Rogers 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 Rogers Communications Inc. 2004 Annual Report

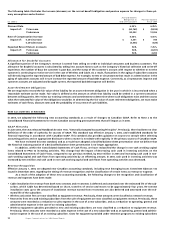

OFF-BALANCE SHEET ARRANGEMENTS

Guarantees

As a regular part of our business, we enter into agreements that provide for indemnification and guarantees to counterparties in trans-

actions involving business sale and business combination agreements, sales of services and purchases and development of assets. Due

to the nature of these indemnifications, we are unable to make a reasonable estimate of the maximum potential amount we could be

required to pay counterparties. Historically, we have not made any significant payment under these indemnifications or guarantees.

Refer to Note 21 to the Consolidated Financial Statements.

Derivative Instruments

As previously discussed, we use derivative instruments to manage our exposure to interest rate and foreign currency risks. We do not

use derivative instruments for speculative purposes.

Operating Leases

We have entered into operating leases for the rental of premises, distribution facilities, equipment and microwave towers and other

contracts. The effect of terminating any one lease agreement would not have an adverse effect on the company as a whole. Refer to

“Contractual Obligations” above and Note 20 to the Consolidated Financial Statements.

ACCOUNTING POLICIES AND NON-GAAP MEASURES

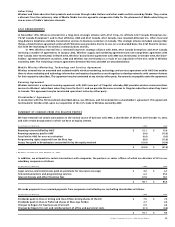

KEY PERFORMANCE INDICATORS AND NON-GAAP MEASURES

We measure the success of our strategies using a number of key performance indicators, which are outlined below. The following key

performance indicators are not measurements in accordance with Canadian or U.S. GAAP and should not be considered as an alternative

to net income or any other measure of performance under Canadian or U.S. GAAP.

Subscriber Counts

We determine the number of subscribers to our services based on active subscribers. A wireless subscriber is, generally, represented by

each identifiable telephone number. A cable subscriber is represented by a dwelling unit. In the case of multiple units in one dwelling,

such as an apartment building, each tenant with cable service, whether invoiced individually or having services included in his or her

rent, is counted as one subscriber. Commercial or institutional units, such as hospitals or hotels, are each considered to be one sub-

scriber. When subscribers are deactivated, either voluntarily or involuntarily for non-payment, they are considered to be deactivations

in the period the services are discontinued. Wireless prepaid subscribers are considered active for a period of 180 days from the date of

their last revenue-generating usage.

Effective at the beginning of the fourth quarter of 2004, wholesale subscribers are reported separately under “wholesale”.

Accordingly, approximately 43,600 Wireless wholesale subscribers were reclassified from the postpaid subscriber base to the “whole-

sale” category. We now report subscribers in four categories: postpaid, prepaid, one-way messaging and wholesale. Postpaid includes

voice-only and data-only subscribers, as well as subscribers with service plans integrating both voice and data.

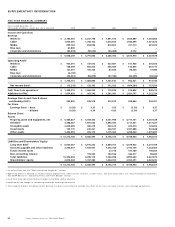

Customer Relationships

Customer relationships, a term used in the Cable segment, is based on active subscribers to basic service plus subscribers who take

Internet service but which do not subscribe to basic cable service. Refer to “Supplementary Information – Cable Non-GAAP Calculations”

for further details on this calculation.

Revenue Generating Units (“RGUs”)

Revenue generating units, a term used in the Cable segment, is based on the aggregate of the active subscribers to basic cable and

Internet services and active households to digital service. Refer to “Supplementary Information – Cable Non-GAAP Calculations” for

further details on this calculation.

Subscriber Churn

Subscriber churn is calculated on a monthly basis. For any particular month, subscriber churn for Cable or Wireless represents the number

of subscribers deactivating in the month divided by the aggregate number of subscribers at the beginning of the month. When used or

reported for a period greater than one month, subscriber churn represents the monthly average of the subscriber churn for the period.

Network Revenue

Network revenue is used in the Wireless segment and represents total Wireless revenue less revenue received from the sale of handset

equipment. The sale of such equipment does not materially affect our operating income as we generally sell equipment to our distribu-

tors at a price approximating our cost to facilitate competitive pricing at the retail level. Accordingly, we believe that network revenue

is a more relevant measure for Wireless’ ability to increase its operating profit, as defined below.

Average Revenue Per User

The average revenue per user (“ARPU”) is calculated on a monthly basis. For any particular month, ARPU represents monthly revenue

divided by the average number of subscribers during the month. In the case of Wireless, ARPU represents monthly network revenue

divided by the average number of subscribers during the month. ARPU, when used in connection with a particular type of subscriber,

represents monthly revenue generated from those subscribers divided by the average number of those subscribers during the month.