Rogers 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

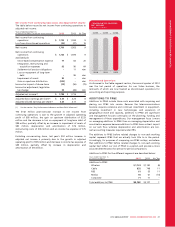

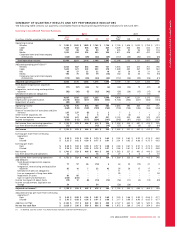

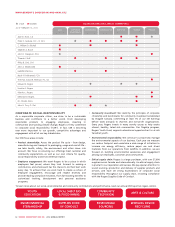

MANAGEMENT’S DISCUSSION AND ANALYSIS

Accounts Receivable Securitization Program

On December 31, 2012 we entered into an accounts receivable

securitization program. It enables us to sell certain trade receivables

into the program with the proceeds recorded in current liabilities as

revolving floating rate loans of up to $900 million. We will continue

to service these accounts receivables and they will continue to be

recorded in current assets on our Statement of Financial Position.

The terms of the Company’s accounts receivable securitization

program are committed until its expiry on December 31, 2015. Initial

funding was received on January 14, 2013. The buyer’s interest in

these trade receivables ranks ahead of the Company’s interest. The

buyer of the Company’s trade receivables has no further claim on any

of our other assets.

Debt Issuances and Redemptions

In June 2012, we issued $500 million of 3.0% Senior Notes due 2017

(the “2017 Notes”) and $600 million of 4.0% Senior Notes due 2022

(the “2022 Notes”). The net proceeds from the offering were $1,091

million after deducting the original issue discount and debt issuance

costs. The net proceeds were used to repay outstanding advances

under our bank credit facility and for general corporate purposes,

which included funding a portion of our ownership interest in MLSE.

In March 2011, we issued $1,450 million of 5.34% Senior Notes due

2021 and $400 million of 6.56% Senior Notes due 2041. The net

proceeds from the offerings were approximately $1,840 million after

deducting the original issue discount and debt issuance costs. The net

proceeds were used to fund the March 2011 redemption of two

public debt issues maturing in 2012, together with the termination of

the associated Debt Derivatives and to partially repay outstanding

advances under our bank credit facility.

In March 2011, we also redeemed the outstanding principal amount

of our US$350 million 7.875% Senior Notes due 2012 and the

outstanding principal amount of our US$470 million 7.25% Senior

Notes due 2012. Concurrently with the redemptions of these senior

notes, we terminated the associated Debt Derivatives. The total cash

expenditure was approximately $1,208 million, consisting of $878

million for the redemption of the senior notes and $330 million to

terminate the Debt Derivatives.

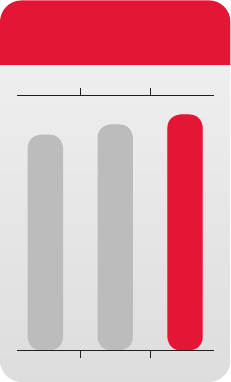

RATIO OF DEBT TO

ADJUSTED OPERATING PROFIT

2.1x 2.2x 2.3x

2010 2011 2012

Share Repurchases

In February 2012, we renewed our normal course issuer bid (“NCIB”)

to repurchase Class B Non-Voting shares of RCI for a further one-year

period. This allows us to purchase up to the lesser of 36.8 million Class

B Non-Voting shares, representing approximately 9% of the then-

issued and outstanding Class B Non-Voting shares, and that number

of Class B Non-Voting shares that can be purchased under the NCIB

for an aggregate purchase price of $1.0 billion.

During 2012, we purchased for cancellation 9,637,230 Class B Non-

Voting shares for $350 million. All of these shares were purchased

directly under the NCIB.

During 2011, we purchased for cancellation 30,942,824 Class B Non-

Voting shares for $1,099 million. Of these shares, 21,942,824 were

purchased for cancellation directly under the NCIB for $814 million,

and the remaining 9,000,000 were purchased for cancellation

pursuant to private agreements with arm’s-length third party sellers

for $285 million.

In February 2013, RCI filed a notice with the TSX of our intention to

renew our NCIB for our Class B Non-Voting shares for a further one-

year period. Subject to acceptance by the TSX, the TSX notice provides

that RCI may, during the twelve-month period, commencing

February 25, 2013 and ending February 24, 2014, purchase on the TSX,

the New York Stock Exchange (“NYSE”) and/or alternate trading

systems up to the lesser of 35.8 million Class B Non-Voting shares and

that number of Class B Non-Voting shares that can be purchased

under the NCIB for an aggregate purchase price of $500 million.

The actual number of Class B Non-Voting shares purchased under the

NCIB and the timing of such purchases will be determined by

management considering market conditions, stock prices, our cash

position and other factors.

Capital Resources

Our capital resources consist primarily of cash flow from operations,

cash and cash equivalents, available lines of credit, accounts

receivable securitization and long-term debt issuances.

This information is forward-looking and should be read in

conjunction with the section “Caution Regarding Forward-Looking

Statements, Risks and Assumptions” and the related disclosures for

the various economic, competitive and regulatory assumptions,

factors and risks that could cause actual future financial and

operating results to differ from those currently expected.

On a consolidated basis, we anticipate that we will generate a net

cash surplus in 2013 from our operations. We expect that we will have

sufficient capital resources to satisfy our cash funding requirements in

2013, including the funding of dividends on our common shares,

taking into account cash from operations and the amount available

under our $2.0 billion bank credit facility and our $900 million

accounts receivable securitization program. At December 31, 2012,

there were no restrictions on the flow of funds between subsidiary

companies or between RCI and any of its subsidiaries.

In the event that we require additional funding, we believe that any

such funding requirements may be satisfied by issuing additional debt

financing, which may include the restructuring of our existing bank

credit facility or issuing public or private debt or amending the terms

of our accounts receivable securitization program or issuing equity, all

depending on market conditions. In addition, we may refinance a

portion of existing debt subject to market conditions and other

factors. There is no assurance that this will or can be done.

52 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT