Rogers 2012 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

ADDITIONAL INFORMATION

Additional information relating to Rogers, including our Information

Circular, Annual Information Form, and discussions of our 2012

quarterly results, may be found online at rogers.com/investors,

sedar.com or sec.gov. Information contained in or connected to these

websites are not a part of and not incorporated into this MD&A.

Additional information on Rogers’ corporate social responsibility

reporting and corporate governance, along with a glossary of

communications and media industry terms, can also be found at

rogers.com/investors.

1. EXECUTIVE SUMMARY

We are one of Canada’s leading diversified communications and

media companies. Through our four operating segments – Wireless,

Cable, RBS and Media – we provide a broad range of services: wireless

and wired voice and data communications, cable television, high-

speed Internet, telephony, wired telecom and data networking

services to businesses. We are also active in television and radio

broadcasting, televised shopping, sports entertainment, digital media,

and consumer, trade and professional publications. Almost all of our

operations and sales are in Canada, supported by a highly skilled and

diversified workforce approximately 24,500 employees strong.

The Canadian telecommunications and media industries are both

subject to various regulatory controls and competitive dynamics as

discussed later in this MD&A. Over the past few years, the industry has

seen a shift toward vertical integration, a migration to next

generation wireless technologies and innovations to deliver

telecommunications services and premium media content across both

traditional and newly developed platforms. We continue to evolve

our corporate strategy to thrive in this operating environment by

focusing on growing areas of our business, including wireless data

revenue and smartphone penetration, and offering products and

services aligned with transforming consumer demands.

We continue to focus on innovation to meet the changing needs and

desires of our customers as technology evolves. We are committed to

providing customers with ground-breaking solutions and state-of-the-

art products at home and for businesses. We put the newest and

fastest Wireless technology available in the hands of our customers

with the expansion of our LTE network, created advanced conversion

of television and Internet experiences with Nextbox 2.0 and Rogers

Anyplace TV, made significant investments to our Cable network to

deliver the fastest Internet speeds available, offered more next-

generation IP based solutions to our enterprise customers. In addition,

we completed the joint acquisition of 37.5% of Maple Leaf Sports &

Entertainment to further enhancing our sports content offerings.

Our strategy requires continued capital investments and innovative

service offerings to maintain our industry leadership and continue to

be the first in Canada to deliver seamless, easy-to-use and reliable

end-to-end supported experiences to our customers.

At Wireless, in 2012, strong data service growth and ongoing

increases to our subscriber base, resulted in revenue growth of 2%

year over year. Wireless activated nearly 2.9 million smartphones,

bringing smartphone penetration to 69% of the postpaid subscriber

base.

To drive future growth opportunities aligned with consumer demand

for advanced mobile data applications, together with the Canadian

Imperial Bank of Commerce (“CIBC”), we launched Canada’s first

mobile payment solution. It allows consumers to pay for purchases

with their CIBC credit card using a compatible Rogers NFC-enabled

smartphone. This is one of the first solutions of its kind anywhere in

the world.

At Cable, in 2012, revenue was positively impacted by growth to our

Internet subscriber base, which was partially offset by market

declines. The increase in Cable revenue reflects our mix of

promotional programs designed to encourage movement of cable

and Internet subscribers to term contracts and higher-end tiers.

Cable demonstrated its commitment to bringing leading Internet

experiences to Canadians by increasing speeds across approximately

90% of its footprint, including doubling the speed of our Ultimate

tier to 150 Mbps and unveiling NextBox 2.0 and Rogers anyplace TV

Home edition application for tablets providing a seamless converged

TV and Internet experience.

At RBS, in 2012, 27% growth of next-generation revenue was offset

by a 32% planned decline in legacy revenue for an overall decline in

RBS revenue of 13%. The shift to higher margin next-generation IP

services enabled RBS to generate 3% growth in adjusted operating

profit. Focusing on the higher margin IP services, RBS launched a new

SIP Trunking voice solution for its enterprise customers.

At Media, in 2012, revenue increased modestly from 2011, primarily

driven by growth in our sports properties. Media experienced a

continued weakness in the advertising sales market that stemmed

from economic softness and shifting trends in advertiser spending.

Media made further investments in first-class content offerings,

purchasing theScore television network and completing several off-

season all-star calibre player acquisitions at the Blue Jays, to be

positioned to monetize on future changes in the economic

environment.

