Rogers 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

Rogers Communications Inc. 2004 Annual Report

An Increase in Paper Prices, Printing Costs or Postage Could Adversely Affect Media’s Results of Operations

A significant portion of Publishing’s operating expenses consist of paper, printing and postage expenses. Paper is Publishing’s single

largest raw material expense, representing approximately 6.7% of Publishing’s operating expenses in 2004. Publishing depends upon

outside suppliers for all of its paper supplies, holds relatively small quantities of paper in stock itself, and is unable to control paper

prices, which can fluctuate considerably. Moreover, Publishing is generally unable to pass paper cost increases on to customers.

Printing costs represented approximately 9.3% of Publishing’s operating expenses in 2004. Publishing relies on third parties for all of its

printing services. In addition, Publishing relies on the Canadian Postal Service to distribute a large percentage of its publications.

A material increase in paper prices, printing costs or postage expenses to Publishing could have a material adverse effect on Media’s

business, results of operations or financial condition.

Changes in Regulatory Policies May Adversely Affect Media’s Business

Media expects the CRTC to review the Commercial Radio Policy of 1998, in 2005. In the interim, the CRTC is reviewing applications for

new satellite and terrestrial subscription-based radio services, including the establishment of a satellite radio policy and licencing

framework. The CRTC has released its digital television policy, covering issues such as priority carriage and simultaneous substitution.

Media believes that the CRTC policy provides an effective framework for the growth and development of digital television broadcast-

ing in Canada. CRTC regulatory processes have also been initiated to develop policy frameworks for the licencing and distribution of

high definition pay and specialty services as well as the transition or migration of specialty services from analog to digital.

The cable and telecommunications industries in Canada generally promote the easing or elimination of foreign ownership

restrictions. If successful, the easing or elimination of such ownership restrictions may cause or require integrated communications

companies to establish a separate ownership structure for their broadcasting content entities.

Tariff Increases Could Adversely Affect Media’s Results of Operations

Copyright liability pressures continue to affect radio services. SOCAN and the Neighbouring Rights Collective Society (“NRCC”) have

proposed increases to each of their respective radio tariffs, with the NRCC also seeking to eliminate important revenue threshold and

all-talk station tariff payment exemptions. If fees were to increase, such increases could adversely affect Media’s results of operations.

A decision from the Copyright Board is expected in 2005.

Pressures Regarding Channel Placement Could Negatively Impact the Tier Status of Certain of Media’s Channels

Pressures regarding the favourable channel placement of The Shopping Channel and Sportsnet below the first cable tier will likely

continue to exist. Unfavourable channel placement could negatively affect the results of The Shopping Channel and Sportsnet.

Introduction of New Technology

The deployment of PVRs could influence Media’s capability to generate television advertising revenues as viewers are provided with

the opportunity to ignore advertising aired on the television networks.

Although it is still too early to determine its impact, the emergence of subscriber-based satellite and digital radio products could

change radio audience listening habits and negatively impact the results of Media’s radio stations.

BLUE JAYS

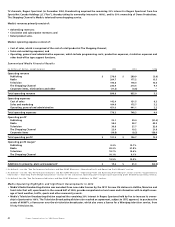

Effective July 31, 2004, due to the redemption and cancellation by the Blue Jays of all of the outstanding preferred voting shares held by

Rogers Telecommunications Limited (“RTL”), a company controlled by our controlling shareholder, we began to consolidate the Blue

Jays’ results. As a result, equity losses of the Blue Jays for the first seven months of 2004 are included in losses from investments accounted

for by the equity method, and the financial results for the remaining five months of 2004 are consolidated with our operations.

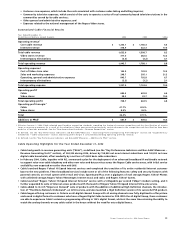

During the five months ended December 31, 2004, the Blue Jays generated revenue of $61.9 million primarily related to baseball

revenue, which comprises home game and concession revenue, and revenue generated from Major League Baseball’s revenue sharing

agreement whereby funds are distributed to and from clubs based on the clubs’ respective revenues.

Operating expenses for the five months ended December 31, 2004 were $68.0 million, which consist primarily of player salaries,

team costs, scouting and stadium operations as well as a non-cash write-off of $15.2 million relating to a lease receivable. As a result, an

operating loss of $6.1 million was recognized for the five months ended December 31, 2004.

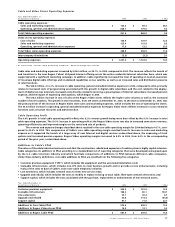

On a pro forma comparative basis, Blue Jays revenue for the 12 months ended December 31, 2004 increased 4.1%, to $136.8 million,

from $131.4 million in the corresponding period of 2003. The operating loss in 2003 of $19.1 million increased to a loss of $21.9 million

in 2004.

On November 29, 2004, the Blue Jays announced an agreement with Sportsco International to acquire Rogers Centre, formerly

SkyDome, for approximately $25 million, subject to closing adjustments. Rogers Centre, the retractable roofed stadium in Toronto,

which seats over 50,000 guests, is the largest entertainment venue in Canada and is the home playing field of the Blue Jays. The acqui-

sition of Rogers Centre was completed on January 31, 2005. Effective January 1, 2005, ownership and management of Rogers’ sports

operations was transferred to Media. As such, beginning in the first quarter of 2005, the results of operations of the Blue Jays and

Rogers Centre will be reported as part of the Media segment.