Rogers 2012 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

obligation. Actuarial gains and losses are determined at the end

of the year in connection with the valuation of the plans and are

recognized in OCI and retained earnings.

The Company uses the following methods and assumptions for

pension accounting associated with its defined benefit plans:

(a) the cost of pensions is actuarially determined and takes

into account the expected rates of salary increases, for

instance, as the basis for future benefit increases;

(b) for the purpose of calculating the expected return on

plan assets, those assets are valued at fair value; and

(c) past service costs from plan amendments are expensed

immediately in the consolidated statements of income

to the extent that they are already vested. Unvested

past service costs are deferred and amortized on a

straight-line basis over the average remaining vesting

period. Contributions to defined contribution plans are

recognized as an employee benefit expense in the

statement of income in the periods during which

related services are rendered by employees.

Contributions to defined contribution plans are recognized as an

employee benefit expense in the consolidated statements of

income in the periods during which related services are rendered

by employees.

(ii) Termination benefits:

Termination benefits are recognized as an expense when the

Company is committed without realistic possibility of

withdrawal, to a formal detailed plan to terminate employment

before the normal retirement date.

(r) Property, plant and equipment:

(i) Recognition and measurement:

Items of PP&E are measured at cost less accumulated

depreciation and accumulated impairment losses.

Cost includes expenditures that are directly attributable to the

acquisition of the asset. The cost of self-constructed assets

includes the cost of materials and direct labour, any other costs

directly attributable to bringing the assets to a working

condition for their intended use, the costs of dismantling and

removing the items and restoring the site on which they are

located, and borrowing costs on qualifying assets. The

determination of directly attributable costs involves significant

management estimates. These estimates include certain direct

labour and direct costs associated with the acquisition,

construction, development or betterment of the Company’s

network are capitalized to PP&E, and interest costs which are

capitalized during construction and development of certain

PP&E.

The cost of new cable subscriber installation costs are capitalized

to cable and wireless network and is depreciated over the useful

lives of the related assets. Costs of other cable connections and

disconnections are expensed, except for direct incremental

installation costs related to reconnect Cable customers, which

are deferred to the extent of reconnect installation revenues.

Gains and losses on disposal of an item of PP&E are determined

by comparing the proceeds from disposal with the carrying

amount of PP&E, and are recognized within other income in the

consolidated statements of income.

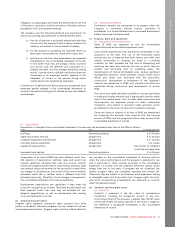

(ii) Depreciation:

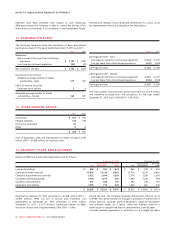

Depreciation is charged to the consolidated statements of income over the estimated useful lives of the PP&E as follows:

Asset Basis Estimated useful life

Buildings Diminishing balance 5 to 25 years

Cable and wireless network Straight-line 3 to 30 years

Computer equipment and software Straight-line 4 to 10 years

Customer premise equipment Straight-line 3 to 5 years

Leasehold improvements Straight-line Over shorter of estimated

useful life and lease term

Equipment and vehicles Diminishing balance 3 to 20 years

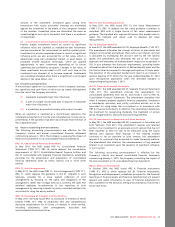

Components of an item of PP&E may have different useful lives.

The selection of depreciation methods, rates, and useful lives

requires significant estimates that take into account industry

trends and company-specific factors. Depreciation methods, rates

and residual values are reviewed at least annually or when there

are changes in circumstances, and revised if the current method,

estimated useful life or residual value is different from that

estimated previously. The effect of such changes is recognized in

the consolidated statements of income prospectively.

Development expenditures are capitalized if they meet the

criteria for recognition as an asset. The assets are amortized over

their expected useful lives once they are available for use.

Research expenditures, as well as maintenance and training

costs, are expensed as incurred.

(s) Acquired program rights:

Program rights represent contractual rights acquired from third

parties to broadcast television programs and are carried at cost less

accumulated amortization. Program rights and the related liabilities

are recorded on the consolidated statements of financial position

when the licence period begins and the program is available for use

and is amortized to other external purchases in the consolidated

statements of income over the expected exhibition period, which

ranges from one to five years. If programs are not scheduled, the

related program rights are considered impaired and written off.

Otherwise, they are subject to non-financial asset impairment testing

as intangible assets with finite useful lives. Program rights for multi-

year sports programming arrangements are expensed as incurred,

when the games are aired.

(t) Goodwill and intangible assets:

(i) Goodwill:

Goodwill is measured if the fair value of consideration

transferred, including the recognized amount of any non-

controlling interest of the acquiree, is greater than the fair value

of the identifiable net assets acquired. If the excess is negative,

the difference is recognized immediately in the consolidated

statements of income.

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 91