Rogers 2004 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108 Rogers Communications Inc. 2004 Annual Report

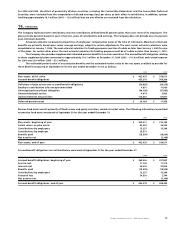

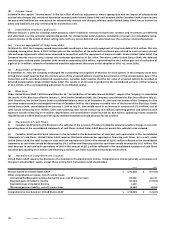

(k) Income taxes:

Included in the caption “Income taxes” is the tax effect of various adjustments where appropriate and the impact of substantively

enacted rate changes that would not have been recorded under United States GAAP until enacted. Under Canadian GAAP, future income

tax assets and liabilities are remeasured for substantively enacted rate changes, whereas under United States GAAP, future income tax

assets and liabilities are only remeasured for enacted tax rates.

(l) Installation revenues and costs:

Effective January 1, 2004, for Canadian GAAP purposes, cable installation revenues for both new connects and re-connects are deferred

and amortized over the customer relationship period. For United States GAAP purposes, installation revenues are immediately recog-

nized in income to the extent of direct selling costs, with any excess deferred and amortized over the customer relationship period.

(m) Loss on repayment of long-term debt:

On March 26, 2004, the Company repaid long-term debt resulting in a loss on early repayment of long-term debt of $2.3 million. This loss

included, among other items, a $40.2 million gain on the realization of the deferred transitional gain related to cross-currency interest

rate exchange agreements which were unwound in connection with the repayment of long-term debt. Under United States GAAP, the

Company records cross-currency interest rate exchange agreements at fair value. Therefore, under United States GAAP, the deferred

transition gain realized under Canadian GAAP would be reduced by $28.8 million, representing the $40.2 million gain net of realization of

a gain of $11.4 million, related to the deferred transition adjustment that arose on the adoption of SFAS 133, (note 23(h)).

(n) Acquisition of Wireless:

At December 31, 2004, the Company exchanged the outstanding stock options of Wireless for stock options in the Company (note 3(a)).

United States GAAP requires that the intrinsic value of the unvested options issued be determined as of the consummation date of the

transaction and be recorded as deferred compensation. Canadian GAAP requires that the fair value of unvested options be recorded as

deferred compensation. Under United States GAAP, this results in an increase in goodwill in the consolidated accounts of the Company

of $2.9 million, with a corresponding adjustment to contributed surplus.

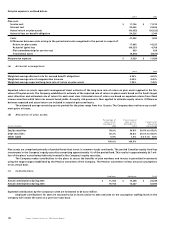

(o) Blue Jays:

Under United States GAAP, FASB Interpretation No. 46, “Consolidation of Variable Interest Entities”, requires the Company to consolidate

the results of the Blue Jays effective January 1, 2004. Under Canadian GAAP, the Company consolidated the Blue Jays effective July 31,

2004. Therefore, the United States GAAP consolidated balance sheet as at December 31, 2004 and net income of the Company for the

year then ended would be unchanged from that of Canadian GAAP as the Company recorded 100% of the losses of the Blue Jays. Under

United States GAAP, consolidation from January 1, 2004 to July 31, 2004 would result in an increase in revenues of $75.0 million, cost of

sales would increase by $70.1 million, sales and marketing costs would increase by $3.8 million, operating general and administrative

expenses would increase by $17.8 million, depreciation and amortization would increase by $5.8 million, operating income would be

reduced by $22.6 million and losses from equity method investments would decrease by $22.6 million.

(p) Statements of cash flows:

(i) Canadian GAAP permits the disclosure of a subtotal of the amount of funds provided by operations before change in non-cash

operating items in the consolidated statements of cash flows. United States GAAP does not permit this subtotal to be included.

(ii) Canadian GAAP permits bank advances to be included in the determination of cash and cash equivalents in the consolidated

statements of cash flows. United States GAAP requires that bank advances be reported as financing cash flows. As a result, under

United States GAAP, the total increase in cash and cash equivalents in 2004 in the amount of $254.3 million reflected in the consolidated

statements of cash flows would be decreased by $10.3 million and financing activities cash flows would decrease by $10.3 million. The

total decrease in cash and cash equivalents in 2003 in the amount of $37.2 million reflected in the consolidated statement of cash flows

would be decreased by $10.3 million and financing activities cash flows would be increased by $10.3 million.

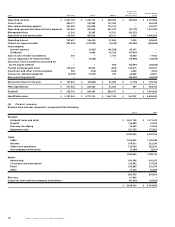

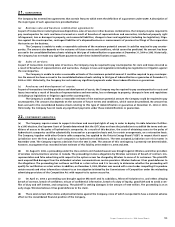

(q) Statement of comprehensive income:

United States GAAP requires the disclosure of a statement of comprehensive income. Comprehensive income generally encompasses all

changes in shareholders’ equity, except those arising from transactions with shareholders.

2004 2003

Net loss based on United States GAAP $ (270,625) $ (57,150)

Other comprehensive income, net of income taxes:

Unrealized holding gains arising during the year, net of income taxes 69,586 67,727

Realized gains included in income (10,567) (17,902)

Realized losses included in income 1,650 –

Minimum pension liability, net of income taxes (8,483) (4,982)

Comprehensive loss based on United States GAAP $ (218,439) $ (12,307)