Rogers 2012 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

2012 FINANCIAL HIGHLIGHTS

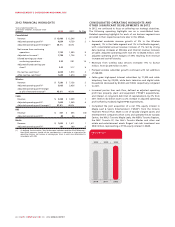

Years ended December 31,

(In millions of dollars, except per share

amounts) 2012 2011 % Chg

Consolidated

Revenue $ 12,486 $ 12,346 1

Adjusted operating profit(1) 4,834 4,739 2

Adjusted operating profit margin(1) 38.7% 38.4%

Net income from continuing

operations 1,732 1,590 9

Adjusted net income(1) 1,788 1,736 3

Diluted earnings per share -

continuing operations 3.32 2.91 14

Adjusted diluted earnings per

share(1) 3.43 3.17 8

Pre-tax free cash flow(1) 2,029 1,973 3

After-tax free cash flow(1) 1,649 1,874 (12)

Wireless

Revenue $ 7,280 $ 7,138 2

Adjusted operating profit(1) 3,063 3,036 1

Adjusted operating profit margin

as a% of network revenue(1) 45.6% 46.0%

Cable

Revenue $ 3,358 $ 3,309 1

Adjusted operating profit(1) 1,605 1,549 4

Adjusted operating profit margin(1) 47.8% 46.8%

RBS

Revenue $ 351 $ 405 (13)

Adjusted operating profit(1) 89 86 3

Media

Revenue $ 1,620 $ 1,611 1

Adjusted operating profit(1) 190 180 6

(1) As defined. See the section “Key Performance Indicators and Non-GAAP Measures”.

Non-GAAP measures should not be considered as a substitute or alternative for

operating income, net income or earnings per share in each case determined in

accordance with IFRS.

CONSOLIDATED OPERATING HIGHLIGHTS AND

OTHER SIGNIFICANT DEVELOPMENTS IN 2012

In 2012, we continued to focus on achieving our strategic objectives.

The following operating highlights are on a consolidated basis.

Detailed operating highlights for each of our business segments are

provided in their respective sections later in this MD&A.

• Generated moderate revenue growth of 2% in the Wireless

segment, 1% in the Cable segment and 1% in the Media segment,

with consolidated annual revenue increase of 1% led by strong

data revenue increases at Wireless and Internet revenue increases

at Cable. Adjusted operating profit rose 2% to $4,834 million, with

adjusted operating profit margins of 39% resulting from revenue

increase and cost efficiencies.

• Revenues from wireless data services increased 17% to $2,722

million, from $2,325 million in 2011.

• Postpaid wireless subscriber growth continued with net additions

of 268,000.

• Cable grew high-speed Internet subscribers by 71,000 and cable

telephony lines by 22,000, while basic television and digital cable

households decreased by 83,000 and 9,000, respectively compared

to 2011.

• Increased pre-tax free cash flow, defined as adjusted operating

profit less property, plant and equipment (“PP&E”) expenditures,

and interest on long-term debt (net of capitalization), by 3% from

2011 levels to $2 billion due to a 2% increase in adjusted operating

profit offset by modestly higher PP&E expenditures.

• Completed the joint acquisition of a net 75% equity interest in

Maple Leaf & Sports Entertainment (“MLSE”) from the Ontario

Teachers’ Pension Plan. MLSE is one of Canada’s largest sports and

entertainment companies which owns and operates the Air Canada

Centre, the NHL’s Toronto Maple Leafs, the NBA’s Toronto Raptors,

the MLS’ Toronto FC, the AHL’s Toronto Marlies and other real

estate and entertainment assets. Rogers’ net cash investment was

$540 million, representing a 37.5% equity interest in MLSE.

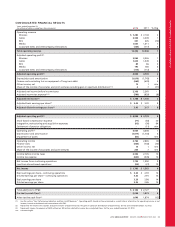

($)

ADJUSTED EPS

$2.96 $3.20 $3.45

2010 2011 2012

24 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT