Rogers 2004 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

Rogers Communications Inc. 2004 Annual Report

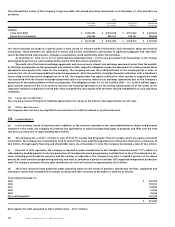

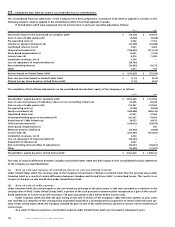

21. GUARANTEES:

The Company has entered into agreements that contain features which meet the definition of a guarantee under GAAP. A description of

the major types of such agreements is provided below:

(a) Business sale and business combination agreements:

As part of transactions involving business dispositions, sales of assets or other business combinations, the Company may be required to

pay counterparties for costs and losses incurred as a result of breaches of representations and warranties, intellectual property right

infringement, loss or damages to property, environmental liabilities, changes in laws and regulations (including tax legislation), litiga-

tion against the counterparties, contingent liabilities of a disposed business or reassessments of previous tax filings of the corporation

that carries on the business.

The Company is unable to make a reasonable estimate of the maximum potential amount it could be required to pay counter-

parties. The amount also depends on the outcome of future events and conditions, which cannot be predicted. No amount has been

accrued in the consolidated balance sheets relating to this type of indemnification or guarantee at December 31, 2004 or 2003. Historically,

the Company has not made any significant payments under these indemnifications or guarantees.

(b) Sales of services:

As part of transactions involving sales of services, the Company may be required to pay counterparties for costs and losses incurred as

a result of breaches of representations and warranties, changes in laws and regulations (including tax legislation) or litigation against

the counterparties.

The Company is unable to make a reasonable estimate of the maximum potential amount it could be required to pay counterpar-

ties. No amount has been accrued in the consolidated balance sheets relating to this type of indemnification or guarantee at December 31,

2004 or 2003. Historically, the Company has not made any significant payments under these indemnifications or guarantees.

(c) Purchases and development of assets:

As part of transactions involving purchases and development of assets, the Company may be required to pay counterparties for costs and

losses incurred as a result of breaches of representations and warranties, loss or damages to property, changes in laws and regulations

(including tax legislation) or litigation against the counterparties.

The Company is unable to make a reasonable estimate of the maximum potential amount the Company could be required to pay

counterparties. The amount also depends on the outcome of future events and conditions, which cannot be predicted. No amount has

been accrued in the consolidated balance sheets relating to this type of indemnification or guarantee at December 31, 2004 or 2003.

Historically, the Company has not made any significant payments under these indemnifications or guarantees.

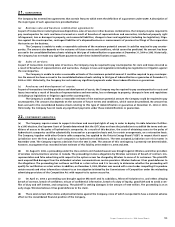

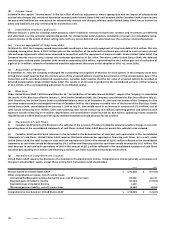

22. CONTINGENT LIABILITIES:

(a) The Company requires access to support structures and municipal rights of way in order to deploy its cable television facilities.

In a 2003 decision, the Supreme Court of Canada determined that the CRTC does not have the jurisdiction to establish the terms and con-

ditions of access to the poles of hydroelectric companies. As a result of this decision, the costs of obtaining access to the poles of

hydroelectric companies could be substantially increased on a prospective basis and, for certain arrangements, on a retroactive basis.

The Company, together with other Ontario cable companies, has applied to the Ontario Energy Board (“OEB”) to request that it assert

jurisdiction over the fees paid by such companies to hydroelectric distributors. The OEB accepted jurisdiction over this matter in

November 2004. The Company expects a decision from the OEB in 2005. The amount of this contingency is presently not determinable,

however, management has recorded its best estimate of this liability at December 31, 2004 and 2003.

(b) On August 9, 2004, a proceeding under the Class Actions Act (Saskatchewan) was brought against Wireless and other providers

of wireless communications services in Canada. The proceeding involves allegations by Wireless customers of breach of contract, mis-

representation and false advertising with respect to the system access fee charged by Wireless to some of its customers. The plaintiffs

seek unquantified damages from the defendant wireless communications service providers. Wireless believes it has good defences to

the allegations. The proceeding has not been certified as a class action and it is too early to determine whether the proceeding will

qualify for certification as a class action. In addition, on December 9, 2004, Wireless was served with a court order compelling it to produce

certain records and other information relevant to an investigation initiated by the Commissioner of Competition under the misleading

advertising provisions of the Competition Act with respect to its system access fee.

(c) On April 21, 2004 a proceeding was brought against Microcell and its subsidiary, Microcell Solutions Inc. and others alleging

breach of contract, breach of confidence, misuse of confidential information, breach of a duty of loyalty, good faith and to avoid a con-

flict of duty and self interest, and conspiracy. The plaintiff is seeking damages in the amount of $160 million. The proceeding is at an

early stage. Wireless believes it has good defences to the claim.

(d) There exist certain other claims and potential claims against the Company, none of which is expected to have a material adverse

effect on the consolidated financial position of the Company.