Rogers 2004 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96 Rogers Communications Inc. 2004 Annual Report

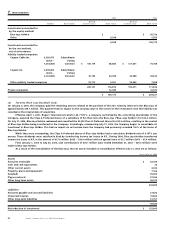

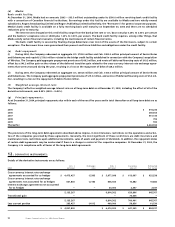

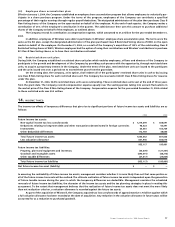

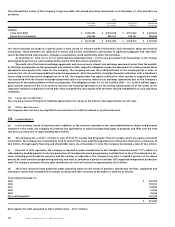

At December 31, 2004, as a result of the exchange offer, the following Wireless’ stock options were exchanged for RCI options:

2004 2003

Weighted Weighted

average average

Number of exercise Number of exercise

options price options price

Options outstanding, beginning of year 4,227,097 $ 24.22 3,471,017 $ 25.04

Granted – – 1,111,200 20.47

Exercised (1,875,547) 20.70 (158,495) 18.18

Forfeited (85,496) 25.31 (196,625) 22.39

Exchanged for RCI options (2,266,054) 27.09 – –

Options outstanding, end of year – – 4,227,097 24.22

Exercisable, end of year – – 2,291,372 $ 27.36

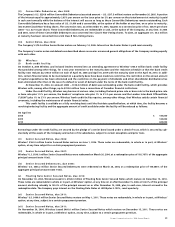

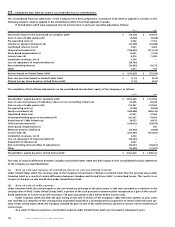

On January 1, 2004, the Company adopted CICA Handbook Section 3870 and recorded a charge to opening retained earnings of $7.0 mil-

lion for stock options granted to employees on or after January 1, 2002 (note 2(p)).

For the year ended December 31, 2004, the Company recorded compensation expense of approximately $15.1 million, related to

stock options granted to employees.

As a result of the above transactions and the exchange of Wireless options for RCI options (note 3(a)), $72.0 million was recorded

in contributed surplus.

Based on stock options issued subsequent to January 1, 2002, the stock-based compensation expense for the year ended

December 31, 2003 would have been increased by $6.4 million, and pro forma net income for the year ended December 31, 2003 would

have been $122.8 million ($0.32 per share, basic and $0.31 per share, diluted).

The weighted average estimated fair value at the date of the grant for RCI options granted during 2004 was $12.64 (2003 – $10.78)

per share. No Wireless options were granted in 2004. The weighted average fair value at the date of grant for Wireless options granted

for 2003 was $12.20 per share. The fair value of each option granted was estimated on the date of the grant using the Black-Scholes

option pricing model with the following assumptions:

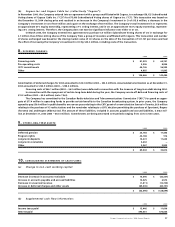

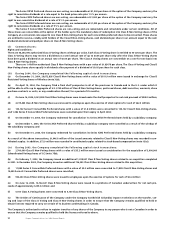

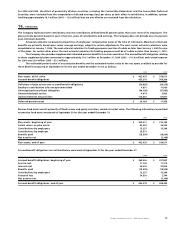

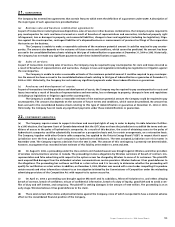

2004 2003

RCI’s risk-free interest rate 4.36% 4.42%

Wireless’ risk-free interest rate – 4.50%

RCI’s dividend yield 0.38% 0.21%

Wireless’ dividend yield ––

Volatility factor of the future expected market price of RCI’s Class B Non-Voting shares 44.81% 50.20%

Volatility factor of the future expected market price of Wireless’ Class B Restricted Voting shares – 55.17%

Weighted average expected life of the RCI options 6.0 years 6.6 years

Weighted average expected life of the Wireless options – 5.3 years

The weighted average estimated fair value at the date of exchange of Wireless options to RCI options was $22.15. The fair value of each

vested RCI option granted upon exchange was estimated at the date of the announcement of the exchange offer to acquire the remain-

ing shares of Wireless held by the public and as at the closing date thereof for unvested options, using the Black-Scholes fair value

option pricing model with the following assumptions:

Vested Unvested

options options

Risk-free interest rate 4.12% 4.07%

Volatility factor of the future market price of RCI’s Class B Non-Voting shares 43.06% 43.26%

Dividend yield 0.35% 0.32%

Weighted average expected life of the options 5.33 years 5.71 years

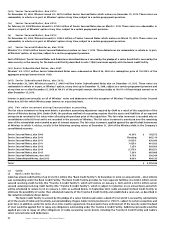

(ii) Employee share purchase plan:

The employee share purchase plan, which was discontinued in 2003, was provided to enable employees of the Company an opportunity

to obtain an equity interest in the Company by permitting them to acquire Class B Non-Voting shares. A total of 1,180,000 Class B Non-

Voting shares were set aside and reserved for allotment and issuance pursuant to the employee share purchase plan.

Under the terms of the employee share purchase plan, participating employees of the Company received a bonus at the end of

the term of the plan. The bonus was calculated as the difference between the share price at the date the employee received the loan

and the lesser of 85% of the closing price at which the shares traded on The Toronto Stock Exchange on the trading day immediately

prior to the purchase date or the closing price on a date that is approximately one year subsequent to the original issue date.

Compensation expense recorded for the Company’s employee share purchase plan for 2003 was $0.6 million.

In addition, employees of Wireless were able to participate in Wireless’ employees share purchase plan. Compensation expense

recorded in Wireless for 2003 was $0.3 million. The plan was also discontinued in 2003.