Rogers 2004 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

Rogers Communications Inc. 2004 Annual Report

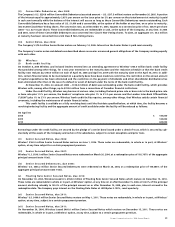

(b) Cogeco Inc. and Cogeco Cable Inc. (collectively “Cogeco”):

In November 2004, the Company entered into an agreement with a group unaffiliated with Cogeco, to exchange 658,125 Subordinated

Voting shares of Cogeco Cable Inc. (“CCI”) for 675,000 Subordinated Voting shares of Cogeco Inc. (“CI”). This transaction was based on

the December 13, 2004 closing price and resulted in an increase in the Company’s investment in CI of $15.8 million, a decrease in the

Company’s investment in CCI of $6.9 million and a gain on the exchange of $8.9 million. The Company’s total investment in CI represents

an approximate 21% equity ownership, representing a 7% voting interest, and in CCI an approximate 16.5% equity ownership, represent-

ing a 4% voting interest. Therefore, the Company does not exercise significant influence over either CI or CCI.

In March 2003, the Company entered into agreements to purchase 3.0 million Subordinate Voting shares of CCI in exchange for

2.7 million Class B Non-Voting shares of the Company from a group of investors unaffiliated with Cogeco. This transaction and number

of shares exchanged was based on the closing market value of CCI shares on the date of the transaction of $11.727 per share and had

the effect of increasing the Company’s investment in CCI by $35.3 million, including costs of the transaction.

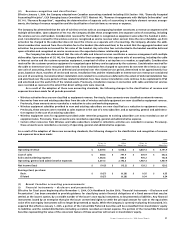

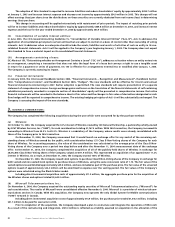

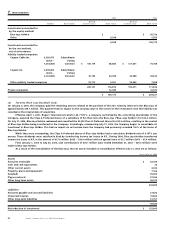

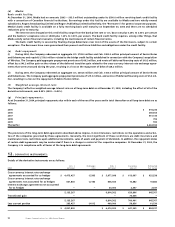

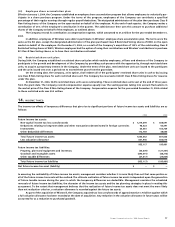

8. DEFERRED CHARGES:

2004 2003

Financing costs $ 81,229 $ 64,741

Pre-operating costs 3,506 8,854

CRTC commitments 44,746 56,992

Other 4,985 11,893

$ 134,466 $ 142,480

Amortization of deferred charges for 2004 amounted to $35.3 million (2003 – $42.4 million). Accumulated amortization as at December 31,

2004 amounted to $123.9 million (2003 – $138.3 million).

Financing costs of $66.1 million (2003 – $6.2 million) were deferred in connection with the issuance of long-term debt during 2004.

In connection with the repayment of certain long-term debt during the year, the Company wrote-off deferred financing costs of

$19.2 million (2003 – $5.5 million) (note 11(e)).

The Company has committed to the Canadian Radio-television and Telecommunications Commission (“CRTC”) to spend an aggre-

gate of $77.4 million in operating funds to provide certain benefits to the Canadian broadcasting system. In prior years, the Company

agreed to pay $50.0 million in public benefits over seven years relating to the CRTC grant of a new television licence in Toronto, $6.0 million

relating to the purchase of 13 radio stations and the remainder relating to a CRTC decision permitting the purchase of Sportsnet, Rogers

(Toronto) Ltd. and Rogers (Alberta) Ltd. The amount of these liabilities, included in accounts payable and accrued liabilities, is $48.3 mil-

lion at December 31, 2004 (2003 – $63.5 million). Commitments are being amortized over periods ranging from six to seven years.

