Rogers 2012 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

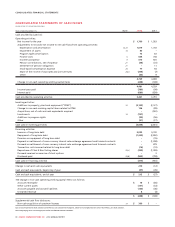

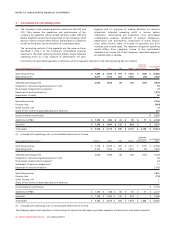

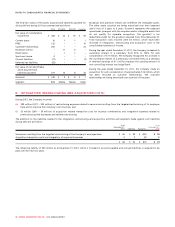

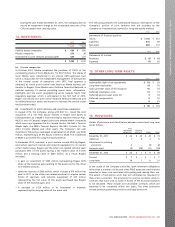

The final fair values of the assets acquired and liabilities assumed for

all acquisitions during 2011 are summarized as follows:

Atria BOUNCE BOB-FM Compton

Fair value of consideration

transferred $ 426 $ 22 $ 16 $ 40

Current assets 10 1 1 1

PP&E 132 – – 10

Customer relationships 200 – – 23

Broadcast licence – 11 6 –

Brand name – 1 1 –

Spectrum licence 4 – – –

Current liabilities (17) – – (1)

Deferred tax liabilities (52) – – –

Fair value of net identifiable

assets acquired and

liabilities assumed 277 13 8 33

Goodwill $ 149 $ 9 $ 8 $ 7

Segment RBS Media Media Cable

Broadcast and spectrum licenses are indefinite life intangible assets.

The other assets acquired are being amortized over their expected

useful lives of 3 years to 5 years. Goodwill represents the expected

operational synergies with the acquiree and/or intangible assets that

do not qualify for separate recognition. The goodwill is tax

deductible except for the goodwill acquired from Atria Networks LP.

Total transaction costs incurred were $4 million, which have been

recorded in integration, restructuring and acquisition costs in the

consolidated statement of income.

During the year ended December 31, 2011, the Company increased its

ownership interest in a subsidiary from 53% to 100% for cash

consideration of $11 million. The Company recognized this increase in

the ownership interest of a previously controlled entity as a decrease

in retained earnings of $11 million because the carrying amount of

non-controlling interest was insignificant.

During the year ended December 31, 2011, the Company made an

acquisition for cash consideration of approximately $16 million, which

has been recorded as customer relationships. The customer

relationships are being amortized over a period of five years.

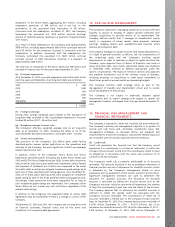

8. INTEGRATION, RESTRUCTURING AND ACQUISITION COSTS:

During 2012, the Company incurred:

(a) $89 million (2011 – $52 million) of restructuring expenses related to severances resulting from the targeted restructuring of its employee

base and to improve the Company’s cost structure; and

(b) $3 million (2011 – $4 million) of acquisition related transaction costs for business combinations and integration expenses related to

previously acquired businesses and related restructuring.

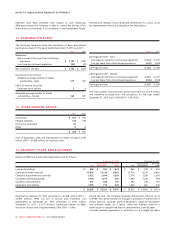

The additions to the liabilities related to the integration, restructuring and acquisition activities and payments made against such liabilities

during 2012 are as follows:

As at

December 31,

2011 Additions Payments

As at

December 31,

2012

Severances resulting from the targeted restructuring of the Company’s employee base $ 46 $ 89 $ (85) $50

Acquisition transaction costs and integration of acquired businesses 2 3 (2) 3

$ 48 $ 92 $ (87) $53

The remaining liability of $53 million as at December 31, 2012, which is included in accounts payable and accrued liabilities, is expected to be

paid over the next two years.

96 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT