Rogers 2004 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

Rogers Communications Inc. 2004 Annual Report

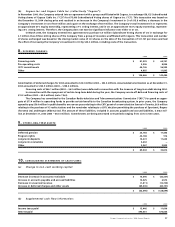

(b) Convertible Preferred Securities and Warrants:

Convertible Preferred Securities were issued in 1999 with a face value of $600.0 million to a subsidiary of Microsoft Corporation

(“Microsoft”). These Convertible Preferred Securities bear interest at 51/2% per annum, payable quarterly in cash, Class B Non-Voting

shares or additional Convertible Preferred Securities, at the Company’s option. The Convertible Preferred Securities are convertible, in

whole or in part, at any time, at Microsoft’s option, into 28.5714 Class B Non-Voting shares per $1,000 aggregate principal amount of

Convertible Preferred Securities, representing a conversion price of $35 per Class B Non-Voting share. In August 2004, the Company and

Microsoft agreed to amend the terms of such securities whereby certain transfer restrictions will terminate on March 28, 2006 unless a

qualifying offer to purchase these securities is made by the Company. In the event such transfer restrictions terminate, during a three

month period subsequent to March 28, 2006 the Company has the option to extend the maturity of these securities for up to three years

from the original August 11, 2009 maturity date. The Company has the option of repaying the Convertible Preferred Securities in cash or

Class B Non-Voting shares.

As part of the transaction to issue the Convertible Preferred Securities, the Company issued 5,333,333 warrants to Microsoft,

each exercisable into one Class B Non-Voting share. These warrants expired on August 11, 2002.

The Company received cash proceeds of $600.0 million for the issue of the Convertible Preferred Securities and warrants, which

were allocated to Convertible Preferred Securities, including the conversion feature, in the amount of $576.0 million and the warrants in

the amount of $24.0 million. Upon expiration of the warrants in 2002, $24.0 million was transferred to contributed surplus. Interest on

the Convertible Preferred Securities is recorded for accounting purposes as a charge to the consolidated statements of deficit, similar to

a dividend (note 2(t)(i)).

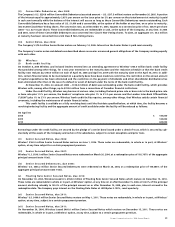

(c) Stock option and share purchase plans:

(i) Stock option plans:

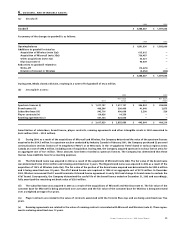

Details of the RCI stock option plan are as follows:

The Company’s stock option plan provides senior employee participants an incentive to acquire an equity ownership interest in the

Company over a period of time and, as a result, reinforces executives’ attention on the long-term interest of the Company and its

shareholders. Under the plan, options to purchase Class B Non-Voting shares of the Company on a one-for-one basis may be granted to

employees, directors and officers of the Company and its affiliates by the Board of Directors or by the Company’s Management

Compensation Committee. There are 15 million options authorized under the 2000 plan, 12.5 million options authorized under the 1996

plan, and 4.75 million options authorized under the 1994 plan. The term of each option is 10 years; the vesting period is generally four

years but may be adjusted by the Management Compensation Committee as of the date of grant. The exercise price for options is equal

to the fair market value of the Class B Non-Voting shares, as quoted on The Toronto Stock Exchange on the grant date.

On December 31, 2004, all stock options of Wireless were exchanged for options of RCI (note 3(a)).

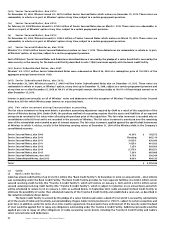

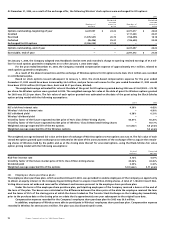

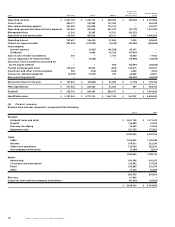

At December 31, 2004, a summary of the RCI option plan is as follows:

2004 2003

Weighted Weighted

average average

Number of exercise Number of exercise

options price options price

Outstanding, beginning of year 18,981,033 $ 19.06 16,226,896 $ 18.82

Granted 303,666 25.88 4,197,800 18.70

Exercised (4,019,485) 16.97 (952,250) 8.99

Forfeited (1,154,959) 26.62 (491,413) 27.89

Exchanged from Wireless options 3,965,594 15.48 – –

Outstanding, end of year 18,075,849 18.37 18,981,033 19.06

Exercisable, end of year 12,184,543 $ 18.69 12,171,834 $ 17.85

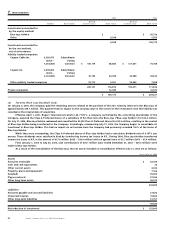

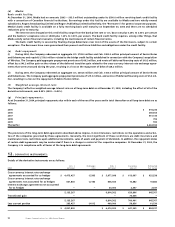

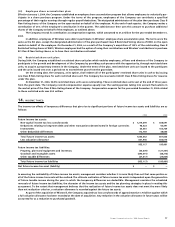

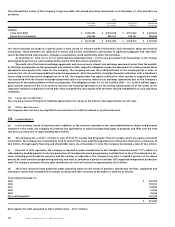

At December 31, 2004, the range of exercise prices, the weighted average exercise price and the weighted average remaining contrac-

tual life are as follows:

Options outstanding Options exercisable

Weighted

average Weighted Weighted

remaining average average

Range of Number contractual exercise Number exercise

exercise prices outstanding life (years) price exercisable price

$5.78 – $8.92 3,215,476 2.8 $ 6.68 3,149,850 $ 6.68

$9.38 – $13.17 3,647,045 5.6 11.36 2,197,883 11.76

$14.83 – $20.59 2,304,138 8.1 16.94 544,774 17.70

$20.60 – $26.00 6,728,840 7.1 23.26 4,235,686 23.94

$26.01 – $38.16 2,180,350 5.4 33.72 2,056,350 33.94

18,075,849 6.0 18.37 12,184,543 18.69