Rogers 2004 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 Rogers Communications Inc. 2004 Annual Report

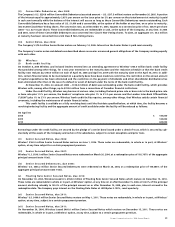

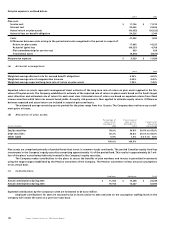

(d) Media:

Bank credit facility:

At December 31, 2004, Media had no amounts (2003 – $63.5 million) outstanding under its $500.0 million revolving bank credit facility

with a consortium of Canadian financial institutions. Borrowings under this facility are available to Media and two wholly-owned

subsidiaries, Rogers Broadcasting Limited and Rogers Publishing Limited (collectively, the “Borrowers”) for general corporate purposes.

Media’s bank credit facility is available on a fully revolving basis until maturity on September 30, 2006 and there are no scheduled

reductions prior to maturity.

The interest rates charged on this credit facility range from the bank prime rate or U.S. base rate plus 0.25% to 2.50% per annum

and the bankers’ acceptance rate or LIBOR plus 1.25% to 3.50% per annum. The bank credit facility requires, among other things, that

Media satisfy certain financial covenants, including the maintenance of certain financial ratios.

The bank credit facility is secured by floating charge debentures over most of the assets of the Borrowers, subject to certain

exceptions. The Borrowers have cross-guaranteed their present and future liabilities and obligations under the credit facility.

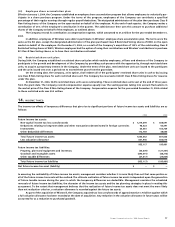

(e) Debt repayment:

(i) During 2004, the Company redeemed an aggregate U.S. $708.4 million and Cdn. $300.0 million principal amount of Senior Notes

and Debentures and repaid $1,750.0 million related to the bridge credit facility established in connection with the Company’s acquisition

of Wireless. The Company paid aggregate prepayment premiums of $49.2 million, and wrote off deferred financing costs of $19.2 million,

offset by a $40.2 million gain on the release of the deferred transition gain related to the cross-currency interest rate exchange agree-

ments that were unwound during the year, resulting in a loss on the repayment of debt of $28.2 million.

(ii) During 2003, the Company redeemed an aggregate U.S. $334.8 million and Cdn. $165.0 million principal amount of Senior Notes

and Debentures. The Company paid aggregate prepayment premiums of $19.3 million, and wrote off deferred financing costs of $5.5 mil-

lion, resulting in a loss on the repayment of debt of $24.8 million.

(f) Weighted average interest rate:

The Company’s effective weighted average interest rate on all long-term debt as at December 31, 2004, including the effect of all of the

derivative instruments, was 8.05% (2003 – 8.48%).

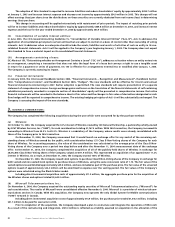

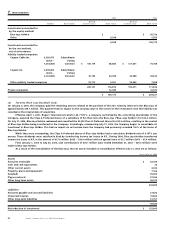

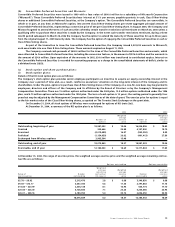

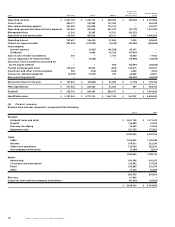

(g) Principal repayments:

As at December 31, 2004, principal repayments due within each of the next five years and in total thereafter on all long-term debt are as

follows:

2005 $ 618,236

2006 260,553

2007 451,135

2008 706

2009 590

Thereafter 6,663,934

The provisions of the long-term debt agreements described above impose, in most instances, restrictions on the operations and activi-

ties of the companies governed by these agreements. Generally, the most significant of these restrictions are debt incurrence and

maintenance tests, restrictions upon additional investments, sales of assets and payment of dividends. In addition, the repayment dates

of certain debt agreements may be accelerated if there is a change in control of the respective companies. At December 31, 2004, the

Company is in compliance with all terms of the long-term debt agreements.

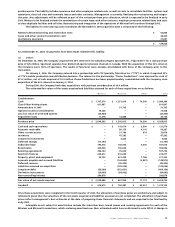

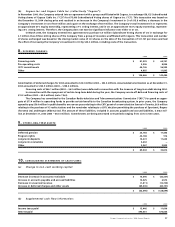

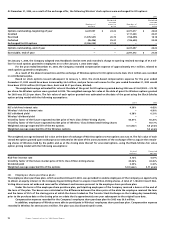

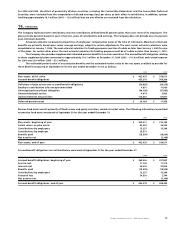

12. DERIVATIVE INSTRUMENTS:

Details of the derivative instruments are as follows:

U.S. $ Exchange Cdn. $ Carrying Estimated

2004 notional rate notional amount fair value

Cross-currency interest rate exchange

agreements accounted for as hedges $ 4,473,437 1.3363 $ 5,977,998 $ 613,667 $ 932,538

Cross-currency interest rate exchange

agreements not accounted for as hedges 661,830 1.2183 806,304 10,882 10,882

Interest exchange agreements not accounted

for as hedges – – 30,000 2,347 2,347

5,135,267 6,814,302 626,896 945,767

Transitional gain – – 73,505 –

5,135,267 6,814,302 700,401 945,767

Less current portion 283,437 1.4112 400,000 58,856 61,530

$ 4,851,830 $ 6,414,302 $ 641,545 $ 884,237