Rogers 2004 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

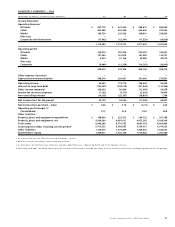

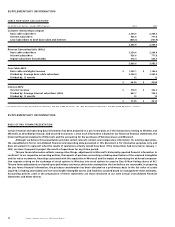

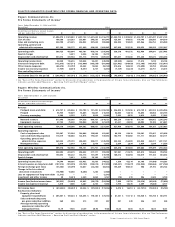

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular amounts in thousands of dollars, except per share amounts)

Years ended December 31, 2004 and 2003

1. NATURE OF THE BUSINESS:

Rogers Communications Inc. (“RCI”) is a Canadian communications company, carrying on business on a national basis, engaged in cable

television, Internet access and video retailing through its wholly-owned subsidiary, Rogers Cable Inc. (“Cable”), wireless voice, messag-

ing and data services through its wholly-owned subsidiary Rogers Wireless Communications Inc. (“Wireless”) (2003 – 55.8% ownership),

in radio and television broadcasting, televised home shopping and publishing through its wholly-owned subsidiary, Rogers Media Inc.

(“Media”) and in sports entertainment through its wholly-owned subsidiary Blue Jays Holdco Inc. (“Blue Jays”). RCI and its subsidiary

companies are collectively referred to herein as the “Company”.

2. SIGNIFICANT ACCOUNTING POLICIES:

(a) Basis of presentation:

The consolidated financial statements are prepared in accordance with Canadian generally accepted accounting principles (“GAAP”) and

differ in certain significant respects from United States GAAP as described in note 23. The consolidated financial statements include the

accounts of RCI and its subsidiary companies. For the period from January 1, 2004 to October 13, 2004, the non-controlling interest of

Wireless represented approximately 44.7% of Wireless’ net income, after dilutions of the Company’s ownership over that period. For the

period from October 14, 2004 to December 31, 2004, the non-controlling interest represented approximately 11.2% of Wireless’ net

income, after dilutions of the Company’s ownership over that period. Intercompany transactions and balances are eliminated on consol-

idation. When RCI’s subsidiaries issue additional common shares to unrelated parties, RCI accounts for these issuances as if the Company

had sold a portion of its interest in that subsidiary and, accordingly, records a gain or loss on dilution of RCI’s interest.

Investments over which the Company is able to exercise significant influence are accounted for by the equity method. Other

investments are recorded at cost. Investments are written down when there is evidence that a decline in value that is other than tem-

porary has occurred.

Certain comparative figures have been reclassified to conform with the current year’s presentation.

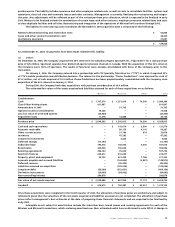

(b) Property, plant and equipment:

Property, plant and equipment (“PP&E”) are recorded at purchase cost. During construction of new assets, direct costs plus a portion of

applicable overhead costs are capitalized. Repairs and maintenance expenditures are charged to operating expense as incurred.

The cost of the initial cable subscriber installation is capitalized.

(c) Depreciation:

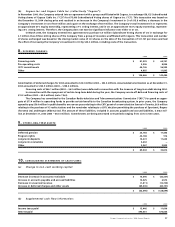

PP&E are depreciated annually over their estimated useful lives as follows:

Asset Basis Rate

Buildings Mainly straight line 5% to 62/3%

Towers, head-ends and transmitters Straight line 62/3% to 10%

Distribution cable, subscriber drops and wireless network equipment Straight line 62/3% to 25%

Wireless network radio base station equipment Straight line 121/2% to 141/3%

Computer equipment and software Straight line 141/3% to 331/3%

Customer equipment Straight line 20% to 331/3%

Leasehold improvements Straight line Over term of lease

Other equipment Mainly diminishing balance 20% to 331/3%

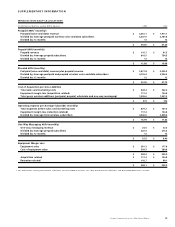

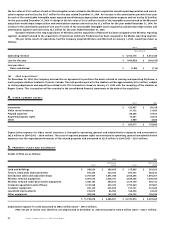

(d) Asset retirement obligations:

Asset retirement obligations are legal obligations associated with the retirement of long-lived tangible assets that result from their

acquisition, lease, construction, development or normal operations. The Company records the estimated fair value of a liability for an

asset retirement obligation in the year in which it is incurred and when a reasonable estimate of fair value can be made. The fair value

of a liability for an asset retirement obligation is the amount at which that liability could be settled in a current transaction between

willing parties, that is, other than in a forced or liquidation transaction and, in the absence of observable market transactions, is deter-

mined as the present value of expected cash flows. The Company subsequently allocates the asset retirement cost to expense using a

systematic and rational method over the asset’s useful life, and records the accretion of the liability as a charge to operating expense.

(e) Long-lived assets:

Long-lived assets, including PP&E and intangible assets with finite useful lives, are amortized over their useful lives. The Company

reviews long-lived assets for impairment annually or more frequently if events or changes in circumstances indicate that the carrying

amount may not be recoverable. If the sum of the undiscounted future cash flows expected to result from the use and eventual dispo-

sition of a group of assets is less than its carrying amount, it is considered to be impaired. An impairment loss is measured as the

amount by which the carrying amount of the group of assets exceeds its fair value. At December 31, 2004 and 2003, no impairments in

the carrying value of these assets existed.

77

Rogers Communications Inc. 2004 Annual Report