Rogers 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGEMENT’S DISCUSSION AND ANALYSIS

Each of our four business lines reports financial results, from

operating revenue and adjusted operating profit to various operating

metrics, associated with their respective businesses. Please refer to the

relevant sections in this MD&A for details.

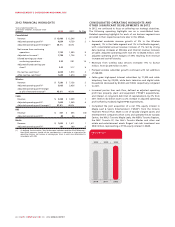

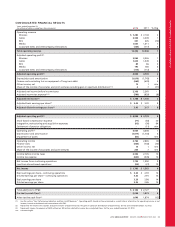

Consolidated Revenue

Of the $140 million year-over-year increase in our consolidated

revenue, Wireless contributed $142 million, Cable contributed $49

million and Media contributed $9 million, partially offset by decreases

in revenue of $54 million in RBS and in corporate items and

intercompany eliminations of $6 million. The increase was due to

overall higher subscriber levels, data revenue and equipment sales at

Wireless and higher Internet revenue at Cable, partially offset by

lower overall revenue at RBS due to the phased exit of the legacy

services business.

Consolidated Adjusted Operating Profit

Of the $95 million year-over-year increase in our consolidated

adjusted operating profit, Wireless contributed $27 million, Cable

contributed $56 million, RBS contributed $3 million, and Media

contributed $10 million, partially offset by a decrease in corporate

items and intercompany eliminations of $1 million. The increases at

Wireless and Cable were due to the revenue growth described above

combined with cost efficiencies.

Adjusted operating profit for 2012 and 2011, respectively, excludes:

(i) stock-based compensation expense of $77 million and $64 million;

(ii) integration, restructuring and acquisition expenses of $92 million

and $56 million; and (iii) settlement of pension obligations of $nil and

$11 million.

For details on the determination of adjusted operating profit, which

is a non-GAAP measure, see the section “Key Performance Indicators

and Non-GAAP Measures”.

Consolidated Adjusted Net Income

On a consolidated basis, adjusted net income increased to $1,788

million from $1,736 million, primarily due to increased year-over-year

adjusted operating profits of 2%.

Adjusted net income for 2012 and 2011, respectively, excludes:

(i) stock-based compensation expense of $77 million and $64 million;

(ii) integration, restructuring and acquisition expenses of $92 million

and $56 million; (iii) settlement of pension obligations of $nil and $11

million; (iv) loss on repayment of long-term debt of $nil and $99

million; (v) impairment of assets of $80 million and $nil; (vi) gain on

spectrum distribution of $233 million and $nil; (vii) the related income

tax recovery of the aforementioned items of $14 million and $56

million; and (viii) the income tax impact of legislative tax change of

$54 million and a recovery of $28 million.

For a discussion of consolidated reconciling items from adjusted

operating profit to net income and adjusted net income, please refer

to the section “Consolidated Analysis”.

Adjusted Basic and Diluted Earnings Per Share

On a consolidated basis, both adjusted basic and diluted earnings per

share increased 8%, year-over-year. The increases were primarily

attributable to increased adjusted net income of 3% year-over-year

and the effect of our share buybacks.

For details on the determination of adjusted basic and diluted

earnings per share, which are non-GAAP measures, see the section

“Key Performance Indicators and Non-GAAP Measures”.

Pre-tax Free Cash Flow

The year-over-year increase in our consolidated pre-tax cash flow was

primarily attributed to 2% growth of adjusted operating profit,

partially offset by higher additions to PP&E.

Pre-tax free cash flow is defined as adjusted operating profit less

PP&E expenditures and interest on long-term debt (net of

capitalization). For details on the determination of pre-tax free cash

flow, which is a non-GAAP measure, see the section “Key

Performance Indicators and Non-GAAP Measures”.

SEGMENT REVIEW

WIRELESS

Wireless Industry Trends

> Focus on Customer Retention

The wireless communications industry’s current market penetration in

Canada is estimated to be 78% of the population, compared to

approximately 109% in the U.S. and approximately 123% in the

United Kingdom. We expect market penetration in Canada to grow

by approximately 4% over each of the next several years. As market

penetration deepens and competition intensifies, a strategic focus is

required on strengthening the customer experience, promoting new

data and voice services to existing customers, and retaining customers

through enhanced service, subsidized handset upgrades and other

value-added capabilities.

> Demand for Sophisticated Data Applications

The ongoing development of more sophisticated wireless networks,

devices and applications has created increased data functionality. At

the same time, it has enabled Canadians to access – and demand – an

ever-expanding array of content, from popular apps to high-quality

streaming video, music and television programming. Wireless believes

that the rapid introduction of such new technologies and capabilities

will continue to drive the growth of wireless data services into the

future.

> Convergence of Technologies

Technologies across wireless and wireline platforms have been

increasingly converging over recent years. This convergence has

enabled Wireless to launch new applications for customers, such as an

application where the user can manage their recordings from a

smartphone or a tablet, and a live TV content streaming application

to smartphones and tablets.

> Increased Competition from Other Wireless Operators

Wireless faces intensive competition from incumbent national and

regional wireless operators as well as a number of smaller, relatively

new entrants in the Canadian wireless market. This trend is

elaborated in the “Competition in Our Businesses” section of this

MD&A. Over the past three years, the smaller new entrants have

introduced unlimited usage pricing plans and extremely aggressive

pricing and promotions. This has resulted in downward price

adjustments, particularly for wireless voice services, as well as

increases in customer churn.

> Migration to Next Generation Wireless Technology

Advances in wireless data transmission technologies, combined with

customer demand for more sophisticated wireless services and data

functionality, have led wireless providers to migrate towards the next

generation of broadband wireless data networks, such as LTE and

HSPA+. These networks enable far higher data transmission speeds

with increased efficiency, low latency and enhanced video streaming

capabilities. Additionally, these networks support a variety of

increasingly advanced data applications – among them, broadband

Internet access, multimedia services and seamless access to corporate

information systems, including desktop, client and server-based

applications, on a local, national or international basis. Wireless has

34 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT