Rogers 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 Rogers Communications Inc. 2004 Annual Report

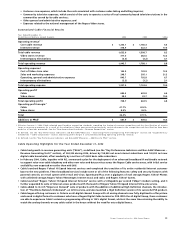

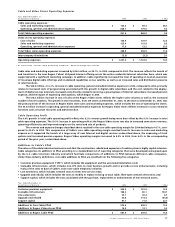

The 15.4% year-over-year increase in additions to PP&E was primarily attributable to spending on scaleable infrastructure which

increased by $107.9 million, of which $93.4 million was related to spending on the voice-over-cable telephony initiative; an increase in

customer premises equipment of $22.4 million related to growth in the number of digital terminals purchased and an increase within

that mix towards higher priced PVR and HDTV digital terminals; and an increase in support capital of $16.1 million, a portion of which

relates to Cable’s voice-over-cable telephony initiative. These increases were offset by reduced spending on upgrades and rebuild of

$73.6 million. In total, approximately $106.1 million was spent during 2004 on the voice-over-cable telephony initiative.

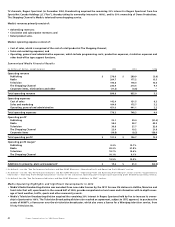

Cable Employees

Remuneration represents a material portion of Cable’s expenses. At December 31, 2004, Cable had approximately 5,920 full-time

equivalent employees, 2,640 of which were employed by Rogers Video, an increase of 450 employees from the approximate 5,470 at

December 31, 2003. The increase in employees is attributable to the growth at the Rogers Video stores and the need to service a growing

base of digital and Internet subscribers. Total remuneration paid to employees (both full- and part-time) in 2004 was approximately

$259.1 million, an increase of 9.5% from $236.6 million from 2003.

CABLE RISKS AND UNCERTAINTIES

Cable’s business is subject to risks and uncertainties that could result in a material adverse effect on its business and financial results as

outlined below.

Cable May Fail to Achieve Expected Revenue Growth From New and Advanced Cable Products and Services

Cable expects that a substantial portion of its future growth will be achieved from new and advanced cable, Internet, voice-over-cable

telephony and other IP products and services. Accordingly, it has invested and continues to invest significant capital resources in the

development of a technologically advanced cable network in order to support a wide variety of advanced cable products and services,

and have invested and continue to invest significant resources in the development of new services to be provided over the network.

However, consumers may not provide sufficient demand for the enhanced cable products and services that are offered. In addition, any

initiatives to increase prices for Cable’s services may result in increased churn of Cable’s subscribers and a reduction in the total number

of subscribers. Alternatively, Cable may fail to anticipate demand for certain products and services, or may not be able to offer or

market these new products and services successfully to subscribers. Cable’s failure to retain existing subscribers while increasing pricing

or attract subscribers to new products and services, or failure to keep pace with changing consumer preferences for cable products

and services, could slow revenue growth and have a material adverse effect on their business and financial condition. In addition, its

discounted bundled product and service offerings may fail to reduce churn and may have an adverse impact on its financial results.

Cable Plans to Invest Substantial Resources in Connection With its Voice-Over-Cable Telephony Services, and it

May Not Recover All or Any of its Investment

In connection with the offering of voice-over-cable telephony services, Cable anticipates that it will initially invest approximately

$200 million prior to commercial launch in mid-2005, with approximately $106 million of the investment having already occurred during

2004. Once this initial platform is deployed, the additional variable additions to PP&E associated with adding each voice-over-cable tele-

phony service subscriber, which includes uninterruptible back-up powering at the home, is expected to be in the range of $300 to $340

per subscriber addition. Cable does not expect to generate significant revenue from this investment during the next few years. It also

cannot predict whether its voice-over-cable-telephony services will be accepted by its customers or whether its voice-over-cable tele-

phony services will be competitive, from a quality and price perspective, with other telephony services that are and will be available to

its customers. In addition, in deciding to invest in voice-over-cable telephony services, Cable has assumed that Incumbent Local

Exchange Carriers (“ILECs”) will continue to be regulated for voice services and that effective safeguards will be maintained to restrict

the ILECs’ ability to offer these services in an anti-competitive manner. Cable also has assumed that no material access obligations or

other new restrictions will be placed on them. If these assumptions prove to be incorrect, Cable may not recover any or all of its invest-

ment in voice-over-cable telephony services, which could have a material adverse effect on its business and financial condition.

Cable Faces Substantial Competition

Technological, regulatory and public policy trends have resulted in a more competitive environment for cable television service

providers, Internet Service Providers (“ISPs”) and video sales and rental services in Canada. Cable faces competition from entities utiliz-

ing other communications technologies and may face competition from other technologies being developed or to be developed in the

future. The ability to attract and retain customers is also highly dependent on the quality and reliability of service provided, as well as

execution of business processes in relation to services provided by competitors. Competitors of Cable include direct-to-home (“DTH”),

satellite providers and other distributors of multi-channel television signals to homes for a fee, including “grey market” satellite

service providers, which are U.S. direct broadcast satellite (“DBS”), providers whose signals are not sold but can be acquired in Canada,

terrestrially-based video service providers, microwave multi-point distribution system (“MMDS”), operators, satellite master antennae

television systems (“SMATVs”), and over-air television broadcasters. Other competitors of the cable television business are providers of

“black market” pirate systems to Canadian customers that enable customers to take, without paying a fee, programming services from

U.S. and Canadian satellite providers by defeating the conditional access technology of the systems preventing unauthorized access.

Competitors of the Internet business include other ISPs offering competing residential and commercial Internet access services.

Competitors of the DVD, videocassette and video game sales and rental business include other video rental and retail outlets, as well as

alternative entertainment media, such as theatres, sporting events, PPV services and broadcasting services, as well as competition from

VOD and SVOD services introduced by cable television providers, legal and illegal methods of accessing entertainment online and

online-based subscription rental services. Any of these factors could reduce our market share or decrease our revenue.