Rogers 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

Rogers Communications Inc. 2004 Annual Report

• Through its 50% ownership of Dome Productions, a mobile production and distribution business, acquired in January 2004, Media has

worked to increase production and distribution of HDTV content in Canada, resulting in increased HD programming from Sportsnet.

In October 2004, the OMNI channels began broadcasting in HD, with its signals available exclusively via Cable.

• In August 2004, Media’s Publishing division successfully launched LouLou, Canada’s first paid circulation shopping magazine for

young women.

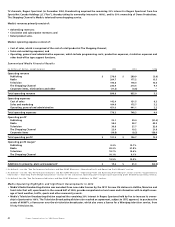

Overview of Media 2004 Financial Results

Total revenue for Media was $899.8 million in 2004, an increase of $44.8 million, or 5.2%, from $855.0 million in 2003. Of the $44.8 million

revenue growth, $27.5 million was generated by Radio, The Shopping Channel contributed $20.4 million of the growth, and Television

contributed $18.8 million. These increases were partially offset by an $11.3 million reduction in revenue at Publishing. The year-over-

year changes for the respective divisions are discussed below. Across all of Media’s divisions, approximately 53.5% of the total 2004

revenue was advertising based, as opposed to subscription or transaction based, essentially unchanged from 53.4% in 2003.

Total Media operating expenses were $778.3 million, up 4.0%, or $30.0 million over 2003. This increase was driven by an increase

in cost of sales of $10.9 million attributable to increased sales at The Shopping Channel, an increase in operating, general and adminis-

trative expenses of $9.9 million, or 2.2%, and an increase in sales and marketing expenses of $9.2 million due to initiatives at Media

focused on building brand recognition and promoting the various properties within its respective target demographics.

Total operating profit was $121.5 million in 2004, a year-over-year increase of 13.9%, or $14.8 million, which was primarily attrib-

utable to the results at the Radio and Television divisions. The year-over-year changes in operating expenses for the respective

divisions are discussed below.

Publishing

Revenue at Publishing was $278.6 million, a reduction of $11.3 million, or 3.9%, from $289.9 million in 2003. Publishing experienced con-

tinued growth in its Women’s group of magazines, including the successful launch of LouLou in August, 2004, which was offset by the

closure of Physicians Financial News (“PFN”) in August 2004, the transfer of Rogers Medical Information Solutions (“RMIS”) to RCI at the

end of the third quarter of 2004 and modest declines in certain of its other groups.

The combination of the closure of PFN, the transfer of RMIS and the continued focus on its cost structure, partially offset by

startup costs associated with the launch of LouLou, enabled Publishing to reduce operating expenses by $5.0 million, or 1.9%, from

$260.5 million in 2004. The decrease in revenue, offset somewhat by the decrease in operating expenses, resulted in operating profit at

Publishing of $23.1 million, a $6.3 million, or 21.4% decrease from 2003. Through 2005, Publishing intends to continue to build LouLou

and all publication revenues while leveraging its reorganized infrastructure and reduced cost structure.

Radio

Radio revenue was $204.7 million, a $27.5 million, or 15.5%, increase from $177.2 million in 2003. The increase in Radio’s revenues over

2003 was primarily attributable to the continued success of the JACKFM format and 680 News and a general upturn in demand for local

advertising over prior year levels.

In addition to the costs associated with several reformatting initiatives, Radio increased spending on sales and marketing by

13.1%, as compared to 2003, in an effort to promote the reformatted stations as well as to reinforce the positioning in the market of

certain stations in key markets in Canada. The result was a 5.9% increase in year-over-year operating expenses at Radio.

With Radio’s revenue growth far outpacing its operating expense growth, operating profit increased by $19.3 million, or 49.9%,

from 2003, to $58.0 million and operating profit margins increased by 650 basis points, to 28.3%.

In 2005, Radio intends to launch the three newly licenced FM stations in the Maritimes, which will provide these communities with

comprehensive local news and information along with in-depth coverage of local weather, traffic, sports and other community events.

Television

Television in general experienced softness with respect to national advertising sales coupled with the impact of the NHL player lockout

and this was reflected in the results of both the Sportsnet and OMNI properties. The $18.8 million increase in Television’s total revenues

over 2003 primarily reflects the acquisition of the 50% interest in Dome Productions.

While the NHL player lockout was a significant contributor to lower advertising sales at Sportsnet, it also led to a significant

reduction in programming and production costs as a result of games not being produced or aired. The reduction in costs associated

with the NHL player lockout was more than offset by increased operating costs from the newly acquired interest in Dome Productions,

resulting in the $9.7 million increase in Television’s operating expenses from 2003 levels. Revenue growth surpassed the increase in

operating costs, resulting in a $9.1 million increase in Television’s operating profit, compared to 2003.

In 2005, the Television division intends to focus on continuing to grow both the Sportsnet and OMNI properties, and will look to

complete the acquisition of and then integrate NOWTV, a Vancouver over-the-air television broadcaster, pending regulatory approval

of the transaction.

The Shopping Channel

The Shopping Channel’s revenue increased by $20.4 million, or 9.7%, to $230.9 million, from $210.5 million in 2003, driven by increases in

Health and Beauty and Jewellery product categories. In 2004, off-air sales represented 27.5% of revenue, up from 26.8% in 2003, which

included catalogue, website and physical store sales.

Operating profit at The Shopping Channel was $23.4 million, a $4.2 million, or 21.9%, increase from $19.2 million in 2003. Results

at The Shopping Channel in 2004 reflected a generally improved retail climate over that experienced during 2003, which was impacted

by such factors as the SARS outbreak, combined with a continued focus on reducing product return rates, driving operating efficiencies

from our national distribution centre and favourable purchasing power enabled by improved Canadian dollar exchange rates.

In 2005, The Shopping Channel intends to grow the selection of unique product offerings and various sales channels that have

made it one of Canada’s largest retailers while at the same time looking to reduce costs through further operating efficiencies.