Rogers 2004 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78 Rogers Communications Inc. 2004 Annual Report

(f) Goodwill and intangible assets:

(i) Goodwill:

Goodwill is the residual amount that results when the purchase price of an acquired business exceeds the sum of the amounts allocated

to the tangible and intangible assets acquired, less liabilities assumed, based on their fair values. When the Company enters into a busi-

ness combination, the purchase method of accounting is used. Goodwill is assigned as of the date of the business combination to

reporting units that are expected to benefit from the business combination.

Goodwill is not amortized but instead is tested for impairment annually or more frequently if events or changes in circumstances

indicate that the asset might be impaired. The impairment test is carried out in two steps. In the first step, the carrying amount of the

reporting unit, including goodwill, is compared with its fair value. When the fair value of the reporting unit exceeds its carrying amount,

goodwill of the reporting unit is not considered to be impaired and the second step of the impairment test is unnecessary. The second

step is carried out when the carrying amount of a reporting unit exceeds its fair value, in which case, the implied fair value of the report-

ing unit’s goodwill, determined in the same manner as the value of goodwill is determined in a business combination, is comparedwith

its carrying amount to measure the amount of the impairment loss, if any.

(ii) Intangible assets:

Intangible assets acquired in a business combination are recorded at their fair values. Intangible assets with finite lives are amortized

over their estimated useful lives and are tested for impairment, as described in note 2(e). Intangible assets having an indefinite life,

such as spectrum licences, are not amortized but instead are tested for impairment on an annual or more frequent basis by comparing

their fair value with book value. An impairment loss on indefinite life intangible assets is recognized when the carrying amount of the

asset exceeds its fair value.

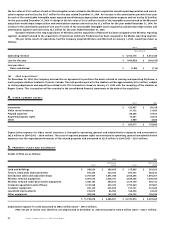

Intangible assets with determinable lives are amortized on a straight-line basis annually over their estimated useful lives as follows:

Subscriber base 21/4to 42/3years

Brand name – Rogers 20 years

Brand name – Fido 5 years

Roaming agreements 12 years

Player contracts 5 years

The Company has tested goodwill and intangible assets with indefinite lives for impairment at December 31, 2004 and 2003 and deter-

mined that no impairment in the carrying value of these assets existed.

(g) Foreign currency translation:

Monetary assets and liabilities denominated in a foreign currency are translated into Canadian dollars at the exchange rate in effect at

the balance sheet date and non-monetary assets and liabilities and related amortization expenses are translated at the historical

exchange rate. Revenue and expenses, other than depreciation and amortization, are translated at the average rate for the month in

which the transaction was recorded. The accounting for the effect of cross-currency interest rate exchange agreements used to hedge

long-term debt is described in note 2(m). Exchange gains or losses on translating long-term debt are recognized in the consolidated

statements of income. In 2004, foreign exchange losses related to the translation of long-term debt totalled $66.9 million (2003 – gain of

$290.7 million).

(h) Deferred charges:

The costs of obtaining bank and other debt financings are deferred and amortized on a straight-line basis over the life of the debt to

which they relate.

During the development and pre-operating phases of new products and businesses, related incremental costs are deferred and

amortized on a straight-line basis over periods of up to five years.

(i) Inventories:

Inventories are valued at the lower of cost, on a first-in, first-out basis, and net realizable value. Video rental inventory, which includes

videocassettes, DVDs and video games, is depreciated to a pre-determined residual value. The residual value of the video rental inven-

tory is recorded as a charge to operating expense upon the sale of the video rental inventory. Depreciation of video rental inventory is

charged to operating expense on a diminishing-balance basis over a six-month period.

(j) Pension benefits:

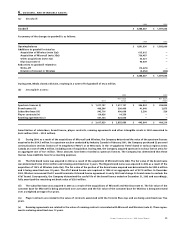

The Company accrues its pension plan obligations as employees render the services necessary to earn the pension. The Company uses

the current settlement discount rate to measure the accrued pension benefit obligation and uses the corridor method to amortize actu-

arial gains or losses (such as changes in actuarial assumptions and experience gains or losses) over the average remaining service life of

the employees. Under the corridor method, amortization is recorded only if the accumulated net actuarial gains or losses exceed 10% of

the greater of accrued pension benefit obligation and the value of the plan assets at the beginning of the year.

The Company uses the following methods:

(i) The cost of pensions is actuarially determined using the projected benefit method prorated on service and management’s best

estimate of expected plan investment performance, salary escalation, compensation levels at the time of retirement and retirement

ages of employees. Changes in these assumptions would impact future pension expense.

(ii) For the purpose of calculating the expected return on plan assets, those assets are valued at fair value.