Rogers 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 Rogers Communications Inc. 2004 Annual Report

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

For the year ended December 31, 2004

Management’s discussion and analysis (“MD&A”) should be read in conjunction with our 2004 Audited Consolidated Financial Statements

and Notes thereto. The financial information presented herein has been prepared on the basis of Canadian generally accepted account-

ing principles (“GAAP”) and is expressed in Canadian dollars. Please refer to Note 23 to the 2004 Audited Consolidated Financial

Statements for a summary of differences between Canadian and United States (“U.S.”) GAAP. This discussion, the Audited Consolidated

Financial Statements and the Notes thereto have been reclassified to reflect the retrospective application of Canadian Institute of

Chartered Accountants (“CICA”) Handbook Section 1100, “Generally Accepted Accounting Principles”, Emerging Issues Committee (“EIC”)

Abstract 142, “Revenue Arrangements with Multiple Deliverables”, and EIC Abstract 141, “Revenue Recognition”. The retrospective adop-

tion of these pronouncements resulted in our presentation of a classified balance sheet and the reclassification of the change in non-cash

working capital items related to property, plant and equipment (“PP&E”) expenditures from operating activities to additions to

PP&E under investing activities. For a more complete discussion, see the section entitled “New Accounting Standards – GAAP Hierarchy”.

The retrospective adoption of these pronouncements also resulted in the reclassification of certain revenue and expense items, which

are detailed in the section entitled “New Accounting Standards – Revenue Recognition”. This MD&A is current as of March 7, 2005.

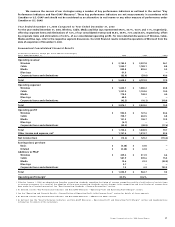

This MD&A is organized into five sections:

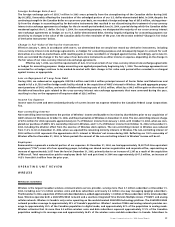

In this discussion of operating results and financial position, the terms “we”, “us”, “our”, and “the Company” refer to Rogers

Communications Inc. and our subsidiaries, which are reported in the following four segments:

• “Cable”, which refers to our wholly-owned subsidiary Rogers Cable Inc. and its subsidiaries;

• “Wireless”, which refers to our wholly-owned subsidiary Rogers Wireless Communications Inc. and its subsidiaries including Rogers

Wireless Inc. (“RWI”);

• “Media”, which refers to our wholly-owned subsidiary Rogers Media Inc. and its subsidiaries;

• “Blue Jays”, which refers to our wholly-owned subsidiary Blue Jays Holdco Inc., which owns the Toronto Blue Jays Baseball Club.

“RCI” refers to Rogers Communications Inc. excluding its subsidiaries.

Throughout this discussion, percentage changes are calculated using numbers rounded to the decimal to which they appear.

OVERVIEW

Our Business 19

Our Strategy 19

Significant 20

Fourth Quarter

2004 Events

Seasonality 20

Competition 20

Operating and 20

Financial Results

OPERATING

UNIT REVIEW

Wireless 23

Cable 32

Media 40

Blue Jays 45

FINANCING AND

RISK MANAGEMENT

Consolidated Liquidity 46

and Capital Resources

Interest Rates and 48

Foreign Exchange

Management

Outstanding Share Data 50

Dividends and Other 50

Payments on RCI Equity

Securities

Government Regulation 50

Corporate Risks 51

and Uncertainties

Commitments and Other 53

Contractual Obligations

Off-Balance Sheet 54

Arrangements

ACCOUNTING POLICIES

AND NON-GAAP

MEASURES

Key Performance 54

Indicators and

Non-GAAP Measures

Critical Accounting 56

Policies and Estimates

New Accounting 58

Standards

U.S. GAAP

Differences 59

Intercompany and 61

Related Party

Transactions

ADDITIONAL FINANCIAL

INFORMATION

Five-Year 64

Financial Summary

Summary of 65

Quarterly Results

2004 Quarterly 66

Summary

2003 Quarterly 67

Summary

Supplementary 69

Information:

Non-GAAP Calculations

Supplementary 70

Information:

Pro Forma Information