Rogers 2004 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84 Rogers Communications Inc. 2004 Annual Report

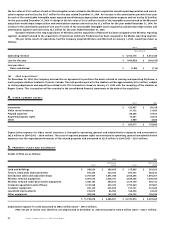

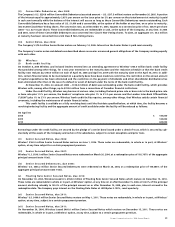

the fair value of $10.0 million of each of the intangible assets related to the Wireless acquisition would impact depreciation and amorti-

zation expense and net loss by $10.7 million for the year ended December 31, 2004. An increase in the amortization period of one year

for each of the amortizable intangible assets acquired would decrease depreciation and amortization expense and net loss by $5.8 million

for the year ended December 31, 2004. A change in the fair value of $10.0 million of each of the intangible assets related to the Microcell

acquisition would impact depreciation and amortization expense and net loss by $1.2 million for the year ended December 31, 2004. An

increase in the amortization period of one year for each of the amortizable intangible assets acquired would decrease depreciation and

amortization expense and net loss by $3.2 million for the year ended December 31, 2004.

Goodwill related to the step acquisitions of Wireless and the acquisition of Microcell has been assigned to the Wireless reporting

segment. Goodwill related to the acquisitions of Sportsnet and Dome Productions has been assigned to the Media reporting segment.

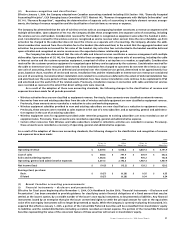

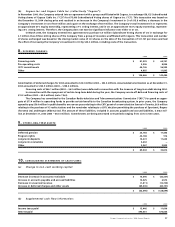

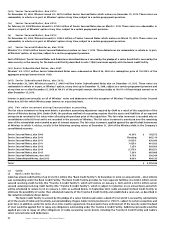

The pro forma results of operations, had the Company acquired Wireless and Microcell on January 1, 2003, would have been as

follows:

2004 2003

(Unaudited)

Operating revenue $ 6,156,715 $ 5,351,128

Loss for the year $ (449,830) $ (245,415)

Loss per share:

Basic and diluted $ (1.88) $ (1.16)

(d) 2005 acquisitions:

On November 26, 2004, the Company entered into an agreement to purchase the assets related to owning and operating SkyDome, a

multi-purpose stadium located in Toronto, Canada. The cash purchase price for the stadium will be approximately $25.0 million, subject

to closing adjustments and acquisition-related costs. This transaction closed on January 31, 2005 with the renaming of the stadium as

Rogers Centre. This transaction will be recorded in the consolidated financial statements at the date of the acquisition.

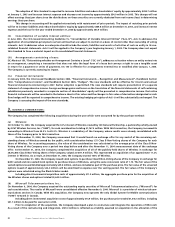

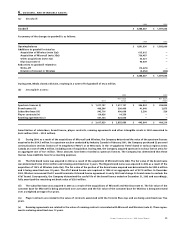

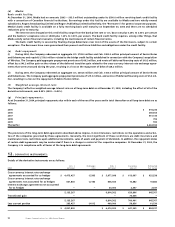

4. OTHER CURRENT ASSETS:

2004 2003

Inventories $ 123,457 $ 69,318

Video rental inventory 31,132 31,685

Prepaid expenses 88,288 57,812

Acquired program rights 13,651 16,813

Other 3,989 3,365

$ 260,517 $ 178,993

Depreciation expense for video rental inventory is charged to operating, general and administrative expenses and amounted to

$62.5 million in 2004 (2003 – $60.4 million). The costs of acquired program rights are amortized to operating, general and administrative

expenses over the expected performances of the related programs and amounted to $25.8 million in 2004 (2003 – $20.9 million).

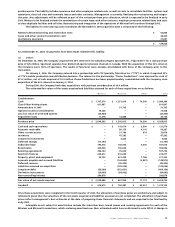

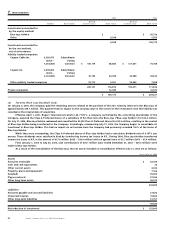

5. PROPERTY, PLANT AND EQUIPMENT:

Details of PP&E are as follows:

2004 2003

Net book Net book

Cost value Cost value

Land and buildings $ 349,029 $ 286,665 $ 313,695 $ 263,262

Towers, head-ends and transmitters 670,229 330,032 593,757 282,612

Distribution cable and subscriber drops 3,707,609 1,891,048 3,438,248 1,855,201

Wireless network equipment 3,091,614 1,635,707 2,629,608 1,369,704

Wireless network radio base station equipment 1,459,153 464,812 1,375,739 465,172

Computer equipment and software 1,310,068 403,423 1,193,064 397,867

Customer equipment 625,130 235,829 613,741 212,026

Leasehold improvements 210,810 86,983 168,296 67,224

Other equipment 495,036 152,338 416,722 126,236

$ 11,918,678 $ 5,486,837 $ 10,742,870 $ 5,039,304

Depreciation expense for 2004 amounted to $984.0 million (2003 – $973.6 million).

PP&E not yet in service and, therefore, not depreciated at December 31, 2004 amounted to $305.8 million (2003 – $223.1 million).