Rogers 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

light of customer demand for more sophisticated data applications

and devices.

The modest year-over-year decrease in other operating expenses,

excluding the retention spending increase, was driven by the growth

in the Wireless’ subscriber base. This growth meant higher customer

care costs for serving our expanding postpaid subscriber base and

supporting more sophisticated devices and services, combined with

increased spending on advertising and promotion. However, such

increased expenses were predominately offset by savings related to

strategic cost management and productivity initiatives. Wireless

continues to focus on implementing a program of permanent cost

reduction and efficiency improvement initiatives to control the

overall operating expense structure and derive scale efficiencies across

various functions, in line with our strategy to improve our cost

structure and drive ongoing productivity.

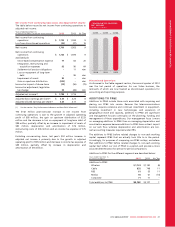

Wireless Adjusted Operating Profit

The 1% year-over-year increase in Wireless’ adjusted operating profit

and the 45.6% adjusted operating profit margin on network revenue

(which excludes equipment sales revenue) for 2012 primarily reflects

the modest increases in network and equipment revenue, partially

offset by an increase in total operating expenses, driven by the record

high volume of smartphone activations and upgrades as discussed in

the preceding section.

($)

WIRELESS POSTPAID

MONTHLY ARPU

$72.62 $70.26 $69.30

2010 2011 2012

(%)

WIRELESS POSTPAID

MONTHLY CHURN

1.18% 1.32% 1.29%

2010 2011 2012

CABLE

Cable Industry Trends

> Investment in Improved Cable Networks and Expanded Service

Offerings

In recent years, North American cable companies have made

substantial investments in: (i) the installation of fibre-optic cable,

including initiatives to push fibre closer to the home; (ii) electronics in

their respective networks; and (iii) the development of Internet,

digital cable and voice-over-cable telephony services. These

investments have enabled cable companies to offer expanded

packages of digital cable television services (such as VOD and SVOD,

pay television packages, PVR and HDTV programming, and streaming

video to multiple non-TV devices), increasingly fast tiers of Internet

access and widespread home phone services to residential and small

business customers.

> Increased Competition from Alternative Broadcasting

Distribution Undertakings (“BDUs”)

As fully described in the section “Competition in Our Businesses”,

Canadian cable television systems generally face legal and illegal

competition from several alternative multi-channel broadcasting

distribution systems.

> Growth of Internet Protocol-Based Services

Telephony over the Internet has become a direct competitor to

Canadian cable systems and the incumbent telephone providers we

primarily compete against. Voice over Internet Protocol (“VoIP”)

telephony services are being provided by non-facilities-based

providers, such as Skype and Vonage, which market VoIP services to

individuals who already subscribe to high-speed Internet services over

which their VoIP products operate. In addition, certain television and

movie content is more prevalent than ever over the Internet.

Traditional TV viewing has been increasingly augmented by these and

other emerging options such as over-the-top television offerings as

Netflix and Apple TV.

> Increasing Availability of Online and Wireless Access to Cable

TV Content

Cable and content providers throughout North America continue to

create platforms that provide online and wireless access to increasing

amounts of television content. These platforms, including Rogers

Anyplace TV, generally provide authentication features controlling

and limiting access to specific content subscribed to at the user’s

residence. The launch and development of these online content

platforms are still in the early stages and subject to ongoing

discussions between content providers and cable companies with

respect to how to access on-demand versions of traditionally televised

content is granted, controlled and monetized.

In addition, cable providers in the U.S. and Canada, including Rogers,

have increasingly focused on developing streaming video applications

for smartphones, tablets and gaming devices. As well, Cable also now

provides applications for smartphones and tablets that enable

customers to remotely search content and remotely program their

Rogers PVR from their wireless device.

> Facilities-Based Telephony Services Competitors

For several years, competition has been strong in the long distance

telephony service markets, with the average price per minute

generally continuing to decline each year. Competition in the local

telephone market also continues between Cable, Incumbent Local

Exchange Carriers (“ILECs”) and various VoIP providers, as discussed

above.

> Increased Competition from Non-Facilities-Based Internet

Service Providers (“ISPs”)

Internet services delivered by non-facilities-based service providers

that take advantage of regulated wholesale pricing is an increasing

threat. These service providers offer unlimited Internet usage at

significantly lower prices and are attracting a growing number of

subscribers.

Demand generally continues to grow for Cable’s services, particularly

Internet, digital television and cable telephony. The variable costs

associated with supporting this growth, such as the cost of additional

content, commissions for subscriber activations and the fixed costs of

acquiring new subscribers, are material. Accordingly, fluctuations in

the number of activations of new subscribers from period to period

result in fluctuations in costs associated with sales, marketing and

field services.

Over the past two years, the competitive intensity in Cable’s territory

has escalated significantly. This reflects the increasing availability of a

competing IPTV television offering from Cable’s primary ILEC

competitor that is increasingly being offered at deeply discounted

promotional pricing to attract new customers. This has resulted in a

slowing of customer acquisition volumes at Cable and an increase in

promotional and retention pricing offers, both of which have served

to dampen Cable’s revenue growth rates.

38 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT