Rogers 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

Rogers Communications Inc. 2004 Annual Report

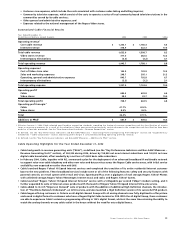

and CE levels was primarily due to the acquisition of Microcell, which resulted in increases in the areas of sales operations, customer

care, retention, credit and collections, network operations and information technology. Wireless also relies on employees of RCI in the

area of, amongst other things, customer service call centres, for a material amount of services. These RCI employees are not included in

the FTE levels that Wireless reports.

Total remuneration paid to employees (both full- and part-time) in 2004 was approximately $226.0 million, an increase of $61.8 mil-

lion, or 37.6%, from $164.2 million in the prior year.

WIRELESS RISKS AND UNCERTAINTIES

Wireless’ business is subject to risks and uncertainties that could result in a material adverse effect on its business and financial results

as outlined below.

Wireless Faces Substantial Competition

The Canadian wireless communications industry is highly-competitive. In the wireless voice and data market, Wireless competes pri-

marily with two other wireless service providers and may in the future compete with other companies, including resellers, such as

Virgin Mobile Canada, Sprint Canada and Primus. Potential users of wireless voice and data systems may find their communications

needs satisfied by other current or developing technologies, such as WiFi, “hotspots” or trunk radio systems, which have the technical

capability to handle mobile telephone calls. Wireless also competes with rivals for dealers and retail distribution outlets. There can be

no assurance that its current or future competitors will not provide services comparable or superior to those provided by Wireless, or at

lower prices, adapt more quickly to evolving industry trends or changing market requirements, enter the market in which Wireless

operates, or introduce competing services. Any of these factors could reduce Wireless’ market share or decrease its revenue.

Price Competition Could Adversely Affect Wireless’ Churn Rate and Revenue Growth

Aggressive pricing by industry participants in previous years caused significant reductions in Canadian wireless communications pricing.

Wireless believes that competitive pricing is a factor in causing churn. Wireless cannot predict the extent of further price competition

and customer churn in the future, but it anticipates some ongoing re-pricing of its existing subscriber base as lower pricing offered

to attract new customers is extended to or requested by existing customers. In addition, as wireless penetration of the population

deepens, new wireless customers may generate lower average monthly revenues than those from its existing customers, which could

slow revenue growth.

Wireless May Fail to Achieve Expected Revenue Growth from New and Advanced Wireless Services

Wireless expects that a substantial portion of its future revenue growth will be achieved from new and advanced wireless voice and

data transmission services. Accordingly, Wireless has invested and continues to invest significant capital resources in the development

of its GSM/GPRS/EDGE network in order to offer these services. However, there may not be sufficient consumer demand for these

advanced wireless services. Alternatively, Wireless may fail to anticipate or satisfy demand for certain products and services, or may not

be able to offer or market these new products and services successfully to subscribers. The failure to attract subscribers to new pro-

ducts and services, or failure to keep pace with changing consumer preferences for wireless products and services, would slow revenue

growth and have a material adverse effect on Wireless’ business and financial condition.

Wireless Expects to Experience Significant Change in the Wireless Communications Industry

The wireless communications industry is experiencing significant technological change. This includes the increasing pace of upgrades to

existing wireless systems, evolving industry standards, ongoing improvements in the capacity and quality of digital technology, shorter

development cycles for new products and enhancements and changes in end-user needs and preferences. There is also uncertainty as to

the pace and extent that consumer demand for wireless services will continue to increase, as well as the extent to which airtime and

monthly recurring charges may continue to decline. As a result, Wireless’ future prospects and those of its industry remain uncertain.

Wireless Remains Subject to Risks Arising out of its Acquisition of Microcell, such as the Risks that it May Not Be

Able to Successfully Integrate Microcell and May Not Be Able to Realize the Anticipated Synergies

Wireless’ acquisition of Microcell was based in part on the belief that acquiring Microcell would enable Wireless to achieve cost savings

from elimination of duplicative operations and redundant infrastructure and to benefit from efficiencies in operations and capital

spending. The successful realization of these synergies will depend on a number of factors, many of which are beyond Wireless’ control.

Wireless may not be able to achieve the cost savings it anticipates from the acquisition, thereby causing its financial results to be less

than expected.

Wireless may not be able to successfully integrate and manage Microcell’s business because of unanticipated difficulties in

assimilating Microcell’s operations, services and corporate culture into its own. In particular, Wireless’ existing GSM/GPRS/EDGE network,

information technology systems and billing systems and those of Microcell will require integration that could result in unexpected

costs and complications that could have an adverse impact on Wireless’ ability to retain customers and adversely impact its financial

results and position. If Wireless is unable to successfully integrate and manage Microcell’s business, or if the integration costs, including

severance and other employee related costs, as well as costs to consolidate facilities, systems and operations, are more than antici-

pated or the integration diverts management attention or other resources from the operation of the existing business, then Wireless’

business and financial results may suffer.

Wireless may also be subject to unexpected claims and liabilities arising from the acquisition of Microcell, including claims and

liabilities of Microcell that were not disclosed to Wireless or that exceed their estimates. These claims could be costly to defend and

result in liabilities to Wireless which may be material in amount.