Rogers 2004 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

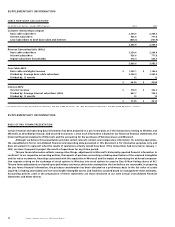

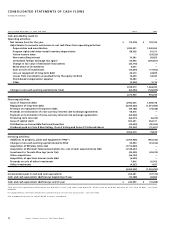

80 Rogers Communications Inc. 2004 Annual Report

Unearned revenue includes subscriber deposits, installation fees and amounts received from subscribers related to services and sub-

scriptions to be provided in future periods.

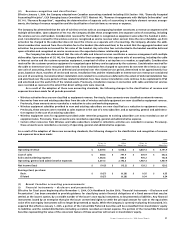

(o) Subscriber acquisition costs:

The Company expenses all costs related to the acquisition or retention of subscribers, except as described in note 2(s)(ii).

(p) Stock-based compensation and other stock-based payments:

Effective January 1, 2004, Canadian GAAP requires the Company to calculate the fair value of stock-based compensation awarded to

employees and to expense the fair value over the vesting period of the stock options. In accordance with the transition rules, the

Company adopted the standard retroactively to January 1, 2002 without restating prior periods. The Company determined the fair

value of stock options granted to employees since January 1, 2002 using the Black-Scholes option pricing model and recorded an adjust-

ment to opening retained earnings in the amount of $7.0 million, representing the expense for the 2003 and 2002 fiscal years, with a

corresponding increase in contributed surplus.

The Company accounts for all stock-based payments to non-employees and employee awards that are direct awards of stock,

call for settlement in cash or other assets, or are stock appreciation rights that call for settlement by the issuance of equity instruments

using the fair value-based method. The estimated fair value is amortized to expense over the vesting period.

Stock-based awards that are settled in cash or may be settled in cash at the option of employees or directors, including restricted

stock units, are recorded as liabilities. The measurement of the liability and compensation cost for these awards is based on the intrin-

sic value of the awards. Compensation cost for the awards is recorded in operating income over the vesting period of the award.

Changes in the Company’s payment obligation prior to the settlement date are recorded in operating income over the vesting period.

The payment amount is established for these awards on the date of exercise of the award by the employee.

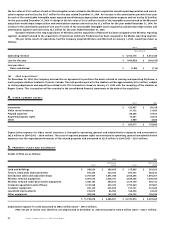

The Company also has an employee share accumulation plan. Under the terms of the plan, participating employees with the

Company can contribute a specified percentage of their regular earnings through regular payroll deductions. The designated adminis-

trator of the plan then purchases Class B Non-Voting shares of the Company on the open market on behalf of the employee. At the end

of each quarter, the Company makes a contribution of 25% of the employee’s contribution in the quarter. The administrator then uses

this amount to purchase additional shares of the Company on behalf of the employee. The Company records its contribution as com-

pensation expense. The share accumulation plan is more fully described in note 13.

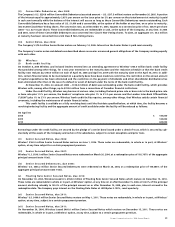

The Company has a directors’ deferred share unit plan, under which directors of the Company are entitled to elect to receive

their remuneration in deferred share units. Upon departure as a director, these deferred share units will be redeemed by the Company

at then current Class B Non-Voting shares’ market price. Compensation expense is recognized in the amount of the directors’ remuner-

ation as their services are rendered. The related accrued liability is adjusted to the market price of the Class B Non-Voting shares at each

balance sheet date and the related adjustment is recorded in operating income. At December 31, 2004, a total of 160,372 (2003 – 109,604)

deferred share units were outstanding. At December 31, 2004, as a result of the acquisition of Wireless, the Company converted 16,517

Wireless deferred share units into 28,905 RCI deferred share units (note 3(a)).

(q) Earnings per share:

The Company uses the treasury stock method for calculating diluted earnings per share. The diluted earnings per share calculation con-

siders the impact of employee stock options and other potentially dilutive instruments, as described in note 15.

(r) Use of estimates:

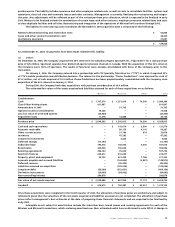

The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of

assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts

of revenue and expenses during the year. Actual results could differ from those estimates.

Key areas of estimation, where management has made difficult, complex or subjective judgments, often as a result of matters

that are inherently uncertain, include the allowance for doubtful accounts, the ability to use income tax loss carryforwards and other

future tax assets, capitalization of internal labour and overhead, useful lives of depreciable assets, discount rates and expected returns

on plan assets affecting pension expense and the pension asset, asset retirement obligations and the recoverability of long-lived

assets, goodwill and intangible assets, which require estimates of future cash flows. For business combinations, key areas of estimation

and judgment include the allocation of the purchase price, related integration and severance costs, as well as the determination of use-

ful lives for amortizable intangible assets acquired including subscriber base, brand names and roaming agreements.

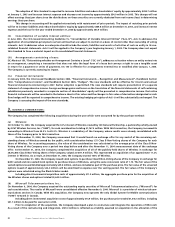

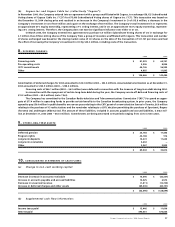

(s) Adoption of new accounting pronouncements:

(i) GAAP hierarchy:

In 2003, the Canadian Institute of Chartered Accountants (“CICA”) released Handbook Section 1100, “Generally Accepted Accounting

Principles”. Previously, there had been no clear definition of the order of authority for sources of GAAP. This standard was effective

January 1, 2004, and established standards for financial reporting in accordance with Canadian GAAP. This standard also provides guid-

ance on sources to consult when selecting accounting policies and appropriate disclosures when a matter is not dealt with explicitly in

the primary sources of GAAP.

The Company has reviewed this new standard and, as a result, has adopted a classified balance sheet presentation since it

believes the historical industry practice of a declassified balance sheet presentation is no longer appropriate.

In addition, within the Company’s consolidated statements of cash flows, it has reclassified the change in non-cash working cap-

ital related to PP&E to investing activities. This change had the impact of decreasing cash used in investing activities on the consolidated

statement of cash flows, compared to the previous method, by $60.0 million (2003 – $81.4 million increase) with a corresponding

decrease (2003 – increase) in cash provided by operating activities.