Rogers 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

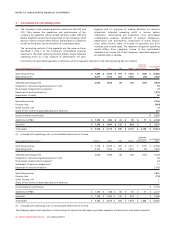

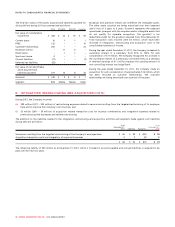

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(TABULAR AMOUNTS IN MILLIONS OF CANADIAN DOLLARS, EXCEPT PER SHARE AMOUNTS)

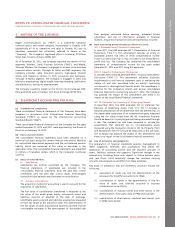

1. NATURE OF THE BUSINESS:

Rogers Communications Inc. (“RCI”) is a diversified Canadian

communications and media company, incorporated in Canada, with

substantially all of its operations and sales in Canada. RCI and its

subsidiary companies are collectively referred to herein as the

“Company”. The Company’s registered office is located at 333 Bloor

Street East, Toronto, Ontario, M4W 1G9.

As of December 31, 2012, the Company reported the results of four

segments: Wireless, Cable, Business Solutions (“RBS”), and Media.

Through Wireless, the Company is engaged in wireless voice and data

communications services. Through its Cable and RBS segments, the

Company provides cable television services, high-speed Internet

access, and telephony services to both consumers and businesses.

Through its Media segment, the Company is engaged in radio and

television broadcasting, digital media, televised shopping, publication

and distribution, and sports entertainment.

The Company is publicly traded on the Toronto Stock Exchange (TSX:

RCI.a and RCI.b) and on the New York Stock Exchange (NYSE: RCI).

2. SIGNIFICANT ACCOUNTING POLICIES:

(a) Statement of compliance:

These consolidated financial statements of the Company have been

prepared in accordance with International Financial Reporting

Standards (“IFRS”) as issued by the International Accounting

Standards Board (“IASB”).

These consolidated financial statements of the Company for the years

ended December 31, 2012 and 2011 were approved by the Board of

Directors on February 14, 2013.

(b) Basis of presentation:

The consolidated financial statements have been prepared on a

historical cost basis, except for certain financial instruments, liabilities

for cash-settled share-based payments and the net deferred pension

liability, which are measured at fair value as described in the

applicable notes. The consolidated financial statements are presented

in millions of Canadian dollars, which is the Company’s functional

currency.

(c) Basis of consolidation:

(i) Subsidiaries:

Subsidiaries are entities controlled by the Company. The

financial statements of subsidiaries are included in the

consolidated financial statements from the date that control

commences until the date that control ceases. Intercompany

transactions and balances are eliminated on consolidation.

(ii) Business combinations:

The acquisition method of accounting is used to account for the

acquisition of subsidiaries.

The fair value of consideration transferred is measured as the

fair value of the assets given, equity instruments issued and

liabilities incurred or assumed at the date of exchange.

Identifiable assets acquired and liabilities assumed are measured

at their fair values at the acquisition date. The determination of

the fair values of assets acquired and liabilities assumed involves

considerable estimates in the development of discounted cash

flow analyses, estimated future earnings, estimated future

subscribers, and use of information available in financial

markets. Acquisition transaction costs are expensed as incurred.

(d) New accounting pronouncements effective in 2012:

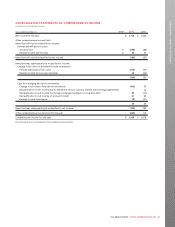

IAS 1, Presentation of Financial Statements

In June 2011, the IASB amended IAS 1, Presentation of Financial

Statements (“IAS 1”). This amendment requires an entity to

separately present the items of other comprehensive income

(“OCI”) as items that may or may not need to be reclassified to

profit and loss. The Company has presented the consolidated

statements of comprehensive income for the years ended

December 31, 2012 and 2011 using this approach.

IFRS 7, Financial Instruments: Disclosures

In October 2010, the IASB amended IFRS 7, Financial Instruments:

Disclosures (“IFRS 7”). This amendment enhances disclosure

requirements to aid financial statement users in evaluating the

nature of, and risks associated with, an entity’s continuing

involvement in derecognized financial assets. The amendment is

effective for the Company’s interim and annual consolidated

financial statements commencing January 1, 2012. The Company

has assessed the impact of this amendment and there is no

impact on the consolidated financial statements.

IAS 12, Deferred Tax: Recovery of Underlying Assets

In December 2010, the IASB amended IAS 12, Deferred Tax:

Recovery of Underlying Assets (“IAS 12”). IAS 12 includes a

rebuttal presumption which determines that the deferred tax on

the depreciable component of an investment property measured

using the fair value model from IAS 40, Investment Property

should be based on its carrying amount being recovered through

a sale. The standard has also been amended to include the

requirement that deferred tax on non-depreciable assets

measured using the revaluation model in IAS 16, Property, Plant

and Equipment (“IAS 16”) should be measured on the sale basis.

The Company has assessed the impact of this amendment and

there is no impact on the consolidated financial statements.

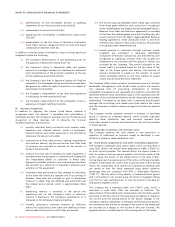

(e) Use of estimates and judgments:

The preparation of financial statements requires management to

make judgments, estimates and assumptions that affect the

application of accounting policies and the reported amounts of

assets, liabilities, revenue and expenses. Significant changes in the

assumptions, including those with respect to future business plans

and cash flows, could materially change the recorded carrying

amounts. Actual results could differ from these estimates.

Key areas of estimation that are inherently uncertain include the

following:

(i) assessment of credit risk and the determination of the

allowance for doubtful accounts (note 19(a));

(ii) consideration of inputs in the determination of the fair

value of assets and liabilities acquired in business

combinations (note 2(c)(ii));

(iii) consideration of industry trends and other factors in the

determination of the useful lives of PP&E (note 2(r)(ii));

(iv) capitalization of direct labour, overhead and interest costs

to PP&E (note 2(r)(i));

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 87