Rogers 2004 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

Rogers Communications Inc. 2004 Annual Report

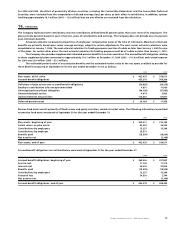

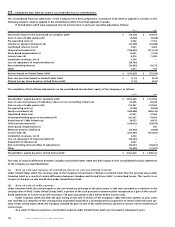

(r) Other disclosures:

United States GAAP requires the Company to disclose accrued liabilities, which is not required under Canadian GAAP. Accrued liabilities

included in accounts payable and accrued liabilities as at December 31, 2004 were $1,100.9 million (2003 – $800.2 million). At December 31,

2004 accrued liabilities in respect of PP&E totalled $116.0 million (2003 – $88.8 million), accrued interest payable totalled $117.6 million

(2003 – $84.0 million), accrued liabilities related to payroll totalled $173.3 million (2003 – $92.5 million), and CRTC commitments totalled

$56.5 million (2003 – $71.5 million).

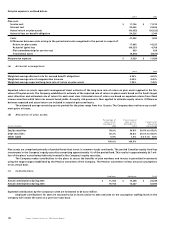

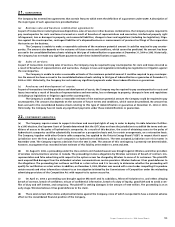

(s) Pensions:

The Company implemented SFAS No. 132, “Employers Disclosures about Pensions and Other Post-retirement Benefits – an amendment

of FASB Statement No. 87, 88 and 106” in the current year. The following summarizes the additional disclosures required and different

pension-related amounts recognized or disclosed in the Company’s accounts under United States GAAP:

2004 2003

Current service cost (employer portion) $ 11,746 $ 11,314

Interest cost 24,003 23,826

Expected return on plan assets (25,153) (22,107)

Amortization:

Transitional asset (a) (9,875) (9,875)

Realized gains included in income (b) 829 829

Net actuarial loss (c) 4,989 7,452

Net periodic pension cost $ 6,539 $ 11,439

2004 2003

Accrued benefit asset $ 3,214 $ 9,598

Accumulated other comprehensive loss 20,970 7,858

Net amount recognized in balance sheet $ 24,184 $ 17,456

Under United States GAAP, the accrued benefit liability related to the Company’s supplemental unfunded pension benefits for certain

executives was $12.5 million (2003 – $10.2 million) and the intangible asset was $6.5 million (2003 – $7.1 million).

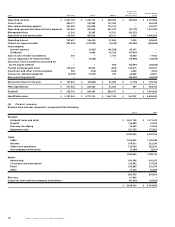

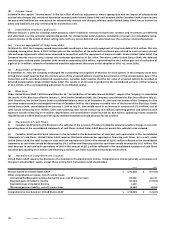

(t) Recent United States accounting pronouncements:

SFAS 153, “Exchanges of Non-monetary Assets – an Amendment of APB Opinion 29”, was issued in December 2004. Accounting

Principles Board (“APB”) Opinion 29 is based on the principle that exchanges of non-monetary assets should be measured based on the

fair value of assets exchanged. SFAS 153 amends APB Opinion 29 to eliminate the exception for non-monetary exchanges of similar pro-

ductive assets and replaces it with a general exception for exchanges of non-monetary assets that do not have commercial substance.

The standard is effective for the Company for non-monetary asset exchanges occurring in fiscal 2006 and will be applied prospectively.

The Company is currently evaluating the impact of this revised standard.

SFAS 123, “Share-Based Payment”, is effective for fiscal 2006 of the Company. This revised standard requires companies to recog-

nize in the income statement, the grant-date fair value of stock options and other equity-based compensation issued to employees.

The fair value of liability-classified awards is remeasured subsequently at each reporting date through the settlement date while the fair

value of equity-classified awards is not subsequently remeasured. The alternative to use the intrinsic value method of APB Opinion 25,

which the Company has chosen for United States GAAP purposes, is eliminated with this revised standard. The Company is currently

evaluating the impact of this revised standard.

In 2004, the Emerging Issues Task Force (“EITF”) reached a consensus regarding EITF 03-06, “Participating Securities and the Two-

Class Method under SFAS No. 128, Earnings Per Share”. The consensus reached addresses the definition of a participating security and

the requisite methodology to use to calculate earnings (loss) per share. The consensus reached in Issue 03-06 will be effective for the fis-

cal year beginning January 1, 2005 and should be applied by restating previously reported earnings (loss) per share. The Company is

currently determining the impact of this consensus.

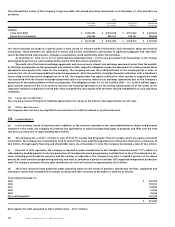

24. SUBSEQUENT EVENT:

On February 7, 2005, the Company was awarded a share of the broadcast rights to the 2010 Olympic Winter Games and the 2012

Olympic Summer Games at a cost of US$31 million.