Rogers 2004 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

Rogers Communications Inc. 2004 Annual Report

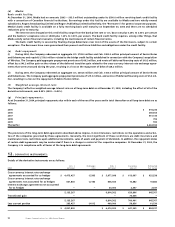

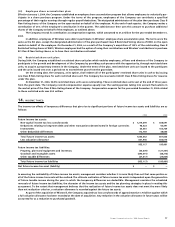

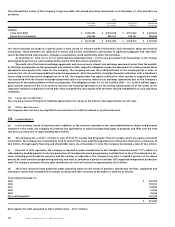

(d) Expected cash flows:

Expected benefit payments for fiscal year ending:

2005 $ 26,000

2006 27,000

2007 28,000

2008 29,300

2009 30,700

141,000

Next 5 years 168,000

$ 309,000

Blue Jays Holdco and Microcell each has defined contribution plans with total pension expense of $0.9 million in 2004 from the date of

consolidation of each to December 31, 2004.

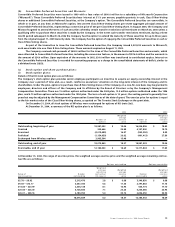

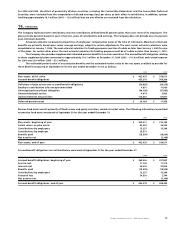

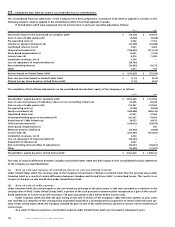

17. SEGMENTED INFORMATION:

(a) Operating segments:

The Company provides wireless services, cable services and, through Media, radio and television broadcasting and the publication of

magazines and periodicals. All of these operating segments are substantially in Canada. As described in note 7(a), commencing July 31,

2004, the Company began to consolidate Blue Jays Holdco and reporting it as a separate operating segment. Effective January 1, 2005,

Blue Jays Holdco became a reporting unit of Media and as a result, will be reported as part of the Media operating segment commenc-

ing in 2005. Information by operating segment for the years ended December 31, 2004 and 2003 are as follows:

Corporate

items and Consolidated

2004 Wireless Cable Media Blue Jays eliminations Total

Operating revenue $ 2,783,525 $ 1,945,655 $ 899,763 $ 61,849 $ (82,543) $ 5,608,249

Cost of sales 509,540 145,936 142,381 – – 797,857

Sales and marketing expenses 444,379 248,754 184,197 6,292 – 883,622

Operating, general and

administrative expenses 879,215 842,306 451,644 61,726 (42,262) 2,192,629

Management fees 11,675 38,913 13,661 – (64,249) –

Depreciation and amortization 497,674 486,038 53,321 14,021 41,497 1,092,551

Operating income (loss) 441,042 183,708 54,559 (20,190) (17,529) 641,590

Interest on long-term debt (219,366) (247,365) (8,912) (5,131) (41,300) (522,074)

Intercompany:

Interest expense (7,196) (552) (42,225) – 49,973 –

Dividends – – 42,915 – (42,915) –

Gain on sale of other

investments 1,445 – – – 13,009 14,454

Loss on repayment of

long-term debt (2,313) (18,013) – – (7,884) (28,210)

Writedown of investments – (494) – – (5,527) (6,021)

Gain (loss) from investments

accounted for by the equity

method – – 1,875 – (20,569) (18,694)

Change in fair value of

derivative instruments (7,796) 34,570 – – – 26,774

Foreign exchange gain (loss) (46,714) (41,089) 358 (512) 20,402 (67,555)

Investment and other income

(expense) 6,494 (378) 598 680 22,152 29,546

Income tax reduction (expense) (6,487) (1,196) (988) (1,618) 6,842 (3,447)

Non-controlling interest ––––(79,581) (79,581)

Net income (loss)

for the year $ 159,109 $ (90,809) $ 48,180 $ (26,771) $ (102,927) $ (13,218)

PP&E expenditures $ 439,157 $ 587,906 $ 19,619 $ 703 $ 7,553 $ 1,054,938

Goodwill acquired $ 1,366,102 $ – $ 53,021 $ 95,509 $ – $ 1,514,632

Goodwill $ 1,739,465 $ 926,445 $ 624,720 $ 95,509 $ 2,548 $ 3,388,687

Identifiable assets $ 5,054,803 $ 3,861,925 $ 1,062,435 $ 162,124 $ 3,131,451 $ 13,272,738