Rogers 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

Rogers Communications Inc. 2004 Annual Report

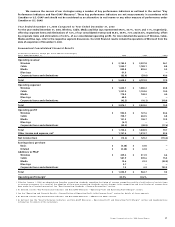

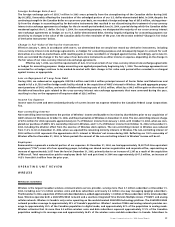

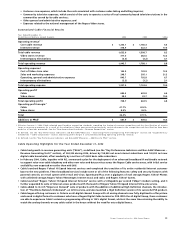

Network Revenue and Subscribers

Years Ended December 31,

(Subscriber statistics in thousands, except ARPU, churn and usage) 2004 2003 %Chg

Postpaid (Voice and Data)1

Gross additions21,161.5 1,021.5 13.7

Net additions2, 3 446.1 400.2 11.5

Acquisition of Microcell subscribers4752.0 – –

Total postpaid retail subscribers34,184.1 3,029.6 38.1

Average monthly revenue per user (“ARPU”)5, 8 $ 59.50 $ 57.25 3.9

Average monthly usage (minutes) 395 361 9.4

Churn31.81% 1.88% (3.7)

Prepaid

Gross additions2319.0 257.4 23.9

Net additions (losses)2, 6 32.5 2.0 –

Acquisition of Microcell subscribers4541.8 – –

Adjustment to subscriber base7– (20.9) –

Total prepaid retail subscribers 1,334.1 759.8 75.6

ARPU8$ 11.88 $ 10.08 17.9

Churn62.94% 2.82% 4.3

Total – Postpaid and Prepaid1

Gross additions21,480.5 1,278.9 15.8

Net additions2478.6 402.2 19.0

Acquisition of Microcell subscribers41,293.8 – –

Adjustment to subscriber base7– (20.9) –

Total retail subscribers35,518.2 3,789.4 45.6

ARPU blended5, 8 $ 50.08 $ 47.19 6.1

One-Way Messaging

Gross additions 29.0 42.5 (31.7)

Net losses (45.2) (61.1) (26.0)

Total subscribers 196.1 241.3 (18.7)

ARPU8$ 9.25 $ 8.40 10.1

Churn 2.78% 3.13% (11.2)

Wholesale subscribers191.2

1 Effective at the beginning of fourth quarter 2004, on a prospective basis, wholesale subscribers are reported separately under the “wholesale” category.

Accordingly, approximately 43,600 wholesale subscribers were reclassified from the postpaid subscriber base to the “wholesale” category.

2 Subscriber activity includes Microcell beginning November 9, 2004.

3 Effective December 1, 2004, voluntarily deactivating subscribers are required to continue billing and service for 30 days from the date termination is

requested, consistent with the subscriber agreement terms and conditions, resulting in approximately 15,900 additional net postpaid subscribers being

included in the year. This had the impact of reducing postpaid churn by 0.04% for the year.

4 Microcell subscriber base upon acquisition effective on November 9, 2004.

5 Effective January 1, 2004, Wireless adopted new Canadian accounting standards regarding the classification of certain items as revenue or expense. As a

result of the adoption of these new accounting standards, certain changes to the recognition and classification have been made for all periods presented.

See the “New Accounting Standards – Revenue Recognition” section.

6 Effective November 9, 2004, the deactivation of prepaid subscribers acquired from Microcell is recognized after 180 days of no usage to conform to the

Wireless prepaid churn definition, impacting approximately 44,000 prepaid subscribers. This had the impact of reducing prepaid churn by 0.45% for the year.

7 In 2003, Wireless determined that subscribers who had only non-revenue usage should not have been included in the prepaid subscriber base and, as such,

made an adjustment to the second quarter of 2003 opening prepaid subscriber base.

8 As defined. See the “Key Performance Indicators and Non-GAAP Measures – Average Revenue Per User” section.

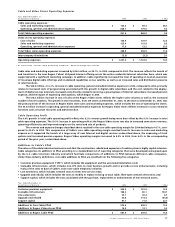

Wireless Network Revenue

Network revenue of $2,502.3 million accounted for 89.9% of Wireless’ total revenues in 2004, and increased 23.3% from 2003. This

growth reflects the 45.6% increase in the number of wireless voice and data subscribers from 2003 combined with a 6.1% year-over-year

increase in blended postpaid and prepaid ARPU. These figures include the results of Microcell from November 9, 2004.

Postpaid voice and data gross subscriber additions in 2004 represented 78.5% of total gross activations and over 93.2% of

Wireless’ total net additions. Wireless has continued its strategy of targeting higher-value postpaid subscribers and selling prepaid

handsets at higher price points, which has contributed to the significantly heavier mix of postpaid versus prepaid subscribers.

The 3.9% year-over-year increase in postpaid ARPU to $59.50 in 2004 reflects the continued growth of wireless data and roaming

revenues and an increase in the penetration of optional services. With the continued increase in the portion of its customer base using

GSM handsets, Wireless has experienced significant increases in roaming revenues from its subscribers traveling outside of Canada,

as well as strong growth in roaming revenues from visitors to Canada utilizing the GSM network. The 108.5% growth in data revenues,

from $67.9 million in 2003 to $141.6 million in 2004, represented approximately 68.4% of the $2.25 increase in postpaid ARPU.

Prepaid ARPU increased to $11.88 in 2004, compared to $10.08 in 2003, as a result of changes to pricing introduced in 2003

together with higher usage per subscriber and the impact of the acquisition of the higher ARPU Microcell prepaid subscriber base.

Wireless’ postpaid voice and data subscriber churn rate of 1.81% in 2004 improved from 1.88% in 2003 and reflects the continued

emphasis on longer-term customer contracts and focused subscriber retention efforts. During 2004, Wireless experienced increased

levels of customers being deactivated for non-payment. As a result, Wireless implemented more restrictive credit requirements during

the fourth quarter of 2004. The increase in prepaid churn to 2.94% in 2004 from 2.82% in the prior year period reflects the minimal sales