Rogers 2004 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86 Rogers Communications Inc. 2004 Annual Report

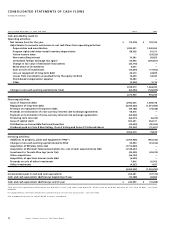

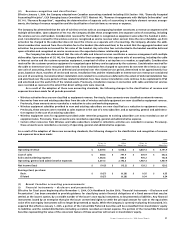

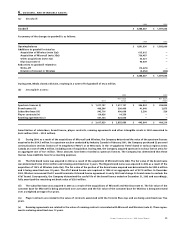

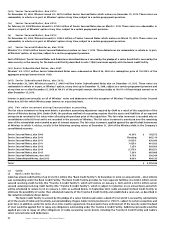

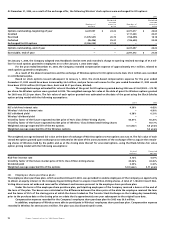

7. INVESTMENTS:

2004 2003

Quoted Quoted

Number Description market value Book value market value Book value

Investments accounted for

by the equity method:

Blue Jays Holdco $ – $ 95,720

Other 9,348 5,055

9,348 100,775

Investments accounted for

by the cost method,

net of write-downs

Publicly traded companies:

Cogeco Cable Inc. 6,595,675 Subordinate

(2003 – Voting

7,253,800) Common $ 169,179 68,884 $ 121,501 75,758

Cogeco Inc. 3,399,800 Subordinate

(2003 – Voting

2,724,800) Common 76,190 44,438 43,488 28,610

Other publicly traded companies 23,772 3,551 25,482 7,508

269,141 116,873 190,471 111,876

Private companies 12,949 16,570

$ 139,170 $ 229,221

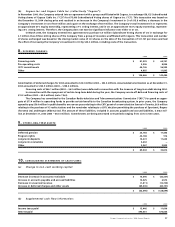

(a) Toronto Blue Jays Baseball Club:

On January 5, 2004, the Company paid the remaining amount related to the purchase of the 20% minority interest in the Blue Jays of

approximately $39.1 million. This payment had no impact on the carrying value or the control of the investment since this liability was

recorded at the original date of acquisition.

Effective April 1, 2001, Rogers Telecommunications Ltd. (“RTL”), a company controlled by the controlling shareholder of the

Company, acquired the Class A Preferred shares of a subsidiary of RCI that owns the Blue Jays (“Blue Jays Holdco”) for $30.0 million.

On July 31, 2004, Blue Jays Holdco redeemed and cancelled the 30,000 Class A Preferred shares for $30.0 million, resulting in the control

of Blue Jays Holdco being transferred to the Company. Accordingly, commencing July 31, 2004, the Company began to consolidate its

investment in Blue Jays Holdco. This had no impact on net income since the Company had previously recorded 100% of the losses of

Blue Jays Holdco.

While they were outstanding, the Class A Preferred shares of Blue Jays Holdco had a cumulative dividend rate of 9.167% per

annum. These dividends were satisfied in kind by transferring income tax losses to RTL. During 2004, Blue Jays Holdco transferred

income tax losses to RTL in the amount of $27.4 million (2003 – $24.0 million) with an agreed value of $2.7 million (2003 – $2.4 million).

From January 1, 2004 to July 30, 2004, cash contributions of $30.1 million (year ended December 31, 2003 – $29.4 million) were

made to Blue Jays Holdco.

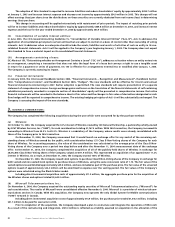

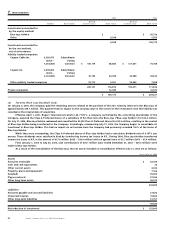

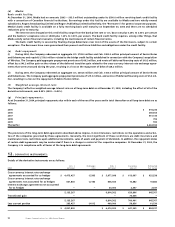

As a result of the consolidation of the Blue Jays, the net assets included on consolidation effective July 31, 2004 are as follows:

As at July 31, 2004

Assets

Accounts receivable $ 32,169

Cash and cash equivalents 70

Other current assets 3,334

Property, plant and equipment 7,166

Goodwill 95,509

Player contracts 27,524

Other long-term assets 36,913

202,685

Liabilities

Accounts payable and accrued liabilities 27,822

Unearned revenue 10,869

Other long-term liabilities 31,151

69,842

Net reduction in investment $ 132,843