Rogers 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

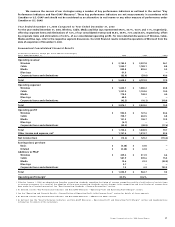

19

Rogers Communications Inc. 2004 Annual Report

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This MD&A includes forward-looking statements concerning the future performance of our business, its operations and its financial

performance and condition. These forward-looking statements include, among others, statements with respect to our objectives, and

strategies to achieve those objectives, as well as statements with respect to our beliefs, plans, expectations, anticipations, estimates or

intentions. When used in this document, the words “believe”, “anticipate”, “intend”, “estimate”, “expect”, “project” and similar expres-

sions are intended to identify forward-looking statements, although not all forward-looking statements contain such words. These

forward-looking statements are based on our current expectations. We caution that all forward-looking information is inherently

uncertain and actual results may differ materially from the assumptions, estimates or expectations reflected or contained in the forward-

looking information, and that actual future performance will be affected by a number of factors, including economic conditions,

technological change, regulatory change and competitive factors, many of which are beyond our control. Therefore, future events and

results may vary significantly from what we currently foresee. We are under no obligation (and we expressly disclaim any such obligation)

to update or alter the forward-looking statements whether as a result of new information, future events or otherwise. For a more

detailed discussion of factors that may affect actual results, see the sections below entitled “Risks and Uncertainties” in the respective

segment discussions and on a consolidated basis.

ADDITIONAL INFORMATION

Additional information relating to us, including our Annual Information Form and a discussion of our most recent quarterly results, may

be found on SEDAR at www.sedar.com or on EDGAR at www.sec.gov.

OVERVIEW

OUR BUSINESS

We are a diversified public Canadian communications and media company. We are engaged in wireless voice and data communications

services through Wireless, Canada’s largest wireless provider and the country’s only Global System for Mobile Communications/General

Packet Radio Service network, with Enhanced Data for GSM Evolution (“EDGE”) technology (“GSM/GPRS/EDGE”) network; in cable

television, high-speed Internet access and video retailing through Canada’s largest cable television provider, Cable; in radio, television

broadcasting, televised shopping, consumer magazines, and trade and professional publication businesses through Media; and in

sports entertainment through the Blue Jays.

We also hold other interests including an investment in a pay-per-view movie service as well as investments in several specialty

television channels, all of which are accounted for by the equity method. In addition, we hold interests in other companies for invest-

ment purposes.

OUR STRATEGY

Our business strategy is to maximize revenue, operating income and return on invested capital by enhancing our position as one of

Canada’s leading national diversified communications and media companies. Our objective is to be the preferred provider of communi-

cations, entertainment and information services to Canadians. We seek to take advantage of opportunities to leverage our networks,

infrastructure, sales channels and marketing resources across the Rogers group of companies to create value for our customers and

shareholders.

RCI helps to identify and facilitate opportunities for Wireless, Cable, Media and the Blue Jays to create bundled product and ser-

vice offerings, as well as for the cross-marketing and cross-promotion of products and services to increase sales and enhance subscriber

loyalty. We also work to identify and implement areas of opportunity for our businesses that will enhance operating efficiencies and

capital utilization by sharing infrastructure, corporate services and sales distribution channels.

We are deploying an advanced broadband Internet Protocol (“IP”) multimedia network to support primary line voice-over-cable

telephony and other new services across our cable service areas. The completion of the network and launch of these services, scheduled

to occur no earlier than mid-2005, is dependent upon a successful technical trial and implementation. This investment plan includes the

capital costs required to deploy a scalable primary line quality digital voice-over-cable telephony service utilizing PacketCable and Data

Over Cable Service Interface Specification (“DOCSIS”) standards, including the costs associated with switching, transport, IP network

redundancy, multi-hour network and customer premises powering, network status monitoring, customer premises equipment, infor-

mation technologies and systems integration. As originally disclosed in February 2004, we anticipate that we will initially invest

approximately $200 million in fixed costs to enable the launch of the service. Approximately $106 million of the initial investment

occurred in 2004. Once this initial platform is deployed, variable additions to PP&E associated with adding each voice-over-cable tele-

phony service customer, which includes uninterruptible back-up powering at the home, are expected to be in the range of $300 to $340

per subscriber addition.

To further our exposure to and scale position in the Canadian wireless market, we announced three significant structural and

strategic initiatives during the latter part of 2004 which are further described below: the acquisition from AT&T Wireless Services, Inc.

(“AWE”) of its 34% stake in Wireless; the acquisition of Microcell Telecommunications Inc. (“Microcell”); and the acquisition of the publicly-

held 11.2% minority interest in Wireless.

For a more detailed discussion of the business strategies of Wireless, Cable, Media and the Blue Jays, refer to the respective seg-

ment discussions below.