Rogers 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

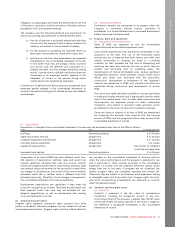

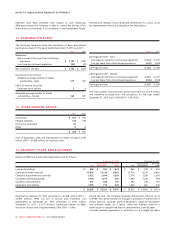

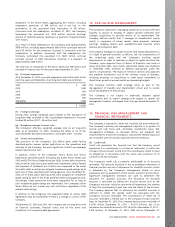

3. SEGMENTED INFORMATION:

(a) The Company’s chief operating decision makers are the CEO and

CFO. They review the operations and performance of the

Company by segments, which include Wireless, Cable, RBS and

Media. Segment results that are reported to the Company’s chief

decision makers include items directly attributable to a segment

as well as those that can be allocated on a reasonable basis.

The accounting policies of the segments are the same as those

described in note 2 to the Company’s consolidated financial

statements. The chief operating decision makers review adjusted

operating profit as a key measure of performance for each

segment and for purposes of making decisions on resource

allocations. Adjusted operating profit is income before

integration, restructuring and acquisition costs, stock-based

compensation expense, settlement of pension obligations,

depreciation and amortization, impairment of assets, finance

costs, other income, share of income of associates and joint

ventures, and income taxes. This measure of segment operating

results differs from operating income in the consolidated

statements of income. All of the Company’s reportable segments

are substantially in Canada.

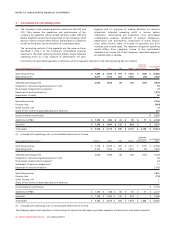

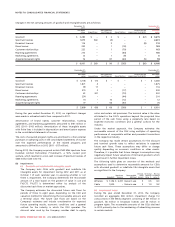

Information by reportable segments is as follows, which is regularly reported to the chief operating decision makers:

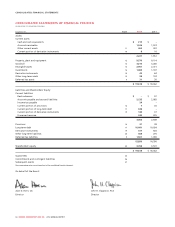

Year ended December 31, 2012 Wireless Cable RBS Media

Corporate

items and

Eliminations Consolidated

Totals

Operating revenue $ 7,280 $ 3,358 $ 351 $ 1,620 $ (123) $ 12,486

Operating costs(1) 4,217 1,753 262 1,430 (10) 7,652

Adjusted operating profit 3,063 1,605 89 190 (113) 4,834

Integration, restructuring and acquisition costs 92

Stock-based compensation expense(1) 77

Depreciation and amortization 1,819

Impairment of assets 80

Operating income 2,766

Finance costs (664)

Other income, net 15

Share of the income of associates and joint ventures 235

Income before income taxes $ 2,352

Additions to PP&E $ 1,123 $ 832 $ 61 $ 55 $ 71 $ 2,142

Goodwill $ 1,146 $ 1,000 $ 215 $ 854 $ – $ 3,215

Total assets $ 9,769 $ 4,719 $ 835 $ 2,157 $ 2,138 $ 19,618

(1) Included with operating costs in consolidated statements of income.

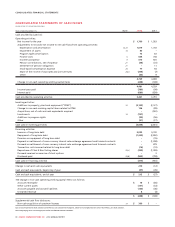

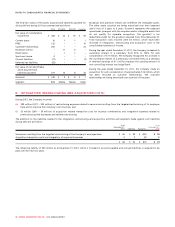

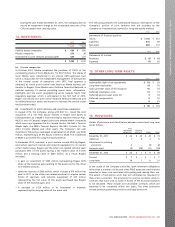

Year ended December 31, 2011 Wireless Cable RBS Media

Corporate

items and

eliminations Consolidated

totals

Operating revenue $ 7,138 $ 3,309 $ 405 $ 1,611 $ (117) $ 12,346

Operating costs(1) 4,102 1,760 319 1,431 (5) 7,607

Adjusted operating profit 3,036 1,549 86 180 (112) 4,739

Integration, restructuring and acquisition costs 56

Stock-based compensation expense(1) 64

Settlement of pension obligations(1) 11

Depreciation and amortization 1,743

Operating income 2,865

Finance costs (738)

Other income, net 1

Share of the income of associates and joint ventures 7

Income before income taxes $ 2,135

Additions to PP&E $ 1,192 $ 748 $ 55 $ 61 $ 71 $ 2,127

Goodwill $ 1,146 $ 1,000 $ 215 $ 919 $ – $ 3,280

Total assets $ 9,184 $ 4,619 $ 924 $ 1,947 $ 1,688 $ 18,362

(1) Included with operating costs in consolidated statements of income.

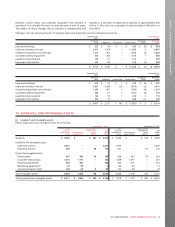

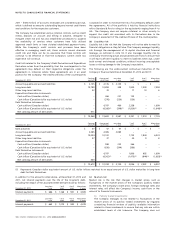

The Company applies the same basis of accounting for transactions between reportable segments as transactions with external parties.

94 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT