Rogers 2004 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88 Rogers Communications Inc. 2004 Annual Report

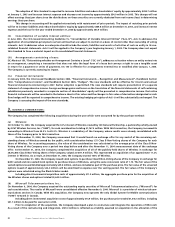

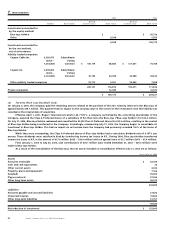

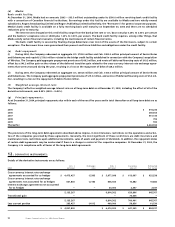

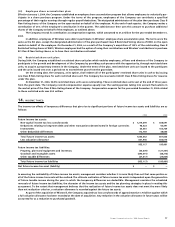

(c) Supplemental disclosure of non-cash transactions:

2004 2003

Class B Non-Voting shares issued on conversion of Series E Convertible Preferred shares $ 1,752 $ 203

CCI shares exchanged for CI shares (note 7(b)) (6,874) –

CCI shares acquired in exchange for CI shares (note 7(b)) 15,801 –

Class B Non-Voting shares issued in exchange for Wireless shares (note 3(a)) 811,867 –

Options to acquire Class B Non-Voting shares issued in exchange for Wireless options (note 3(a)) 73,228 –

Class B Non-Voting shares issued in consideration for acquisition of shares of CCI (note 7(b)) – 35,181

Refer to note 13(a) for details of other non-cash transactions.

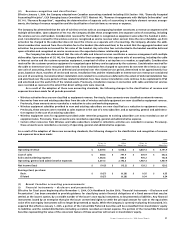

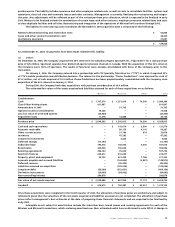

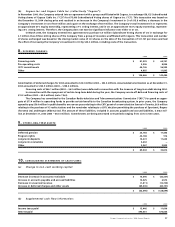

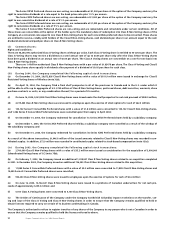

11. LONG-TERM DEBT:

Interest rate 2004 2003

(a) Corporate:

(i) Bank credit facility Floating $ – $ –

(ii) Convertible Debentures, due 2005 5.75% 261,810 271,197

(iii) Senior Notes, due 2006 10.50% 75,000 75,000

336,810 346,197

(b) Wireless:

(i) Bank credit facility Floating – 138,000

(ii) Senior Secured Notes, due 2006 10.50% 160,000 160,000

(iii) Senior Secured Notes, due 2007 8.30% – 253,453

(iv) Senior Secured Debentures, due 2008 9.375% – 430,589

(v) Floating Rate Senior Secured Notes, due 2010 Floating 661,980 –

(vi) Senior Secured Notes, due 2011 9.625% 589,764 633,276

(vii) Senior Secured Notes, due 2011 7.625% 460,000 –

(viii) Senior Secured Notes, due 2012 7.25% 565,692 –

(ix) Senior Secured Notes, due 2014 6.375% 902,700 –

(x) Senior Secured Notes, due 2015 7.50% 661,980 –

(xi) Senior Secured Debentures, due 2016 9.75% 186,438 200,193

(xii) Senior Subordinated Notes, due 2007 8.80% – 231,443

(xiii) Senior Subordinated Notes, due 2012 8.00% 481,440 –

(xiv) Fair value increment arising from purchase accounting 55,232 –

4,725,226 2,046,954

(c) Cable:

(i) Bank credit facility Floating – 36,000

(ii) Senior Secured Second Priority Notes, due 2005 10.00% 350,889 376,777

(iii) Senior Secured Second Priority Notes, due 2007 7.60% 450,000 450,000

(iv) Senior Secured Second Priority Notes, due 2011 7.25% 175,000 –

(v) Senior Secured Second Priority Notes, due 2012 7.875% 421,260 452,340

(vi) Senior Secured Second Priority Notes, due 2013 6.25% 421,260 452,340

(vii) Senior Secured Second Priority Notes, due 2014 5.50% 421,260 –

(viii) Senior Secured Second Priority Debentures, due 2014 9.65% – 300,000

(ix) Senior Secured Second Priority Notes,due 2015 6.75% 337,008 –

(x) Senior Secured Second Priority Debentures, due 2032 83/4% 240,720 258,480

(xi) Senior Subordinated Guaranteed Debentures, due 2015 11.00% 136,819 146,914

2,954,216 2,472,851

(d) Media:

Bank credit facility Floating – 63,500

Mortgages and other Various 34,135 40,730

8,050,387 4,970,232

Less current portion 618,236 11,498

$ 7,432,151 $ 4,958,734

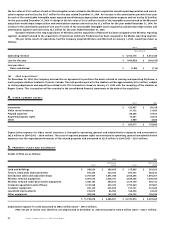

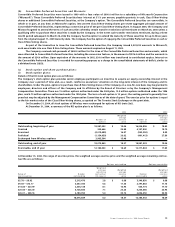

Further details of long-term debt are as follows:

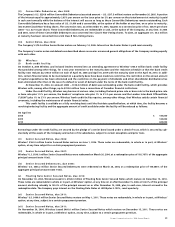

(a) Corporate:

(i) Bank credit facility:

Effective October 13, 2004, the Company entered into a $1,750.0 million senior secured bridge credit facility with a term of up to two

years with a group of Canadian financial institutions. During December 2004, the Company repaid the bridge credit facility in full and

cancelled the facility, resulting in a loss on repayment of debt of $7.9 million, comprising the deferred financing costs (note 11(e)).