Rogers 2004 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

Rogers Communications Inc. 2004 Annual Report

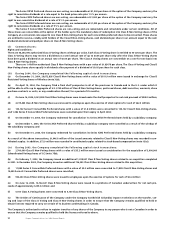

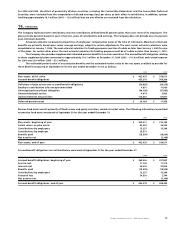

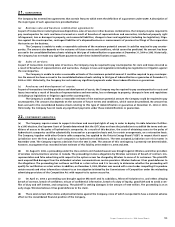

18. RELATED PARTY TRANSACTIONS:

The Company entered into the following related party transactions:

(a) The Company has entered into certain transactions in the normal course of business with AWE, a shareholder of Wireless until

October 13, 2004, and with certain broadcasters in which the Company has an equity interest.

The programming rights acquired from the Blue Jays in 2004 represent the rights acquired from January 1, 2004 to July 30, 2004,

after which time the Blue Jays were consolidated.

The amounts billed (paid) to AWE represent amounts to October 13, 2004, after which AWE was no longer a related party.

2004 2003

Roaming revenue billed to AWE $ 12,146 $ 13,030

Roaming expenses paid to AWE (8,977) (13,628)

Fees paid to AWE for over air activation (31) (292)

Programming rights acquired from the Blue Jays (7,972) (12,028)

Access fees paid to broadcasters accounted for by the equity method (19,011) (18,967)

$ (23,845) $ (31,885)

These transactions are recorded at the exchange amount, being the amount agreed to by the related parties.

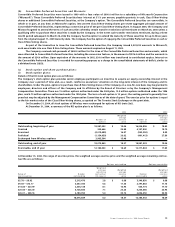

(b) The Company has entered into certain transactions with companies, the partners or senior officers of which are directors of the

Company and/or its subsidiary companies. Total amounts paid by the Company to these related parties are as follows:

2004 2003

Legal services and commissions paid on premiums for insurance coverage $ 4,042 $ 6,100

Telecommunication and programming services 6,340 59,200

Interest charges and other financing fees 37,809 18,105

$ 48,191 $ 83,405

The Company made payments to (received from) companies controlled by the controlling shareholder of the Company as follows:

2004 2003

Dividends paid on Class A Voting and Class B

Non-Voting shares of the Company $ 6,967 $ 6,972

Dividends paid on Class A Preferred shares of Blue Jays Holdco 2,744 2,419

Charges to the Company for business use of aircraft 473 412

Charges by the Company for rent and reimbursement of office and personnel costs (125) (375)

$ 10,059 $ 9,428

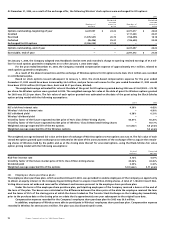

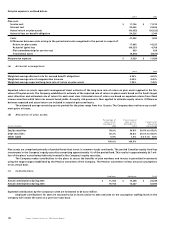

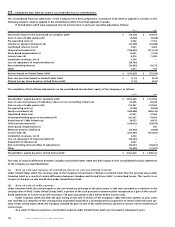

19. FINANCIAL INSTRUMENTS:

(a) Fair values:

The Company has determined the fair values of its financial instruments as follows:

(i) The carrying amounts in the consolidated balance sheets of cash and cash equivalents, accounts receivable, amounts receivable

from employees under share purchase plans, mortgages and loans receivable, bank advances arising from outstanding cheques and

accounts payable and accrued liabilities approximate fair values because of the short-term nature of these instruments.

(ii) Investments:

The fair values of investments, which are publicly traded, are determined by the quoted market values for each of the investments

(note 7). Management believes that the fair values of other investments are not significantly different from their carrying amounts.

(iii) Long-term receivables:

The fair values of long-term receivables approximate their carrying amounts as the interest rates approximate current market rates.

(iv) Long-term debt:

The fair values of each of the Company’s long-term debt instruments are based on the period-end trading values.

(v) Derivative instruments:

The fair values of the Company’s interest exchange agreements, cross-currency interest rate exchange agreements and other derivative

instruments are based on values quoted by the counterparties to the agreements.