Rogers 2004 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106 Rogers Communications Inc. 2004 Annual Report

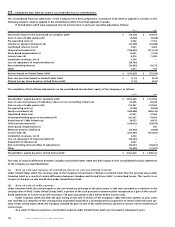

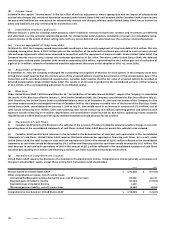

23. CANADIAN AND UNITED STATES ACCOUNTING POLICY DIFFERENCES:

The consolidated financial statements of the Company have been prepared in accordance with GAAP as applied in Canada. In the

following respects, GAAP as applied in the United States differs from that applied in Canada.

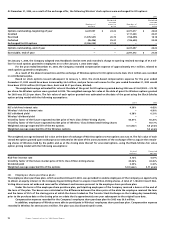

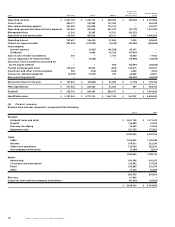

If United States GAAP were employed, the net income (loss) in each year would be adjusted as follows:

2004 2003

Net income (loss) for the year based on Canadian GAAP $ (13,218) $ 129,193

Gain on sale of cable systems (b) (4,028) (4,028)

Pre-operating costs (c) 5,348 11,150

Interest on equity instruments (d) (35,398) (35,388)

Capitalized interest, net (e) 3,061 5,405

Financial instruments (h) (188,420) (217,514)

Stock-based compensation (i) 15,091 (1,150)

Income taxes (k) 8,374 11,493

Installation revenues, net (l) 2,744 –

Loss on repayment of long-term debt (m) (28,760) –

Non-controlling interest (36,630) 43,173

Other 1,211 516

Net loss based on United States GAAP $ (270,625) $ (57,150)

Basic loss per share based on United States GAAP $ (1.13) $ (0.25)

Diluted loss per share based on United States GAAP (1.13) (0.25)

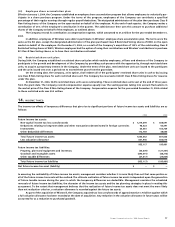

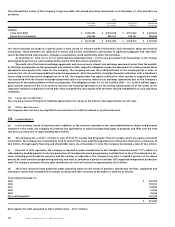

The cumulative effect of these adjustments on the consolidated shareholders’ equity of the Company is as follows:

2004 2003

Shareholders’ equity based on Canadian GAAP $ 2,876,044 $ 1,767,380

Gain on sale and issuance of subsidiary shares to non-controlling interest (a) 46,245 46,245

Gain on sale of cable systems (b) 120,937 124,965

Pre-operating costs (c) (3,506) (8,854)

Equity instruments (d) (588,808) (586,410)

Capitalized interest (e) 41,047 37,986

Unrealized holding gains on investments (f) 152,267 78,596

Acquisition of Cable Atlantic (g) 34,673 34,673

Financial instruments (h) (248,013) (59,593)

Stock-based compensation (i) – 661

Minimum pension liability (j) (20,970) (7,858)

Income taxes (k) (253,567) (253,567)

Installation revenues, net (l) 2,744 –

Loss on repayment of long-term debt (m) (28,760) –

Acquisition of Wireless (n) 2,927 –

Non-controlling interest effect of adjustments (95,031) (58,401)

Other (15,829) (17,701)

Shareholders’ equity based on United States GAAP $ 2,022,400 $ 1,098,122

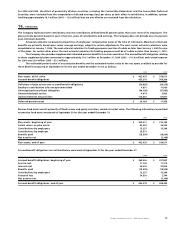

The areas of material difference between Canadian and United States GAAP and their impact on the consolidated financial statements

of the Company are described below:

(a) Gain on sale and issuance of subsidiary shares to non-controlling interest:

Under United States GAAP, the carrying value of the Company’s investment in Wireless would be lower than the carrying value under

Canadian GAAP as a result of certain differences between Canadian and United States GAAP, as described herein. This results in an

increase to the gain on sale and dilution under United States GAAP.

(b) Gain on sale of cable systems:

Under Canadian GAAP, the cash proceeds on the non-monetary exchange of the cable assets in 2000 were recorded as a reduction in the

carrying value of PP&E. Under United States GAAP, a portion of the cash proceeds received must be recognized as a gain in the consoli-

dated statements of income on an after-tax basis. The gain amounted to $40.3 million before income taxes.

Under Canadian GAAP, the after-tax gain arising on the sale of certain of the Company’s cable television systems in prior years

was recorded as a reduction of the carrying value of goodwill acquired in a contemporaneous acquisition of certain cable television sys-

tems. Under United States GAAP, the Company included the gain on sale of the cable television systems in income, net of related future

income taxes.

As a result of these transactions, amortization expense under United States GAAP was increased in subsequent years.