We have a healthy balance sheet from both a leverage and a liquidity

perspective. With an investment grade rating for the year ended

December 31, 2012, our debt-to-adjusted-operating-profit ratio is 2.3

times and we have available liquidity of $3.1 billion, with $213 million

in cash, $900 million available through our new accounts receivable

securitization program, and all of our $2.0 billion fully committed

multi-year bank credit facility available at December 31, 2012.

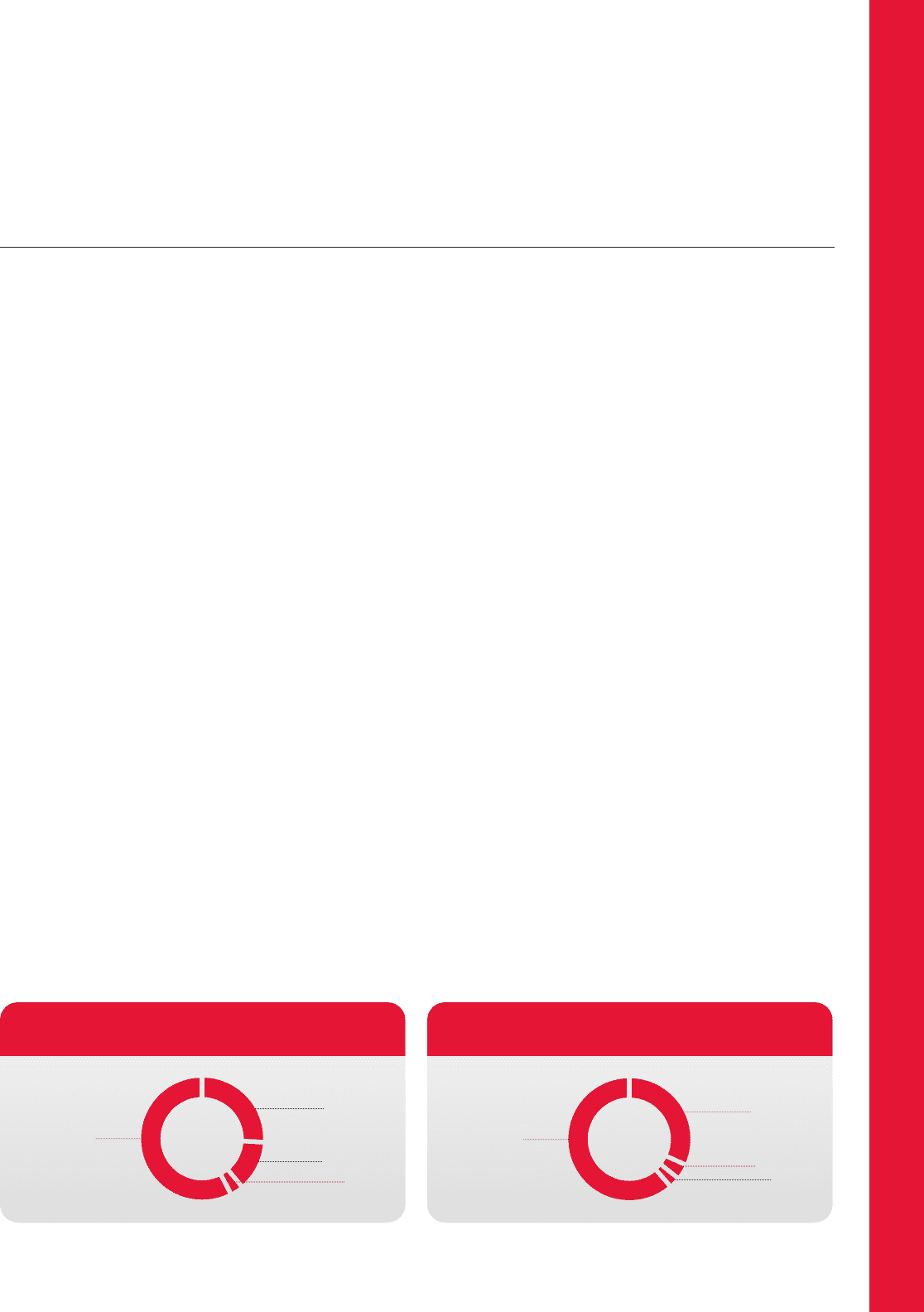

(%)

2012 CONSOLIDATED REVENUE BY SEGMENT

WIRELESS 58%

MEDIA 13%

CABLE 26%

$12.5

RBS 3%

BILLION

(%)

2012 CONSOLIDATED ADJUSTED OPERATING PROFIT BY SEGMENT

WIRELESS 62%

MEDIA 4%

CABLE 32%

RBS 2%

$4.8

BILLION

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 23