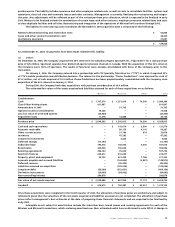

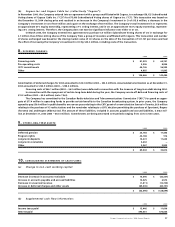

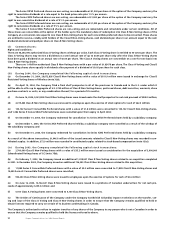

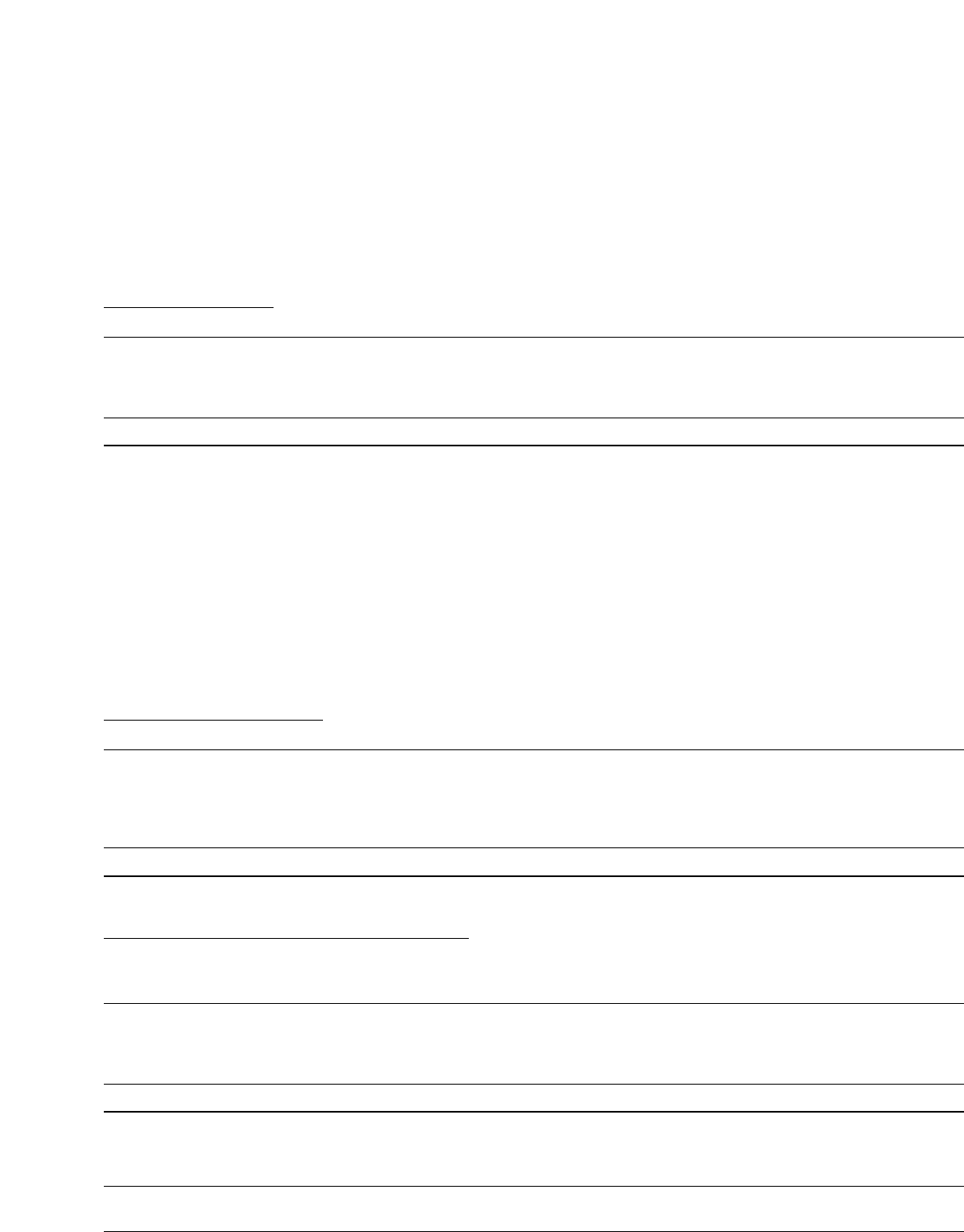

9. OTHER LONG-TERM ASSETS:

2004 2003

Deferred pension $ 24,184 $ 17,456

Program rights 45,188 916

Long-term deposits 14,072 11,635

Long-term receivables 3,632 –

Other 2,367 2,805

$ 89,443 $ 32,812

10. CONSOLIDATED STATEMENTS OF CASH FLOWS:

(a) Change in non-cash working capital:

2004 2003

Decrease (increase) in accounts receivable $ 15,496 $ (42,337)

Increase in accounts payable and accrued liabilities 13,525 6,572

Decrease in unearned revenue (1,811) (12,743)

Increase in deferred charges and other assets (89,300) (80,191)

$ (62,090) $ (128,699)

(b) Supplemental cash flow information:

2004 2003

Income taxes paid $ 13,446 $ 11,606

Interest paid 490,061 474,044