Rogers 2004 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

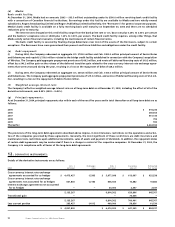

82 Rogers Communications Inc. 2004 Annual Report

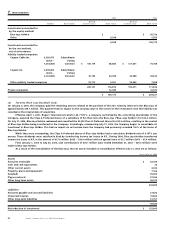

The adoption of this standard is expected to increase liabilities and reduce shareholders’ equity by approximately $490.7 million

at January 1, 2005 and increase interest expense and decrease net income by approximately $54.9 million in 2005. This change will not

affect earnings (loss) per share since the distributions on these securities are currently deducted from net income (loss) in determining

earnings (loss) per share.

This change in accounting will be applied retroactively with restatement of prior periods. The impact of restating prior periods

will be to increase liabilities and reduce shareholders’ equity by approximately $469.8 million at December 31, 2003, and increase interest

expense and the loss for the year ended December 31, 2004 by approximately $53.9 million.

(ii) Consolidation of variable interest entities:

In June 2003, the CICA issued Accounting Guideline 15, “Consolidation of Variable Interest Entities” (“AcG-15”). AcG-15 addresses the

application of consolidation principles to certain entities that are subject to control on a basis of control other than ownership of voting

interests. AcG-15 addresses when an enterprise should include the assets, liabilities and results of activities of such an entity in its con-

solidated financial statements. AcG-15 will be applied in the Company’s year beginning January 1, 2005. The Company does not expect

this standard to have a material impact on its consolidated financial statements.

(iii) Arrangements containing a lease:

EIC Abstract 150, “Determining whether an Arrangement Contains a Lease” (“EIC 150”), addresses a situation where an entity enters into

an arrangement, comprising a transaction that does not take the legal form of a lease but conveys a right to use a tangible asset

in return for a payment or series of payments. EIC 150 is effective for arrangements entered into or modified after January 1, 2005.

The Company is currently assessing its impact.

(iv) Financial instruments:

In January 2005, the CICA issued Handbook Section 3855, “Financial Instruments – Recognition and Measurement”, Handbook Section

1530, “Comprehensive Income”, and Handbook Section 3865, “Hedges”. The new standards will be effective for interim and annual

financial statements commencing in 2007. Earlier adoption is permitted. The new standards will require presentation of a separate

statement of comprehensive income. Foreign exchange gains and losses on the translation of the financial statements of self-sustaining

subsidiaries previously recorded in a separate section of shareholders’ equity will be presented in comprehensive income. Derivative

financial instruments will be recorded in the balance sheet at fair value and the changes in fair value of derivatives designated as cash

flow hedges will be reported in comprehensive income. The existing hedging principles of AcG-13 will be substantially unchanged. The

Company is assessing the impact of the new standards.

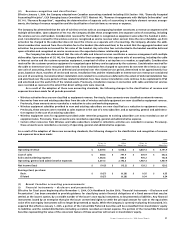

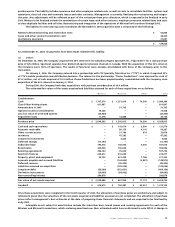

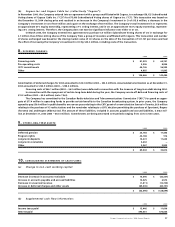

3. BUSINESS COMBINATIONS:

The Company has completed the following acquisitions during the year which were accounted for by the purchase method:

(a) Wireless:

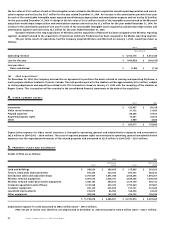

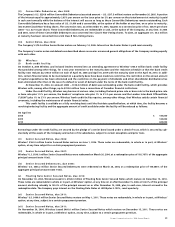

On October 13, 2004, the Company acquired the 34% interest of Wireless owned by JVII General Partnership, a partnership wholly-owned

by AT&T Wireless Services, Inc. (“AWE”), for cash consideration totaling $1,767.4 million. With this transaction, the Company increased its

ownership in Wireless from 55.3% to 89.3%. Wireless is a subsidiary of the Company whose results were already consolidated with

those of the Company prior to this transaction.

On November 11, 2004, the Company announced that it would launch an exchange offer for any and all of the remaining out-

standing shares of Wireless owned by the public, with consideration being 1.75 Class B Non-Voting shares of the Company for each

share of Wireless. For accounting purposes, the value of the consideration was calculated as the average price of the Class B Non-

Voting shares of the Company over a period two days before and after the November 11, 2004 announcement date of the exchange

offer. At December 31, 2004, the Company completed the acquisition of all of the publicly-held shares of Wireless in exchange for

28,072,856 Class B Non-Voting shares of the Company valued at $811.9 million. This represented an acquisition of an approximate 11.2%

interest in Wireless. As a result, at December 31, 2004, the Company owned 100% of Wireless.

On December 31, 2004, the Company issued stock options to purchase Class B Non-Voting shares of the Company in exchange for

both vested and non-vested stock options to purchase shares of Wireless, using the same conversion ratio of 1.75. The fair value of the

vested options issued totalled approximately $49.8 million, and was included as part of the purchase price. The fair value of the unvested

options issued of approximately $23.4 million will be amortized to expense over the vesting period. The fair values of the Company’s

options were calculated using the Black-Scholes model.

Including direct incremental acquisition costs of approximately $11.3 million, the aggregate purchase price for the acquisition of

the Wireless shares and options totaled $2,640.3 million.

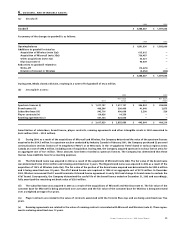

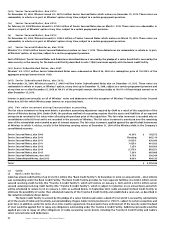

(b) Microcell Telecommunications Inc.:

On November 9, 2004, the Company acquired the outstanding equity securities of Microcell Telecommunications Inc. (“Microcell”) for

cash consideration. The results of Microcell were consolidated effective November 9, 2004. Microcell is a provider of wireless telecom-

munications services in Canada. With this acquisition, the Company now operates the only Global System for Mobile communications

(“GSM”) network in Canada.

Including direct incremental acquisition costs of approximately $14.9 million, the purchase price totaled $1,318.4 million, including

$51.7 million to be paid for warrants in 2005.

Prior to completion of the acquisition, the Company developed a plan to restructure and integrate the operations of Microcell.

As a result of the restructuring and integration, $129.0 million is reflected as a liability assumed on acquisition in the allocation of the