Rogers 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The terms of the Company’s accounts receivable securitization

program are committed until its expiry on December 31, 2015 and the

initial funding was completed on January 14, 2013, subsequent to the

2012 year-end (note 27(d)). The buyer’s interest in these trade

receivables ranks ahead of the Company’s interest and the Company

has provided various credit enhancements through over-

collateralization in the form of reserves and deferral of a portion of

the purchase price from the sale proceeds. From month to month over

the term of the securitization program, the buyer will reinvest the

amounts collected from these receivables by buying additional

interests in certain of the Company’s on-going trade receivables. The

buyer of the Company’s trade receivables has no further claim on any

of the Company’s other assets.

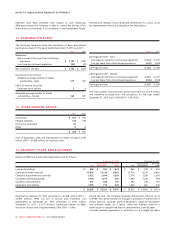

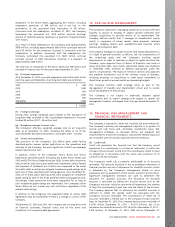

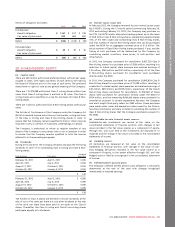

20. OTHER LONG-TERM LIABILITIES:

2012 2011

Deferred pension liability (note 21) $ 343 $ 167

Supplemental executive retirement plan (note 21) 45 39

Restricted share units 28 24

Deferred compensation 13 15

CRTC commitments 912

Stock appreciation rights 99

Program rights liability 55

Other 65

$ 458 $ 276

21. PENSIONS:

The Company maintains both contributory and non-contributory

defined benefit pension plans that cover most of its employees. The

plans provide pensions based on years of service, years of

contributions and earnings. The Company does not provide any non-

pension post retirement benefits. The Company also provides

supplemental unfunded pension benefits to certain executives.

Significant estimates are used in the determination of pension related

balances. Actuarial estimates are based on projections of employees’

compensation levels at the time of retirement. Maximum retirement

benefits are primarily based upon career average earnings, subject to

certain adjustments. The most recent actuarial valuations were

completed as at January 1, 2012, for the Company’s plans.

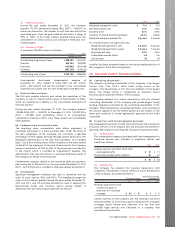

The estimated present value of accrued plan benefits and the

estimated market value of the net assets available to provide for

these benefits for the Company’s funded plans at December 31, 2012

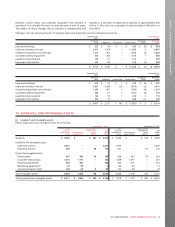

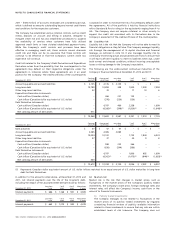

and 2011 are as follows:

2012 2011

Plan assets, at fair value $ 833 $ 684

Accrued benefit obligations 1,167 817

Deficiency of plan assets over accrued benefit

obligations (334) (133)

Effect of asset ceiling limit –(1)

Net deferred pension liability $ (334) $ (134)

Consists of:

Deferred pension asset $9$33

Deferred pension liability (343) (167)

Net deferred pension liability $ (334) $ (134)

The following information is provided on pension fund assets

measured at December 31, 2012 and 2011, for the years then ended:

2012 2011

Plan assets, January 1 $ 684 $ 652

Expected return on plan assets 45 44

Actuarial gain (loss) recognized in other

comprehensive income and equity 30 (17)

Contributions by employees 23 20

Contributions by employer 85 80

Benefits paid (34) (27)

Plan settlements –(68)

Plan assets, December 31 $ 833 $ 684

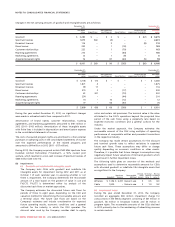

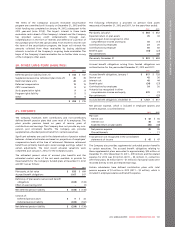

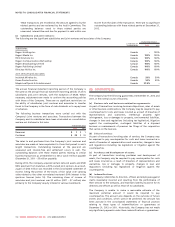

Accrued benefit obligations arising from funded obligations are

outlined below for the years ended December 31, 2012 and 2011:

2012 2011

Accrued benefit obligations, January 1 $ 817 $ 728

Service cost 42 36

Interest cost 48 44

Benefits paid (34) (27)

Contributions by employees 24 20

Actuarial loss recognized in other

comprehensive income and equity 270 73

Plan settlements –(57)

Accrued benefit obligations, December 31 $ 1,167 $ 817

Net pension expense, which is included in employee salaries and

benefits expense, is outlined below:

2012 2011

Plan cost:

Service cost $42 $36

Interest cost 48 44

Expected return on plan assets (45) (44)

Net pension expense 45 36

Plan settlements –11

Total pension cost recognized in the consolidated

statements of income $45 $47

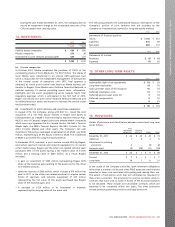

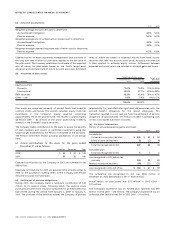

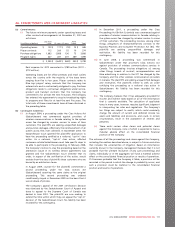

The Company also provides supplemental unfunded pension benefits

to certain executives. The accrued benefit obligations relating to

these supplemental plans amounted to approximately $45 million at

December 31, 2012 (December 31, 2011 – $39 million), and the related

expense for 2012 was $4 million (2011 – $4 million). In connection

with these plans, $5 million (2011 – $1 million) of actuarial losses were

recorded directly to OCI and retained earnings.

Certain subsidiaries have defined contribution plans with total

pension expense of $2 million in 2012 (2011 – $2 million), which is

included in employee salaries and benefits expense.

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 107