Rogers 2004 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

Rogers Communications Inc. 2004 Annual Report

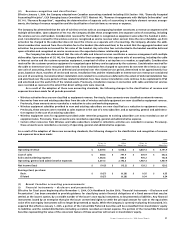

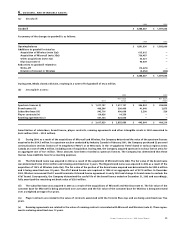

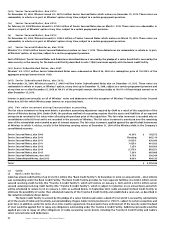

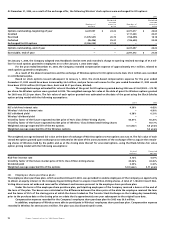

The Tranche B Credit Facility is available, subject to the restriction discussed below*, on a reducing/revolving basis, with the original

amount of credit available under the Tranche B Credit Facility scheduled to reduce as follows:

Reduction

Date of reduction at each date

On January 2:

2006 $ 118,750

2007 118,750

2008 118,750

2009 118,750

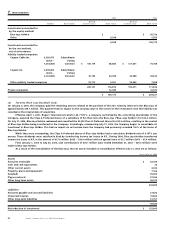

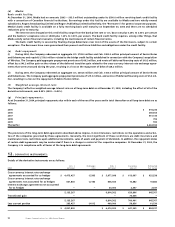

* Of the $475.0 million available under the Tranche B Credit Facility, $400.0 million is reserved to repay the aggregate amount of Cable’s Senior Secured

Second Priority Notes, due 2005 (the “Notes”) (note 11(c)(ii)). When all or any portion of the aggregate amount of the Notes is repaid from time to time from

any source, including the Tranche B Credit Facility, then the $400.0 million reserved amount is reduced by an amount equal to the repayment and such

amount of the Tranche B Credit Facility becomes fully available to Cable.

The Bank Credit Facility requires, among other things, that Cable satisfy certain financial covenants, including the maintenance of cer-

tain financial ratios. The interest rate charged on the Bank Credit Facility ranges from nil to 2.25% per annum over the bank prime rate

or base rate or 0.875% to 3.25% per annum over the bankers’ acceptance rate or LIBOR.

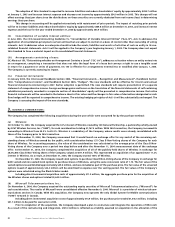

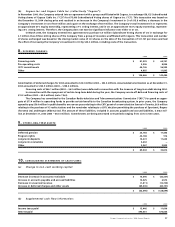

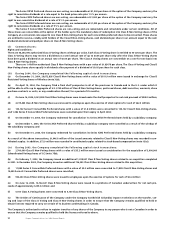

(ii) Senior Secured Second Priority Notes, due 2005:

Cable’s U.S. $291.5 million Senior Secured Second Priority Notes mature on March 15, 2005.

(iii) Senior Secured Second Priority Notes, due 2007:

Cable’s $450.0 million Senior Secured Second Priority Notes mature on February 6, 2007. The notes are redeemable at Cable’s option, in

whole or in part, at any time, subject to a certain prepayment premium.

(iv) Senior Secured Second Priority Notes, due 2011:

On November 30, 2004, Cable issued $175.0 million Senior Secured Second Priority Notes due on December 15, 2011. These notes are

redeemable at Cable’s option, in whole or in part, at any time subject to a certain prepayment premium.

(v) Senior Secured Second Priority Notes, due 2012:

Cable’s U.S. $350.0 million Senior Secured Second Priority Notes mature on May 1, 2012. The notes are redeemable at Cable’s option, in

whole or in part, at any time subject to a certain prepayment premium.

(vi) Senior Secured Second Priority Notes, due 2013:

On June 19, 2003, Cable issued U.S. $350.0 million Senior Secured Second Priority Notes due June 15, 2013. The notes are redeemable at

Cable’s option, in whole or in part, at any time subject to a certain prepayment premium.

(vii) Senior Secured Second Priority Notes, due 2014:

On March 11, 2004, Cable issued U.S. $350.0 million Senior Secured Second Priority Notes due March 2014. The notes are redeemable at

Cable’s option, in whole or in part, at any time subject to a certain prepayment premium.

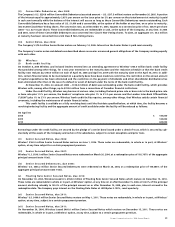

(viii) Senior Secured Second Priority Debentures, due 2014:

In February 2004, Cable redeemed the $300.0 million aggregate principal amount of its Senior Secured Second Priority Debentures, due

January 15, 2014 at a redemption price of 104.825% of the aggregate principal amount (note 11(e)).

(ix) Senior Secured Second Priority Notes, due 2015:

On November 30, 2004, Cable issued U.S. $280.0 million Senior Secured Second Priority Notes, due on March 15, 2015. The notes are

redeemable at Cable’s option, in whole or in part, at any time subject to a certain prepayment premium.

(x) Senior Secured Second Priority Debentures, due 2032:

Cable’s U.S. $200.0 million 8.75% Senior Secured Second Priority Debentures mature on May 1, 2032. The debentures are redeemable at

Cable’s option, in whole or in part, at any time subject to a certain prepayment premium.

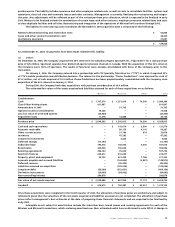

Each of Cable’s senior secured notes and debentures described above is secured by the pledge of a senior bond which is secured by the

same security as the security for the Bank Credit Facility described in note 11(c)(i) and rank equally in regard to the proceeds of any

enforcement of security with the Tranche B Credit Facility.

(xi) Senior Subordinated Guaranteed Debentures, due 2015:

Cable’s U.S. $113.7 million Senior Subordinated Guaranteed Debentures mature on December 1, 2015. The subordinated debentures are

redeemable at Cable’s option, in whole or in part, at any time on or after December 1, 2005, at 105.5% of the principal amount, declining

ratably to 100% of the principal amount on or after December 1, 2009, plus, in each case, interest accrued to the redemption date. The

subordinated debentures are subordinated in right of payment to all existing and future senior indebtedness of Cable (including the

Bank Credit Facility and the senior secured notes and debentures) and are not secured by the pledge of a senior bond.

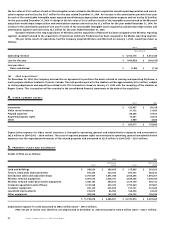

Interest is paid semi-annually on all of Cable’s notes and debentures.