Rogers 2004 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94 Rogers Communications Inc. 2004 Annual Report

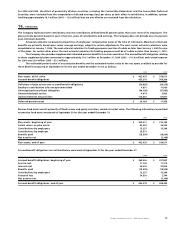

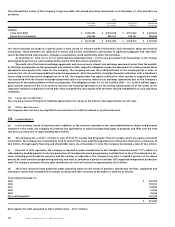

The Series XXVII Preferred shares are non-voting, are redeemable at $1,000 per share at the option of the Company and carry the

right to cumulative dividends at a rate equal to the bank prime rate plus 13/4% per annum.

The Series XXX Preferred shares are non-voting, are redeemable at $1,000 per share at the option of the Company and carry the

right to non-cumulative dividends at a rate of 91/2% per annum.

The Series XXXI Preferred shares are non-voting, are redeemable at $1,000 per share at the option of the Company and carry the

right to cumulative dividends at a rate of 95/8% per annum.

The Series E Convertible Preferred shares are non-voting and are redeemable and retractable under certain conditions. All of

these shares are convertible at the option of the holder up to the mandatory date of redemption into Class B Non-Voting shares of the

Company at a conversion rate equal to one Class B Non-Voting share for each convertible preferred share to be converted. These shares

are entitled to receive, ratably with holders of the Class B Non-Voting shares, cash dividends per share in an amount equal to the cash

dividends declared and paid per share on Class B Non-Voting shares.

(ii) Common shares:

Rights and conditions:

There are 56,240,494 authorized Class A Voting shares without par value. Each Class A Voting share is entitled to 50 votes per share. The

Class A Voting shares may receive a dividend at a semi-annual rate of up to $0.05 per share only after the Class B Non-Voting shares

have been paid a dividend at an annual rate of $0.05 per share. The Class A Voting shares are convertible on a one-for-one basis into

Class B Non-Voting shares.

There are 1.4 billion authorized Class B Non-Voting shares with a par value of $1.62478 per share. The Class A Voting and Class B

Non-Voting shares share equally in dividends after payment of a dividend of $0.05 per share for each class.

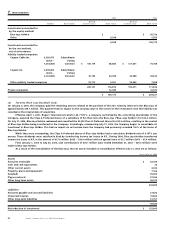

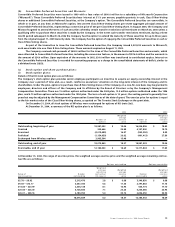

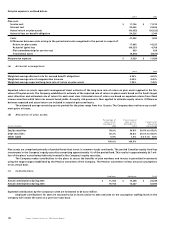

(iii) During 2004, the Company completed the following capital stock transactions:

(a) On December 31, 2004, 28,072,856 Class B Non-Voting shares with a value of $811.9 million were issued in exchange for Class B

Restricted Voting shares of Wireless (note 3(a));

(b) On April 15, 2004, the Company filed a final shelf prospectus in all of the provinces in Canada and in the U.S. under which it

will be able to offer up to aggregate of U.S. $750 million of Class B Non-Voting shares, preferred shares, debt securities, warrants, share

purchase contracts or units, or any combination thereof, for a period of 25 months;

(c) On June 16, 2004, 9,541,985 Class B Non-Voting shares were issued under the shelf prospectus for net cash proceeds of $238.9 million;

(d) 4,019,485 Class B Non-Voting shares were issued to employees upon the exercise of stock options for cash of $62.3 million;

(e) 103,102 Series E Convertible Preferred shares with a value of $1.8 million were converted to 103,102 Class B Non-Voting shares,

and 1,386 Series E Convertible Preferred shares were cancelled upon their expiry in April 2004;

(f) On December 31, 2004, the Company redeemed for cancellation its Series XXVII Preferred shares held by a subsidiary company;

(g) On December 1, 2004, the Series XXX Preferred shares held by a subsidiary company were cancelled as a result of the windup of

the subsidiary company; and

(h) On December 31, 2004, the Company redeemed for cancellation its Series XXXI Preferred shares held by a subsidiary company.

As a result of the above transactions, $1,046.8 million of the issued amounts related to Class B Non-Voting shares was recorded in con-

tributed surplus. In addition, $72.0 million was recorded in contributed surplus related to stock-based compensation (note 13(c)).

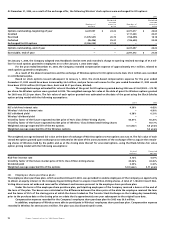

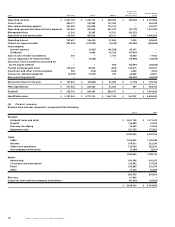

(iv) During 2003, the Company completed the following capital stock transactions:

(a) 2,700,000 Class B Non-Voting shares with a value of $35.2 million were issued as consideration for the acquisition of 3,000,000

Subordinated Voting shares of CCI (note 7(b));

(b) On February 7, 2003, the Company issued an additional 1,329,007 Class B Non-Voting shares related to an acquisition completed

in 2001. In December 2003, the Company issued an additional 736,395 Class B Non-Voting shares related to this acquisition;

(c) 11,889 Series E Convertible Preferred shares with a value of $0.2 million were converted to 11,889 Class B Non-Voting shares and

19,459 Series E Convertible Preferred shares were cancelled;

(d) 952,250 Class B Non-Voting shares were issued to employees upon the exercise of options for cash of $8.6 million;

(e) On June 12, 2003, 12,722,647 Class B Non-Voting shares were issued to a syndicate of Canadian underwriters for net cash pro-

ceeds of approximately $239.0 million; and

(f) 5,100 Class A Voting shares were converted to 5,100 Class B Non-Voting shares.

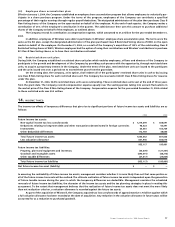

(v) The Articles of Continuance of the Company under the Company Act (British Columbia) impose restrictions on the transfer, vot-

ing and issue of the Class A Voting and Class B Non-Voting shares in order to ensure that the Company remains qualified to hold or

obtain licences required to carry on certain of its business undertakings in Canada.

The Company is authorized to refuse to register transfers of any shares of the Company to any person who is not a Canadian in order to

ensure that the Company remains qualified to hold the licences referred to above.