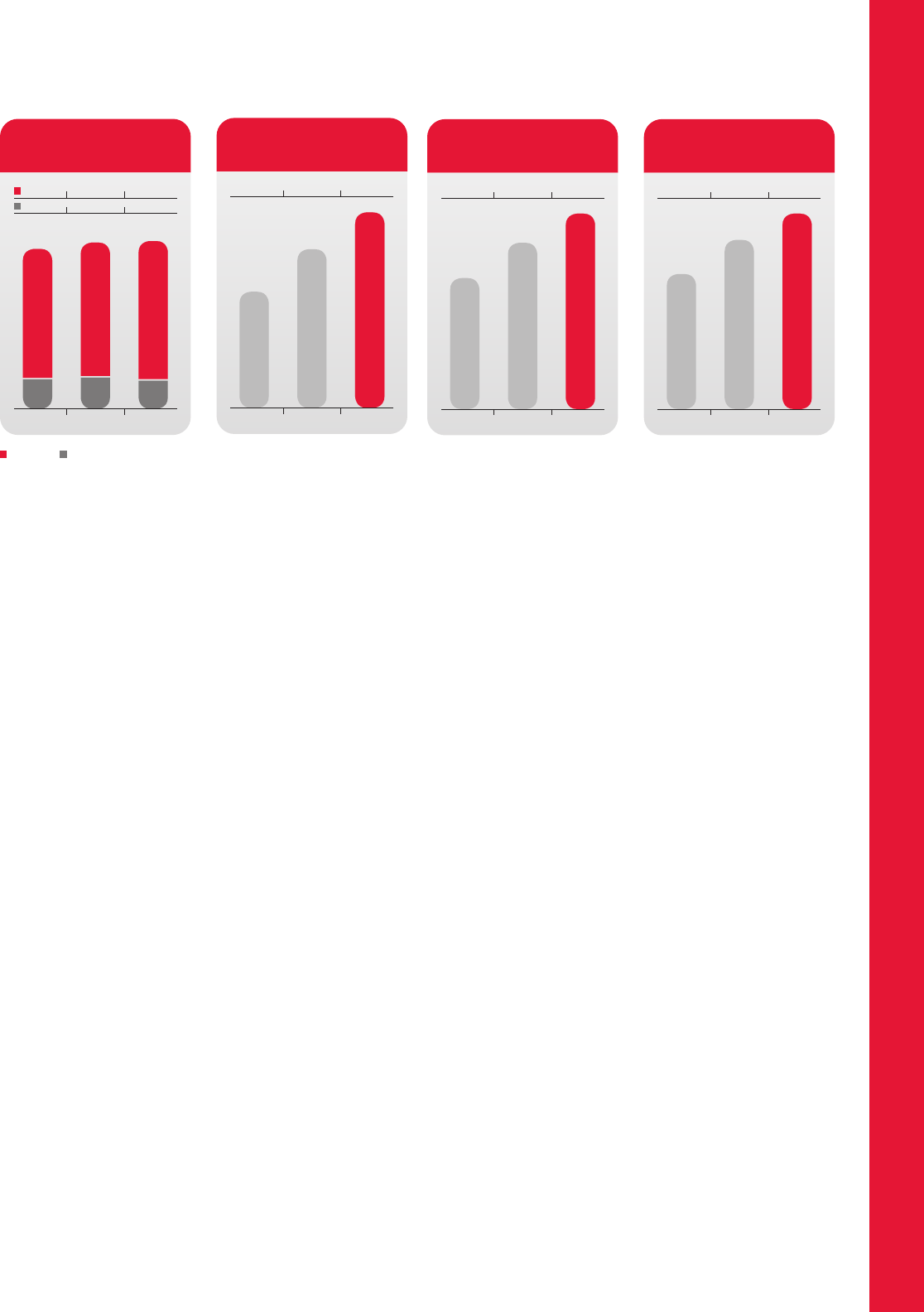

(%)

DATA REVENUE PERCENT

OF BLENDED ARPU

28.1% 35.2% 40.5%

2010 2011 2012

Year-over-year blended ARPU dropped by 1%, driven by an 8.8%

decline in the wireless voice component of blended ARPU primarily

due to competitive intensity in this market, significantly offset by a

14.2% increase in wireless data ARPU.

Wireless Equipment Sales

Equipment sales, net of subsidies, consist of revenue generated from

the sale, generally at or below our cost to independent dealers,

agents and retailers, and directly to subscribers through fulfillment by

Wireless’ customer service groups, websites and telesales. The increase

in revenue from equipment sales for 2012 versus 2011, including

activation fees and net of equipment subsidies, reflects growth in

smartphone activations to the highest levels ever reported by

Wireless, as previously noted.

Wireless Operating Expenses

For assessing business performance, Wireless’ operating expenses are

segregated between cost of equipment, which is composed of

wireless handset and device costs, and other operating expenses,

which include expenses incurred to operate the business on a day-to-

day basis, service existing subscriber relationships and attract new

subscribers.

The $160 million increase in cost of equipment compared to 2011 was

primarily the result of an increase in both hardware upgrades and

smartphone users. A large number of existing iPhone and BlackBerry

subscribers became eligible for subsidized device upgrades during the

second half of 2012. We also activated and upgraded 39% more

iPhones and 16% more smartphones overall than during 2011 and

this was the largest factor behind the year-over-year increase in

expenses. Wireless views these costs as net present value positive

investments in the acquisition and retention of higher ARPU

subscribers, as these customers tend to be lower churning customers

who subscribe to multi-year term contracts and consume higher data

usage.

Total retention spending, including subsidies on handset upgrades,

increased to $942 million, up from $813 million in 2011. This stemmed

from higher volumes of smartphones and a mix of more expensive

smartphones. Increased spending is part of our retention strategy in

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 37