Rogers 2004 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 Rogers Communications Inc. 2004 Annual Report

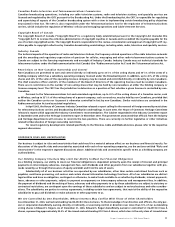

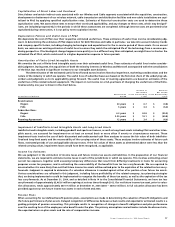

The following table illustrates the increase (decrease) on the accrual benefit obligation and pension expense for changes in these pri-

mary assumptions and estimates:

Accrued Benefit

Obligation at Pension Expense

(In $000’s) End of Fiscal 2004 Fiscal 2004

Discount Rate 6.25% 6.25%

Impact of: 1%increase $ (60,762) $ (8,834)

1%decrease 80,033 12,056

Rate of Compensation Increase 4.00% 4.00%

Impact of: 0.25%increase $ 3,351 $ 785

0.25%decrease (3,453) (825)

Expected Rate of Return on Assets N/A 7.25%

Impact of: 1%increase N/A (3,491)

1%decrease N/A 3,493

Allowance for Doubtful Accounts

A significant portion of the Company’s revenue is earned from selling on credit to individual consumers and business customers. The

allowance for doubtful accounts is calculated by taking into account factors such as the Company’s historical collection and write-off

experience, the number of days the customer is past due, and the status of the customer’s account with respect to whether or not the

customer is continuing to receive service in the case of Wireless and Cable. As a result, fluctuations in the aging of subscriber accounts

will directly impact the reported amount of bad debt expense. For example, events or circumstances that result in a deterioration in the

aging of subscriber accounts will in turn increase the reported amount of bad debt expense. Conversely, as circumstances improve and

customer accounts are adjusted and brought current, the reported bad debt expense will decline.

Asset Retirement Obligations

We are required to record the fair value of the liability for an asset retirement obligation in the year in which it is incurred and when a

reasonable estimate can be made. Fair value is defined as the amount at which that liability could be settled in a current transaction

between willing parties. We review our existing contracts and commitments to determine where such obligations exist and then assess

what the estimated fair value of the obligations would be. In determining the fair value of asset retirement obligations, we must make

estimates of cash flows, discount rates and the probability of occurrence of such liabilities.

NEW ACCOUNTING STANDARDS

In 2004, we adopted the following new accounting standards as a result of changes to Canadian GAAP. Refer to Note 2 to the

Consolidated Financial Statements for recent Canadian accounting pronouncements that will impact us in 2005.

GAAP Hierarchy

In June 2003, the CICA released Handbook Section 1100, “Generally Accepted Accounting Principles”. Previously, there had been no clear

definition of the order of authority for sources of GAAP. This standard was effective January 1, 2004, and established standards for

financial reporting in accordance with Canadian GAAP. This standard also provides guidance on sources to consult when selecting

accounting policies and on appropriate disclosures when a matter is not dealt with explicitly in the primary sources of Canadian GAAP.

We have reviewed this new standard, and as a result have adopted a classified balance sheet presentation since we believe that

the historical industry practice of a declassified balance sheet presentation is no longer appropriate.

In addition, within the Consolidated Statements of Cash Flows, we have reclassified the change in non-cash working capital

items related to PP&E to investing activities. This change had the impact of decreasing cash used in investing activities on the

Consolidated Statements of Cash Flows, compared to our previous method, by $60.0 million in 2004 and increasing cash used in non-

cash working capital and cash flows from operating activities by an offsetting amount. In 2003, cash used in investing activities was

increased by $81.4 million and cash used in non-cash working capital and cash flows from operating activities was decreased.

Revenue Recognition

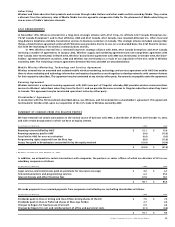

Effective January 1, 2004, we adopted new Canadian accounting standards, including CICA Emerging Issues Committee Abstract 142

issued in December 2003, regarding the timing of revenue recognition and the classification of certain items as revenue or expense.

As a result of the adoption of these new accounting standards, the following changes to the recognition and classification of

revenue and expenses have been made:

• Cable installation fee revenue from both new connects and re-connects is deferred and amortized over the estimated life of the sub-

scriber, which Cable has determined based on churn, transfers of service and moves to be approximately four years. Re-connect

installation costs up to the amount of installation revenue earned from re-connects are also deferred and amortized over the esti-

mated life of the subscriber;

• Wireless activation fees are now classified as equipment revenue. Previously, these amounts were classified as network revenue;

• Recoveries from new and existing subscribers from the sale of equipment are now classified as equipment revenue. Previously, these

amounts were recorded as a reduction to sales expense in the case of a new subscriber, and as a reduction to operating, general and

administrative expense in the case of an existing subscriber;

• Wireless equipment subsidies provided to new and existing subscribers are now classified as a reduction to equipment revenue.

Previously, these amounts were recorded as a sales expense in the case of a new subscriber and as an operating, general and adminis-

trative expense in the case of an existing subscriber. Costs for equipment provided under retention programs to existing subscribers