Rogers 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

Rogers Communications Inc. 2004 Annual Report

are now recorded as a cost of equipment sales. Previously, these amounts were recorded as an operating, general and administrative

expense; and

• Wireless equipment costs for equipment provided under retention programs to existing subscribers are now recorded as cost of

equipment sales. Previously, these amounts were recorded as operating, general and administrative expense.

• Certain other recoveries from subscribers related to collections activities are now classified as network revenue. Previously, these

amounts were recorded as a recovery of operating, general and administrative expenses.

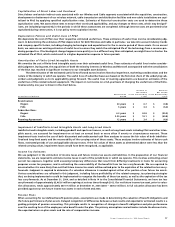

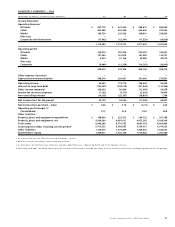

The effect of this adoption on our financial results and on our key performance indicators is as follows:

2004 2003

Prior to After Prior to After

(In millions of dollars) Adoption Adoption Adoption Adoption

Operating Revenue $ 5,639.5 $ 5,608.2 $ 4,847.4 $ 4,791.9

Cost of sales $ 568.6 $ 797.9 $ 505.9 $ 642.2

Sales and marketing expenses 1,082.6 883.6 905.2 742.8

Operating, general and administrative expenses 2,251.3 2,192.6 1,987.3 1,957.9

Operating Profit $ 1,737.0 $ 1,734.1 $ 1,449.0 $ 1,449.0

Net income (loss) $ (10.5) $ (13.2) $ 129.2 $ 129.2

All prior period amounts, including key performance indicators, have been conformed to reflect these changes in classification.

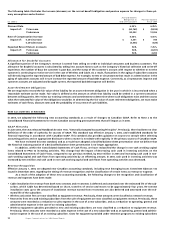

Stock-Based Compensation

Effective January 1, 2004, Canadian GAAP requires us to estimate the fair value of stock-based compensation granted to employees and

to expense the fair value over the vesting period of the stock options. In accordance with the transition rules, we determined the fair

value of options granted to employees since January 1, 2002, using the Black-Scholes Option Pricing Model, and recorded an adjustment

to opening retained earnings in the amount of $7.0 million, representing the expense for the 2002 and 2003 fiscal years. The offset to

retained earnings is an increase in our contributed surplus. For the year ended December 31, 2004, we recognized stock-based compen-

sation expense of approximately $15.1 million.

Accounting for Derivative Instruments

Our cross-currency interest rate exchange agreements (“swaps”) are used to manage the cash flow risks associated with the fluctua-

tions in foreign exchange rates relating to our U.S. dollar-denominated debt. We do not enter into such swaps for speculative purposes.

Prior to January 1, 2004, we accounted for these swaps as hedges of the fluctuations in foreign exchange rates relating to

approximately 67.8% of our U.S. dollar-denominated debt. Under hedge accounting, the foreign exchange gains and losses arising on

the translation of the U.S. dollar-denominated debt at the end of each accounting period was hedged by the equal and offsetting for-

eign exchange gains and losses relating to the swaps that were designated as hedges.

Effective January 1, 2004, we adopted Accounting Guideline 13 (“AcG-13”), “Hedging Relationships”, which established a new

criteria for hedge accounting with application to all hedging relationships in effect on or after January 1, 2004. Effective January 1, 2004,

we re-assessed all our hedging relationships and determined that we would not account for our swaps as hedges for accounting

purposes and consequently began to account for such swaps on a mark-to-market basis, with resulting gains or losses recorded in or

charged against income.

We adjusted the carrying value of these instruments of $338.1 million at December 31, 2003, to the fair value of $385.3 million on

January 1, 2004. The corresponding transitional loss of $47.2 million was deferred and was being amortized to income over the remain-

ing life of the underlying debt instruments.

Effective July 1, 2004, we met the requirements for hedge accounting under AcG-13 for certain of our derivative instruments and,

consequently, on a prospective basis, began to treat approximately US$2,773.4 million notional amount of an aggregate US$2,885.3 million

notional amount, or 96.1% of these exchange agreements, as hedges for accounting purposes on US$2,773.4 million of U.S. dollar-

denominated debt.

A transition adjustment arising on the change from mark-to-market accounting to hedge accounting was therefore calculated as

at July 1, 2004, resulting in a deferred transitional gain of $80.0 million. This transitional gain is being amortized to income over the

shorter of the remaining life of the debt and the term of the exchange agreements. Amortization of the transitional gain from July 1,

2004, to December 31, 2004, totalled $6.5 million.

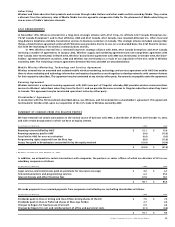

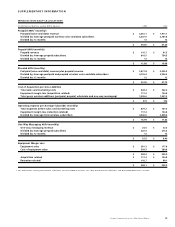

U.S. GAAP DIFFERENCES

We prepare our financial statements in accordance with Canadian GAAP. U.S. GAAP differs from Canadian GAAP in certain respects. The

areas of principal differences and their impact on our Consolidated Financial Statements are outlined below. Refer to Note 23 to the

Consolidated Financial Statements for further details.

The areas of material differences between Canadian and U.S. GAAP and their impact on our consolidated financial statements are as follows:

Gain on sale and issuance of subsidiary shares to non-controlling interest

Under U.S. GAAP, the carrying value of our investment in Wireless would be lower than the carrying value under Canadian GAAP as a

result of certain differences between Canadian and U.S. GAAP, as described herein. This results in an increase to the gain on sale and

dilution under U.S. GAAP.