Rogers 2004 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98 Rogers Communications Inc. 2004 Annual Report

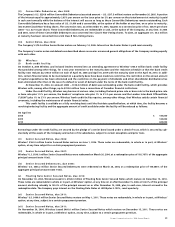

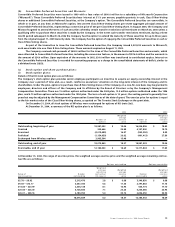

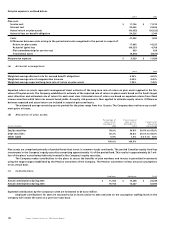

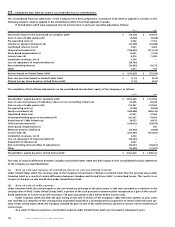

Total income tax expense (reduction) varies from the amounts that would be computed by applying the statutory income tax rate to

income before income taxes for the following reasons:

2004 2003

Statutory income tax rate 35.3% 36.6%

Income tax expense on income before income taxes and non-controlling interest $ 24,643 $ 60,302

Increase (decrease) in income taxes resulting from:

Change in the valuation allowance for future income tax assets (25,089) 46,267

Adjustments to future income tax assets and liabilities for changes in substantively enacted rates (920) (70,502)

Non-taxable portion of capital gains (2,391) (9,610)

Non-deductible (non-taxable) foreign exchange on debt and other items 2,491 (46,954)

Recovery of prior years’ income taxes (6,660) (9,206)

Non-deductible portion of losses from investments accounted for by the equity method 3,715 10,514

Other items (2,563) (14,549)

Large Corporations Tax 10,221 10,881

Income tax expense (reduction) $ 3,447 $ (22,857)

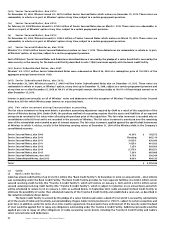

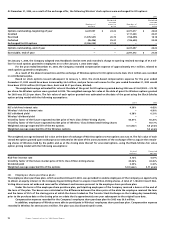

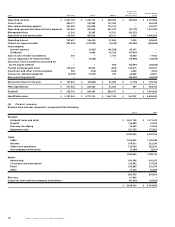

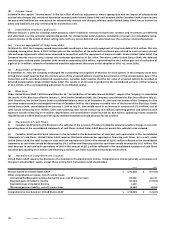

As at December 31, 2004, the Company has the following non-capital income tax losses available to reduce future years’ income for

income tax purposes:

Income tax losses expiring in the year ending December 31:

2005 $ 419,034

2006 316,932

2007 649,487

2008 998,161

2009 219,965

2010 159,654

2011 675,392

2012 25,000

$ 3,463,625

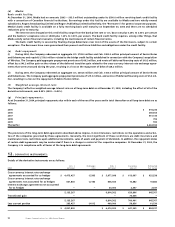

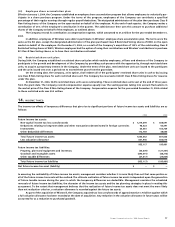

15. EARNINGS (LOSS) PER SHARE:

The following table sets forth the calculation of basic and diluted earnings (loss) per share:

2004 2003

Numerator:

Net income (loss) for the year $ (13,218) $ 129,193

Distribution on Convertible Preferred

Securities, net of income taxes (33,000) (29,791)

Dividends accreted on Convertible Preferred Securities (20,924) (20,033)

Dividends on Series E Preferred shares – (11)

Basic earnings (loss) for the year (67,142) 79,358

Effect of dilutive securities:

Dividends on Series E Preferred shares –11

Diluted earnings (loss) for the year $ (67,142) $ 79,369

Denominator (in thousands):

Weighted average number of shares outstanding – basic 240,435 225,918

Effect of dilutive securities:

Employee stock options – 3,565

Series E Preferred shares – 126

Other – 825

Weighted average number of shares outstanding – diluted 240,435 230,434

Earnings (loss) per share:

Basic $ (0.28) $ 0.35

Diluted (0.28) 0.34