Rogers 2004 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

Rogers Communications Inc. 2004 Annual Report

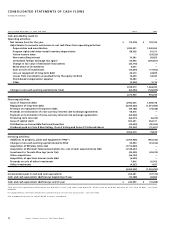

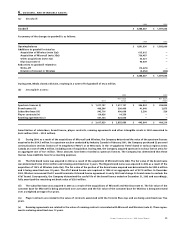

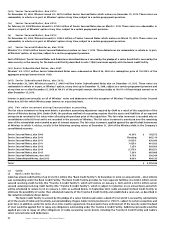

6. GOODWILL AND INTANGIBLE ASSETS:

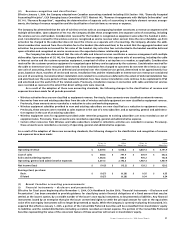

(a) Goodwill:

2004 2003

Goodwill $ 3,388,687 $ 1,891,636

A summary of the changes to goodwill is as follows:

2004 2003

Opening balance $ 1,891,636 $ 1,892,060

Additions to goodwill related to:

Acquisition of Wireless (note 3(a)) 615,615 –

Acquisition of Microcell (note 3(b)) 750,487 –

Other acquisitions (note 3(c)) 53,021 –

Blue Jays (note 7) 95,509 –

Reductions to goodwill related to:

Write-off (12,225) –

Dilution of interest in Wireless (5,356) (424)

$ 3,388,687 $ 1,891,636

During 2004, Media closed a division, resulting in a write-off of goodwill of $12.2 million.

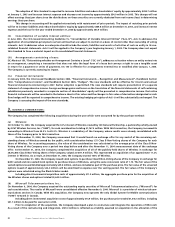

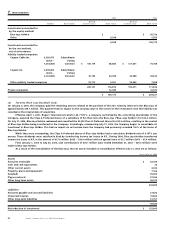

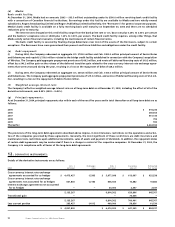

(b) Intangible assets:

2004 2003

Net book Net book

Cost value Cost value

Spectrum licences (i) $ 1,017,157 $ 1,017,157 $ 396,824 $ 396,824

Brand names (ii) 406,396 399,469 41,640 2,875

Subscriber base (iii) 942,716 900,068 5,200 520

Player contracts (iv) 119,926 14,339 – –

Roaming agreements (v) 531,734 524,656 – –

$ 3,017,929 $ 2,855,689 $ 443,664 $ 400,219

Amortization of subscribers, brand licence, player contracts, roaming agreements and other intangible assets in 2004 amounted to

$64.3 million (2003 – $23.5 million).

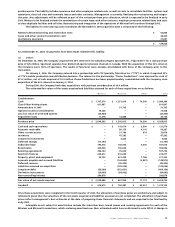

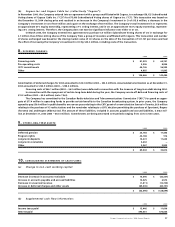

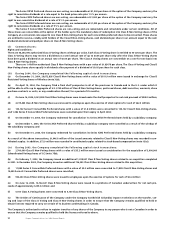

(i) During 2004, as a result of the acquisitions of Microcell and Wireless, the Company determined the value of the spectrum licences

acquired to be $614.3 million. In a spectrum auction conducted by Industry Canada in February 2001, the Company purchased 23 personal

communications services licences of 10 megahertz (“MHz”) or 20 MHz each, in the 1.9 gigahertz (“GHz”) band in various regions across

Canada at a cost of $396.8 million, including costs of acquisition. During 2004, the Company acquired spectrum in various licence areas for

an aggregate cost of $6.1 million. These amounts have been recorded as spectrum licences. The Company has determined that these

licences have indefinite lives for accounting purposes.

(ii) The Fido brand name was acquired in 2004 as a result of the acquisition of Microcell (note 3(b)). The fair value of the brand name

was determined to be $100.0 million and is being amortized over 5 years. The Rogers brand name was acquired in 2004 as a result of the

acquisition of 100% of Wireless (note 3(a)). The fair value of the portion of the brand name acquired was determined to be $302.6 million

and is being amortized over 20 years. The AT&T brand licence was acquired in 1996 at an aggregate cost of $37.8 million. In December

2003, Wireless announced that it would terminate its brand licence agreement in early 2004 and change its brand name to exclude the

AT&T brand. Consequently, the Company determined the useful life of the brand licence ended on December 31, 2003 and accordingly,

fully amortized the remaining net book value of $20.0 million.

(iii) The subscriber base was acquired in 2004 as a result of the acquisitions of Microcell and Wireless (note 3). The fair value of the

customer base for Microcell is being amortized over 2.25 years and the fair value of the customer base for Wireless is being amortized

over a weighted average of 4.3 years.

(iv) Player contracts are related to the value of contracts associated with the Toronto Blue Jays and are being amortized over five

years.

(v) Roaming agreements are related to the value of roaming contracts associated with Microcell and Wireless (note 3). These agree-

ments are being amortized over 12 years.