Rogers 2004 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

Rogers Communications Inc. 2004 Annual Report

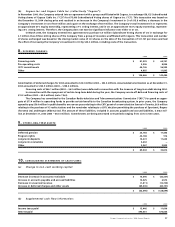

purchase price. This liability includes severance and other employee related costs, as well as costs to consolidate facilities, systems and

operations, close cell sites and terminate leases and other contracts. Management is currently finalizing the restructuring and integra-

tion plan. Any adjustments will be reflected as part of the revised purchase price allocation, which is expected to be finalized in early

2005. Matters to be finalized include the terminations of certain leases and other contracts, employee severance related items and costs

to close duplicate facilities and cell sites. Restructuring and integration of the operations of Microcell will continue through 2005.

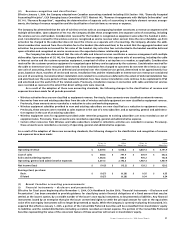

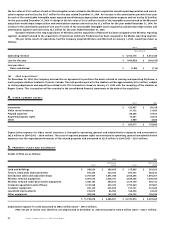

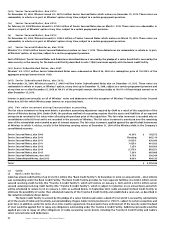

The liability for restructuring costs recorded at the November 9, 2004 acquisition date is comprised of the following:

Network decommissioning and restoration costs $ 52,806

Lease and other contract termination costs 48,329

Involuntary severance 27,891

$ 129,026

As at December 31, 2004, no payments have been made related to this liability.

(c) Other:

On December 23, 2004, the Company acquired the 20% interest in its subsidiary Rogers Sportsnet Inc. (“Sportsnet”) for a cash purchase

price of $45 million. Sportsnet operates four distinct all-sports television channels in Canada. With the acquisition of this 20% interest,

the Company owns 100% of Sportsnet. The results of Sportsnet were already consolidated with those of the Company prior to this

transaction.

On January 2, 2004, the Company entered into a partnership with CTV Specialty Television Inc. (“CTV”) in which it acquired 50%

of CTV’s mobile production and distribution business. The interest in the partnership, “Dome Productions”, was acquired for cash of

$21.3 million, net of cash acquired of $3.5 million. Dome Productions has been proportionately consolidated with the Company since

acquisition of the 50% interest on January 2, 2004.

During 2004, the Company had other acquisitions with purchase consideration of $0.4 million.

The estimated fair values of the assets acquired and liabilities assumed for each of these acquisitions are as follows:

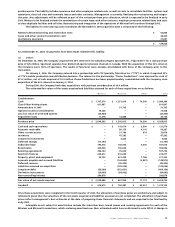

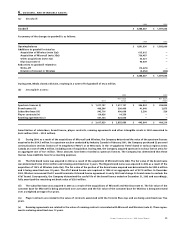

Wireless Microcell Other Total

Consideration:

Cash $ 1,767,370 $ 1,251,819 $ 70,200 $ 3,089,389

Class B Non-Voting shares 811,867 – – 811,867

Amounts due in 2005 – 51,705 – 51,705

Options issued as consideration 73,228 – – 73,228

Less fair value of unvested options (23,440) – – (23,440)

Acquisition costs 11,278 14,888 – 26,166

Purchase price $ 2,640,303 $ 1,318,412 $ 70,200 $ 4,028,915

Cash and cash equivalents $ – $ 118,070 $ 3,500 $ 121,570

Accounts receivable – 86,179 4,118 90,297

Other current assets – 31,796 674 32,470

Inventory – 47,292 – 47,292

Long-term investments – 3,823 – 3,823

Deferred charges (17,197) – – (17,197)

Subscriber base 792,516 140,000 5,000 937,516

Brand name 302,556 100,000 – 402,556

Roaming agreements 496,734 35,000 – 531,734

Spectrum licences 203,677 410,600 – 614,277

Property, plant and equipment 32,123 331,439 7,768 371,330

Accounts payable and accrued liabilities – (144,692) (3,881) (148,573)

Deferred revenue – (45,303) – (45,303)

Liabilities assumed on acquisition – (129,026) – (129,026)

Long-term debt (56,509) (352,651) – (409,160)

Derivative instruments (20,090) (64,602) – (84,692)

Non-controlling interest 290,878 – – 290,878

Fair value of net assets acquired $ 2,024,688 $ 567,925 $ 17,179 $ 2,609,792

Goodwill $ 615,615 $ 750,487 $ 53,021 $ 1,419,123

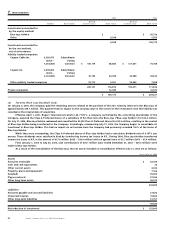

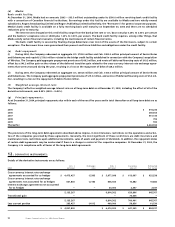

Since these acquisitions were completed in the fourth quarter of 2004, the allocations of purchase prices are preliminary and subject to

refinement given that the valuations of the net assets acquired and liabilities assumed are not completed. The allocations of purchase

prices reflect management’s best estimates at the date of preparing these financial statements and are expected to be finalized by

early 2005.

Intangible assets subject to amortization include the subscriber base, brand names and roaming agreements for each of the

Wireless and Microcell transactions, which are being amortized over their estimated useful lives as disclosed in note 2(f)(ii). A change in