Rogers 2012 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

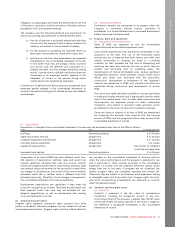

9. INCOME TAXES:

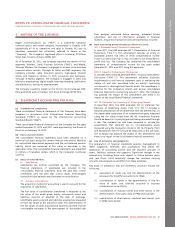

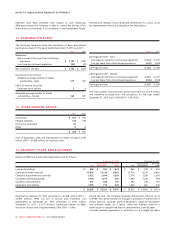

(a) Income tax expense (benefit):

The components of income tax expense (benefit) for the years ended

December 31, 2012 and 2011 were as follows:

Year ended

December 31,

2012

Year ended

December 31,

2011

Continuing operations:

Current income tax expense (benefit) $ 428 $ (136)

Deferred tax expense (benefit):

Origination and reversal of temporary

differences 160 721

Revaluation of deferred tax balances

due to legislative changes 54 (28)

Recognition of previously

unrecognized deferred tax assets (22) (12)

Total deferred tax expense 192 681

Income tax expense from continuing

operations 620 545

Income tax expense from discontinued

operations (note 6) (10) (10)

Total income tax expense $ 610 $ 535

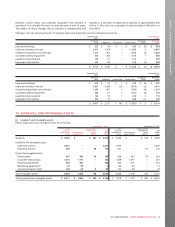

Income tax expense from continuing operations varies from the

amounts that would be computed by applying the statutory income

tax rate to income before income taxes for the following reasons:

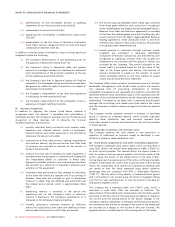

2012 2011

Statutory income tax rate 26.4% 28.0%

Computed income tax expense $ 621 $ 598

Increase (decrease) in income taxes resulting

from:

Revaluation of deferred tax balances due to

legislative changes 54 (28)

Tax rate differential on origination and

reversal of temporary differences –(31)

Non-taxable portion of capital gain (61) –

Recognition of previously unrecognized

deferred tax assets (22) (12)

Impairment of goodwill and intangible assets 11 –

Stock-based compensation 94

Other items 814

Income tax expense from continuing operations $ 620 $ 545

Due to Canadian federal and provincial enacted corporate income tax

rate changes, the statutory income tax rate for the Company

decreased from 28.0% in 2011 to 26.4% in 2012.

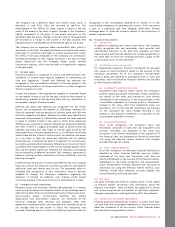

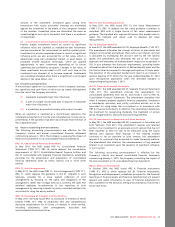

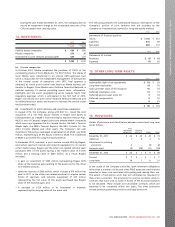

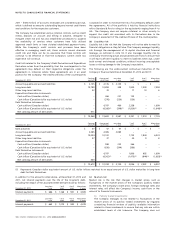

(b) Deferred tax assets and liabilities:

The net deferred tax liability consists of the following:

2012 2011

Deferred tax assets $31$30

Deferred tax liabilities (1,501) (1,390)

Net deferred tax liability $ (1,470) $ (1,360)

The movement of net deferred tax assets and liabilities are summarized as follows:

Deferred tax assets (liabilities) PP&E and

Inventory

Goodwill

and other

intangibles

Stub period

income and

partnership

reserve

Non-capital

income tax loss

carryforwards Other Total

January 1, 2011 $ (464) $ (360) $ (138) $ 54 $ 305 $ (603)

Benefit (expense) in net income (18) (8) (669) 47 (33) (681)

Benefit (expense) in OCI – – – – (21) (21)

Acquisitions (2) (53) – 3 (3) (55)

December 31, 2011 (484) (421) (807) 104 248 (1,360)

Benefit (expense) in net income (117) 61 72 (79) (129) (192)

Benefit (expense) in OCI – – – – 82 82

December 31, 2012 $ (601) $ (360) $ (735) $ 25 $ 201 $ (1,470)

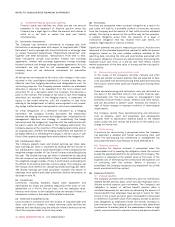

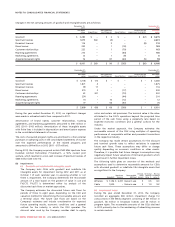

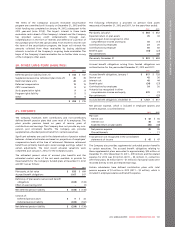

As at December 31, 2012, the Company had Canadian non-capital loss

carryforwards of $75 million, and foreign non-capital loss

carryforwards of $50 million. If not utilized, the majority of the

Canadian and foreign tax losses will expire after 2025. As at

December 31, 2012, the Company had approximately $44 million of

available capital losses to offset future capital gains.

As at December 31, 2012 and 2011, deferred tax assets have not been

recognized in respect of the following items:

2012 2011

Capital losses in Canada $44$41

Tax losses in foreign jurisdictions 34 45

Deductible temporary differences in foreign

jurisdictions 45 45

$ 123 $ 131

The Company has taxable temporary differences associated with its

investment in Canadian domestic subsidiaries. No deferred tax

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 97