Rogers 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 Rogers Communications Inc. 2004 Annual Report

• system access fees, and

• roaming charges;

• prepaid revenues generated principally from charges for airtime, long distance and text messaging;

• one-way messaging (paging) revenues generated from monthly fees and usage charges; and

• equipment revenue generated from the sale of hardware and accessories to independent dealers, agents and retailers, and directly

to new and existing subscribers through direct fulfillment by its customer service groups, Rogers.com ebusiness website and telesales.

Equipment revenue includes activation fees. Equipment subsidies and other incentives related to the activation of new subscribers

or the retention of existing subscribers are recorded as a reduction to equipment revenue.

Wireless’ operating expenses are segregated into three categories for assessing business performance:

• cost of equipment sales;

• sales and marketing expenses, which represent all costs to acquire new subscribers (other than those related to equipment), such as

advertising, commissions paid to third parties for new activations, remuneration and benefits to sales and marketing employees as

well as direct overheads related to these activities; and

• operating, general and administrative expenses, which include all other expenses incurred to operate the business on a day-to-day

basis and to service existing subscriber relationships, including retention costs (other than those related to equipment), inter-carrier

payments to roaming partners and long-distance carriers, and the CRTC contribution levy.

The information provided in the tables below includes the operations of Microcell from the date of acquisition of November 9, 2004.

Schedules of 2003 and 2004 pro forma financial and statistical data, presented as if the acquisition of Microcell had occurred on January

1, 2003, are included in the “Supplementary Information” section.

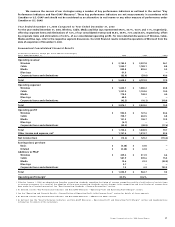

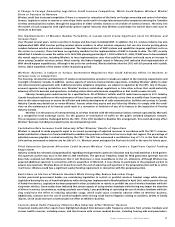

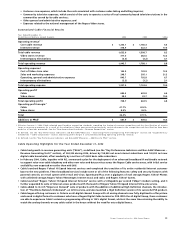

Summarized Wireless Financial Results

(In millions of dollars except operating profit margin)

Years Ended December 31, 2004 2003 %Chg

Operating revenue1

Postpaid (voice and data) $ 2,361.1 $ 1,911.1 23.5

Prepaid 116.7 91.3 27.8

One-way messaging 24.5 27.6 (11.2)

Network revenue 2,502.3 2,030.0 23.3

Equipment revenue 281.2 177.8 58.2

Total operating revenue 2,783.5 2,207.8 26.1

Operating expenses1

Cost of equipment sales 509.6 380.8 33.8

Sales and marketing expenses 444.4 362.0 22.8

Operating, general and administrative expenses 879.1 737.4 19.2

Total operating expenses 1,833.1 1,480.2 23.8

Operating profit2$ 950.4 $ 727.6 30.6

Additions to PP&E3$ 439.2 $ 411.9 6.6

Operating profit margin as % of network revenue238.0% 35.8%

1 As reclassified. See the “New Accounting Standards – Revenue Recognition” section.

2 As defined. See the “Key Performance Indicators and Non-GAAP Measures – Operating Profit and Operating Profit Margin” section.

3 As defined. See the “Key Performance Indicators and Non-GAAP Measures – Additions to PP&E” section.

Wireless Operating Highlights for the Year Ended December 31, 2004

• Effective November 9, 2004, Wireless successfully acquired Microcell for total consideration of approximately $1,318.4 million, making

it Canada’s largest wireless carrier and the country’s only provider operating on the global standard GSM/GPRS technology platform.

• On December 31, 2004, Wireless became a wholly-owned subsidiary of RCI upon the completion of the acquisition by RCI of AWE’s

34% interest and all of RWCI’s publicly-owned Class B Restricted Voting shares.

• Net additions of postpaid voice and data subscribers were 446,100, compared to the 400,200 net additions in 2003, reflecting higher

gross additions, reduced levels of churn, and the acquisition of Microcell. Net additions of prepaid subscribers were 32,500 compared

to 2,000 in 2003, reflecting the combination of Wireless’ continued emphasis on the higher-value postpaid segment of the market,

selling prepaid handsets at higher price points and more price-competitive prepaid offerings in the market.

• Revenues from wireless data services grew approximately 108.5% year-over-year to $141.6 million in 2004 from $67.9 million in 2003,

and represented approximately 5.7% of network revenue compared to 3.3% in 2003.

• Wireless successfully completed the deployment of EDGE technology across the entire Rogers Wireless GSM/GPRS network and has

introduced devices which enable subscribers to enjoy greatly increased wireless data speeds.