Rogers 2004 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

Rogers Communications Inc. 2004 Annual Report

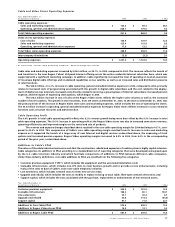

In February 2004, Cable redeemed $300.0 million aggregate principal amount of its 9.65% Senior Secured Second Priority

Debentures due 2014 at a redemption price of 104.825% of the aggregate principal amount which, together with the write-off of

deferred financing costs, resulted in a loss on the repayment of debt of $18.0 million.

In March 2004, Cable completed a debt issue in an aggregate principal amount of US$350.0 million 5.50% Senior Secured Second

Priority Notes due 2014. During the first quarter of 2004, Cable entered into an aggregate US$525.0 million notional amount of new

cross-currency interest rate exchange agreements.

In September 2004, we announced an agreement with Microcell to make an all cash tender offer of $35.00 per share to acquire

Microcell. We completed the acquisition effective November 9, 2004. Including direct incremental acquisition costs of approximately

$14.9 million, the purchase price totalled $1,318.4 million, including warrants of $51.7 million to be acquired in May 2005. However, net

of $118.1 million cash acquired and net of the $51.7 million of warrants to be acquired, the cash outlay was $1,148.6 million. In addition,

we permanently repaid all of Microcell’s $353.2 million outstanding bank debt and cancelled its bank loan agreements. We also

unwound all of Microcell’s cross-currency interest rate exchange agreements at a cost of $64.6 million. The funding for this acquisition

was initially comprised of: utilization of Wireless’ cash on hand, drawdowns under Wireless’ committed $700.0 million amended bank

credit facility, and proceeds from a bridge loan from RCI of up to $900.0 million, of which $850.0 million was drawn for a fee of $4.25 mil-

lion. The bridge loan had a term of up to two years from November 9, 2004, and was made on a subordinated unsecured basis. The

bridge loan’s interest rate was 6.0% per annum and was prepayable in whole or in part without penalty. This $850.0 million bridge loan

was permanently repaid on November 30, 2004, with part of the proceeds of the debt issues completed on the same date.

In October 2004, we established a $1.75 billion bridge credit facility with a group of Canadian financial institutions to fund

(together with cash on hand) the $1.767 billion purchase price of the 34% stake in Wireless from AWE. This bridge facility was perma-

nently repaid in full and cancelled in December 2004 with $350.0 million cash on hand together with the proceeds of a $1.4 billion loan

from Wireless to us.

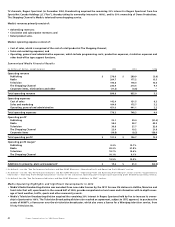

In November 2004, RWI completed aggregate debt issuances in the principal amount of approximately US$2.356 billion (approxi-

mately $2.807 billion) which consisted of: $460.0 million 7.625% Senior Secured Notes due 2011; US$550.0 million Floating Rate Senior

Secured Notes due 2010; US$470.0 million 7.25% Senior Secured Notes due 2012; US$550.0 million 7.50% Senior Secured Notes due 2015;

and US$400.0 million 8.0% Senior Subordinated Notes due 2012. On economic basis, all of the U.S. dollar-denominated debt was hedged

with respect to fluctuations in foreign exchange with cross-currency interest rate exchange agreements.

In November 2004, Cable completed two debt issues totalling US$426.7 million aggregate principal amount consisting of $175.0 mil-

lion 7.25% Senior (Secured) Second Priority Notes due 2011 and US$280.00 million 6.75% Senior (Secured) Second Priority Notes due 2015.

On an economic basis, all of the debt was hedged with respect to fluctuations in foreign exchange with cross-currency interest rate

exchange agreements.

In January 2004, Cable established a dividend/distribution policy to distribute $6.0 million per month to RCI on a recurring basis,

starting January 2004. During 2004, $72.0 million was distributed pursuant to this policy.

In April 2004, we filed a shelf prospectus with each of the provinces in Canada and in the U.S., under which we are able to offer

up to aggregate US$750.0 million of Class B Non-Voting shares, preferred shares, debt securities, warrants, share purchase contracts or

units, or any combination thereof, for a period of 25 months. The $250.0 million equity issue referenced below was made by way of a

prospectus supplement to the final shelf prospectus.

In June 2004, we issued 9,541,985 Class B Non-Voting shares at $26.20 per share for net proceeds of $238.9 million. This equity

issue was done on a “bought deal” basis under our shelf prospectus.

In November 2004, Cable made a $660.0 million distribution to us, as a return of capital, to assist indirectly in the initial financing

of the acquisition of Microcell by Wireless.

In December 2004, Wireless distributed $1,750.0 million to RWCI as a return of capital, of which $1.4 billion was cash. The consid-

eration for the remaining amount was the issuance of $350.0 million demand subordinated non-interest bearing promissory note. RWCI

subsequently advanced $1.4 billion to RCI evidenced by a loan agreement and secured with the shares of our subsidiaries, Cable and

Rogers Acquisition Inc.

We structure our borrowings generally on a stand-alone basis. Therefore, borrowings by each of our three principal operating

groups are generally secured only by the assets of the respective entities within each operating group, and such instruments

generally do not provide for guarantees or cross-collaterization or cross-defaults between groups. Currently, no such guarantees or

cross-collaterization or cross-defaults between the groups exist.

Cable’s amended and restated $1.075 billion bank credit facility, which was established in January 2002, is comprised of two

tranches: (1) the $600 million Tranche A that matures on January 2, 2009, and (2) the $475 million Tranche B that reduces by 25% annually

on each of January 2, 2006, 2007, 2008 and 2009. In September 2003, Cable amended its bank credit facility to eliminate the possibility of

earlier-than-scheduled maturity of Tranche B and availability on a $400.0 million portion of Tranche B has been reserved to repay

Cable’s Senior Secured Notes due 2005. The $400 million reserved amount will be reduced by an amount equal to any repayment of the

Notes due 2005 made from time to time from any source including Tranche B and, as a result, an amount equal to such repayments

becomes available to Cable under Tranche B.

In October 2004, Wireless entered into an amending agreement with its bank lenders on its $700.0 million bank credit facility that

provided, among other things, for a two-year extension of both the maturity date and the reduction schedule such that the bank credit

facility now reduces by $140.0 million on each of April 30, 2008 and April 30, 2009, with the maturity date on April 30, 2010. The provision

for early maturity in the event that our 10.50% Senior Secured Notes due 2006 are not repaid (by refinancing or otherwise) on or prior to

December 31, 2005, has been eliminated. In addition, certain financial ratios to be maintained on a quarterly basis have been made less

restrictive; the restriction on the annual amount of PP&E expenditures has been eliminated; and the restriction on the payment of divi-

dends and other shareholder distributions has been eliminated, other than in the case of a default or event of default under the terms

of the bank credit facility. The terms of the amended bank credit facility generally impose the most restrictive limitations on Wireless’

operations and activities, as compared to its other debt instruments. The most significant of these restrictions are debt incurrence and

maintenance tests based upon certain ratios of debt to adjusted operating profit.