Rogers 2004 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 Rogers Communications Inc. 2004 Annual Report

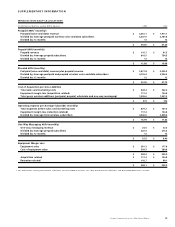

SUPPLEMENTARY INFORMATION

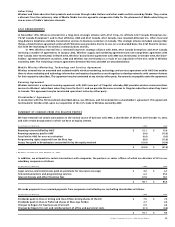

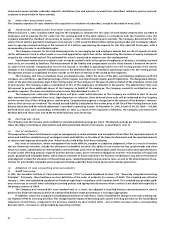

CABLE NON-GAAP CALCULATIONS1

(In millions of dollars, except ARPU figures) 2004 2003

Customer relationships (unique)

Basic cable subscribers 2,254.6 2,269.4

Internet subscribers 936.6 777.8

Less: Subscribers to both basic cable and Internet (835.3) (707.9)

2,355.9 2,339.3

Revenue Generating Units (RGUs)

Basic cable subscribers 2,254.6 2,269.4

Internet subscribers 936.6 777.8

Digital subscribers (households) 675.4 535.3

3,866.6 3,582.5

Core Cable ARPU

Basic cable and digital revenue $ 1,253.1 $ 1,186.4

Divided by: Average basic cable subscribers 2,256.0 2,262.9

Divided by: 12 months 12 12

$ 46.29 $ 43.69

Internet ARPU

Internet revenue $ 378.9 $ 322.3

Divided by: Average Internet subscribers (000s) 847.7 704.2

Divided by: 12 months 12 12

$ 37.25 $ 38.14

1 For definitions of key performance indicators and non-GAAP measures, see “Key Performance Indicators and Non-GAAP Measures ” section.

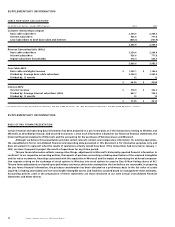

SUPPLEMENTARY INFORMATION

BASIS OF PRO FORMA PRESENTATION

Certain financial and operating data information has been prepared on a pro forma basis as if the transactions relating to Wireless and

Microcell, as described previously, had occurred on January 1, 2003. Such information is based on our historical financial statements, the

historical financial statements of Microcell, and the accounting for the purchases of Wireless shares and Microcell.

Although we believe this presentation provides certain relevant context and comparative information for existing operations,

the unaudited pro forma consolidated financial and operating data presented in this document is for illustrative purposes only and

does not purport to represent what the results of operations actually would have been if the transactions had occurred on January 1,

2003, nor does it purport to project the results of operations for any future period.

This pro forma information reflects, among other things, adjustments to Microcell’s historically reported financial information to

conform it to our respective accounting policies, the impacts of purchase accounting, including amortization of the acquired intangibles

and fair value increments, financings associated with the acquisition of Microcell and the impact of amortizing the deferred compensa-

tion expense arising on the exchange of stock options in Wireless into stock options to acquire Class B Non-Voting shares of RCI.

The pro forma adjustments are based upon preliminary estimates and certain assumptions that we believe are reasonable. In preparing

the pro forma financial information, the purchase consideration has been allocated on a preliminary basis to the fair value of assets

acquired, including amortizable and non-amortizable intangible assets, and liabilities assumed based on management’s best estimates.

Accounting policies used in the preparation of these statements are those disclosed in our 2004 annual Consolidated Financial

Statements and Notes thereto.