Rogers 2004 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

Rogers Communications Inc. 2004 Annual Report

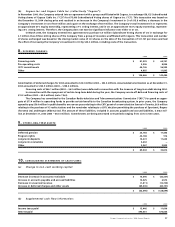

(ii) Convertible Debentures, due 2005:

The Company’s U.S. $224.8 million Convertible Debentures (accreted amount – U.S. $217.5 million) mature on November 26, 2005. A portion

of the interest equal to approximately 2.95% per annum on the issue price (or 2% per annum on the stated amount at maturity) is paid

in cash semi-annually while the balance of the interest will accrue so long as these Convertible Debentures remain outstanding. Each

Convertible Debenture has a face value of U.S. $1,000 and is convertible, at the option of the holder at any time, on or prior to maturity,

into 34.368 Class B Non-Voting shares. The conversion rate, as at December 31, 2004, equates to a conversion price of U.S. $28.15 per share

(2003 – U.S. $27.16 per share). These Convertible Debentures are redeemable in cash, at the option of the Company, at any time. In 2004

and 2003, none of these Convertible Debentures was converted into Class B Non-Voting shares. To date, an aggregate U.S. $0.2 million

at maturity has been converted into 6,528 Class B Non-Voting shares.

(iii) Senior Notes, due 2006:

The Company’s $75.0 million Senior Notes mature on February 14, 2006. Interest on the Senior Notes is paid semi-annually.

The Company’s senior notes and debentures described above are senior unsecured general obligations of the Company ranking equally

with each other.

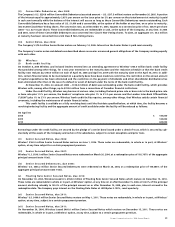

(b) Wireless:

(i) Bank credit facility:

On October 8, 2004 Wireless and its bank lenders entered into an amending agreement to Wireless’ $700.0 million bank credit facility

that provided among other things, for a two year extension to the maturity date and the reduction schedule so that the bank credit

facility now reduces by $140.0 million on each of April 30, 2008 and April 30, 2009 with the maturity date on the April 30, 2010. In addi-

tion, certain financial ratios to be maintained on a quarterly basis have been made less restrictive, the restriction on the annual amount

of capital expenditures has been eliminated and the restriction on the payment of dividends and other shareholder distributions has

been eliminated other than in the case of a default or event of default under the terms of the bank credit facility.

At December 31, 2004, no amount (2003 – $138.0 million) of debt was outstanding under the bank credit facility, which provides

Wireless with, among other things, up to $700.0 million from a consortium of Canadian financial institutions.

Under the credit facility, Wireless may borrow at various rates, including the bank prime rate or base rate to the bank prime rate

or base rate plus 13/4% per annum, the bankers’ acceptance rate plus 1% to 23/4% per annum and the London Inter-Bank Offered Rate

(“LIBOR”) plus 1% to 23/4% per annum. Wireless’ bank credit facility requires, among other things, that Wireless satisfy certain financial

covenants, including the maintenance of certain financial ratios.

This credit facility is available on a fully revolving basis until the first date specified below, at which time, the facility becomes a

revolving/reducing facility and the aggregate amount of credit available under the facility will be reduced as follows:

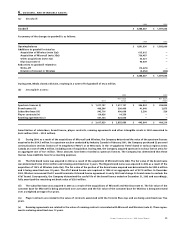

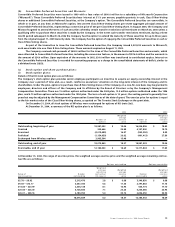

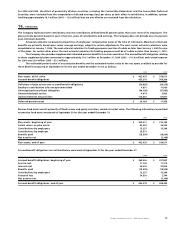

On April 30:

2008 $ 140,000

2009 140,000

2010 420,000

Borrowings under the credit facility are secured by the pledge of a senior bond issued under a deed of trust, which is secured by sub-

stantially all the assets of the Company and certain of its subsidiaries, subject to certain exceptions and prior liens.

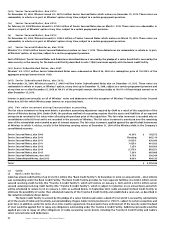

(ii) Senior Secured Notes, due 2006:

Wireless’ $160.0 million Senior Secured Notes mature on June 1, 2006. These notes are redeemable, in whole or in part, at Wireless’

option, at any time subject to a certain prepayment premium.

(iii) Senior Secured Notes, due 2007:

Wireless’ U.S. $196.1 million Senior Secured Notes were redeemed on March 26, 2004, at a redemption price of 102.767% of the aggregate

principal amount (note 11(e)).

(iv) Senior Secured Debentures, due 2008:

Wireless’ U.S. $333.2 million Senior Secured Debentures were redeemed on March 26, 2004, at a redemption price of 104.688% of the

aggregate principal amount (note 11(e)).

(v) Floating Rate Senior Secured Notes, due 2010:

On November 30, 2004, Wireless issued U.S. $550.0 million of Floating Rate Senior Secured Notes which mature on December 15, 2010.

These notes are redeemable in whole or in part, at Wireless’ option, at any time on or after December 15, 2006 at 102.0% of the principal

amount, declining rateably to 100.0% of the principal amount on or after December 15, 2008, plus, in each case, interest accrued to the

redemption date. The Company pays interest on the Floating Rate Notes at LIBOR plus 3.125%, reset quarterly.

(vi) Senior Secured Notes, due 2011:

Wireless’ U.S. $490.0 million Senior Secured Notes mature on May 1, 2011. These notes are redeemable, in whole or in part, at Wireless’

option, at any time, subject to a certain prepayment premium.

(vii) Senior Secured Notes, due 2011:

On November 30, 2004, Wireless issued $460.0 million Senior Secured Notes which mature on December 15, 2011. These notes are

redeemable, in whole or in part, at Wireless’ option, at any time, subject to a certain prepayment premium.